Phemex Australia Review in 2025

Phemex has significantly impacted cryptocurrency trading since its establishment in 2019, carving out a reputation as a secure and efficient trading platform.

As a potential user in Australia, you have access to a platform brought to life by a team with a strong background in financial technology—precisely, a group of eight former Morgan Stanley executives.

They bring over 40 years of combined experience to the table, aiming to deliver high-frequency technology with stability that caters to the demands of traders worldwide.

In the dynamic and often complex realm of cryptocurrencies, you require a platform that offers a range of trading instruments and ensures a user-friendly experience.

Phemex provides an array of trading options, including spot trading and derivatives like futures and options, that are suitable for you, whether you’re stepping into the crypto space for the first time or are a skilled trader looking to diversify your investment strategies.

Their commitment to keeping the platform accessible and within competitive fee ranges makes it an appealing choice for Australian traders.

With its mobile application, Phemex ensures that you remain connected to the markets wherever you are, allowing you to act on market developments as they unfold.

The platform supports an extensive selection of cryptocurrencies, allowing you to trade over 270 digital assets.

Such flexibility and reach affirm Phemex’s position as a notable player in the global, specifically, Australian cryptocurrency exchange landscape.

Phemex Product Offerings [Futures, Spot, Options, Staking, NFTs, etc]

Phemex provides you with a broad spectrum of cryptocurrency trading services. Here’s a detailed look at what they offer:

- Futures Trading: You can engage in futures trading on Phemex, which allows for high-leverage trading, meaning you can open more prominent positions with less capital. This platform equips you with tools to speculate on the future prices of cryptocurrencies.

- Spot Trading: You are also offered spot trading capabilities, where you can purchase and sell cryptocurrencies at prevailing market prices. This straightforward form of trading is well-suited for those looking to exchange the physical asset.

- Options Trading: While not as prominently featured in the provided search results, options trading may be a part of the Phemex platform.

- Staking: You can participate in staking on Phemex. Staking allows you to earn rewards by holding specific cryptocurrencies. This provides an opportunity to earn passive income on your digital asset holdings.

- NFTs: The platform has ventured into the dynamic world of Non-Fungible Tokens (NFTs). With Phemex, you can trade NFTs, which are unique digital assets representing ownership or proof of authenticity of a wide range of virtual and real-world items.

- Copy Trading: If you’re new or prefer a hands-off approach, you might appreciate Phemex’s copy trading platform, letting you mirror the actions of seasoned traders. It’s a way to leverage the expertise of others while you’re building your own.

PhemeX’s multi-faceted platform is designed to cater to a wide range of cryptographic trading needs, ensuring that whether you’re a seasoned trader or just starting, you have access to a suite of tools to facilitate your trading journey.

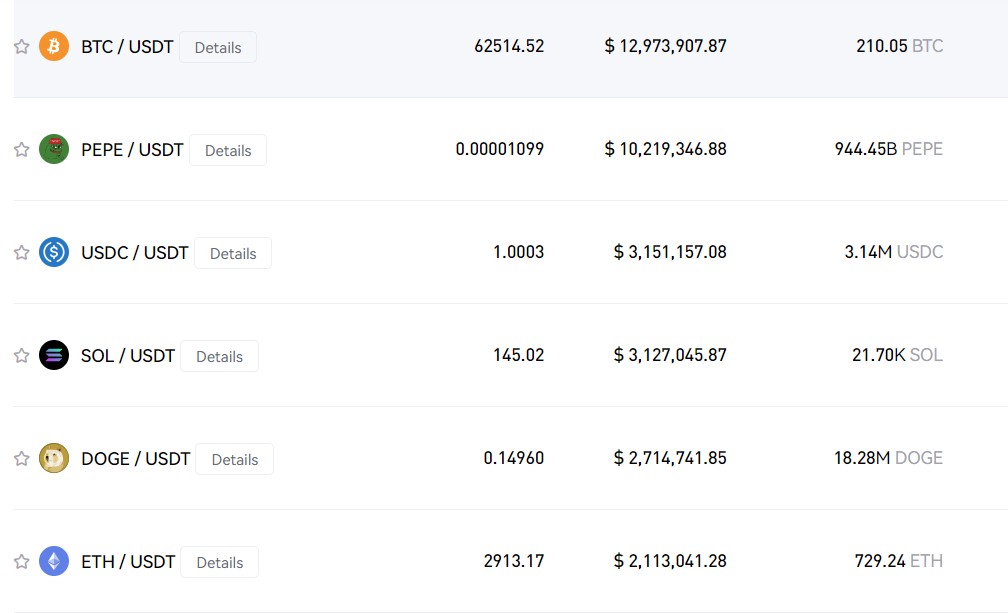

Phemex Supported Coin List

Phemex provides support for a wide selection of cryptocurrencies, encompassing a variety of options you can trade. As a user, you have access to major cryptocurrencies and altcoins, which guarantees you can diversify your trading strategies and preferences.

Major Cryptocurrencies:

- Bitcoin (BTC): The original cryptocurrency, launched in 2009, and the most widely known and traded digital asset.

- Litecoin (LTC): Created in 2011, this coin is modeled on Bitcoin but features faster transaction confirmation times.

Altcoins and Tokens:

- Cosmos (ATOM): Operational since 2019, this is a decentralized network enabling inter-blockchain communication.

- Polkadot (DOT): A multi-chain interchange and translation architecture that became available in 2020, allowing different blockchains to transfer messages and value trust-free.

- EOS (EOS): A platform for decentralized applications, providing advanced infrastructure for developers.

Phemeх ensures that your portfolio can be as diverse as the market offerings. Your trades can be spread across various assets, aligning with a strategy that suits your investment goals.

Remember, it’s essential to stay informed about which coins and tokens are currently supported, as Phemex periodically updates its listings to adapt to changes in the market and user demand.

Phemex Order Types

Phemex offers a range of order types to meet your trading needs. These order types are instrumental in executing trades based on your strategy, risk tolerance, and market conditions.

- Market Orders: These orders are executed immediately at the current market price. You might choose this type for rapid transactions to ensure your order is completed immediately.

- Limit Orders: With limit orders, you set a specific price for executing your order. This order will only be filled at the specified price or better, giving you control over the execution rate.

- Stop Loss Orders: This type allows you to set a minimum price limit for selling a security. It’s an effective risk management tool to cap your potential losses on a position.

- Take Profit Orders: Conversely, take profit orders let you set an upper limit to lock in profits once a certain price level is reached.

Phemex also supports conditional orders executed once specific criteria are met, adding flexibility to your trading approach. Here’s a quick reference:

| Order Type | Purpose | Usage Tips |

|---|---|---|

| Market | Immediate execution at current prices | For urgent transacting |

| Limit | Execution at a specified or better price | For precise entry/exit points |

| Stop Loss | Minimize potential losses | As risk management |

| Take Profit | Secure profits at a target price | To lock in gains |

Remember to monitor market conditions and the order book, especially when placing market orders, as prices fluctuate quickly. Your order type selection should align with your trading goals and market analysis.

Phemex’s Liquidation Mechanism

Phemex uses an automated system to handle liquidations, specifically designed to manage the risks of leveraged trading.

When you trade with leverage, gains and losses have a higher potential. Phemex’s system ensures that if the value of your position moves against you, reaching a level where your initial margin is threatened, the platform will automatically close your position.

This process is detailed as follows:

- Initial Margin: The funds you provide to open a leveraged position.

- Mark Price: Used by Phemex to establish the actual value of the asset, minimizing unjust liquidations caused by market manipulation.

- Liquidation Price: The specific price level at which your position will be closed.

- For long positions, the liquidation price is set below the entry price.

- For short positions, it stands above the entry price.

The liquidation mechanism is meant to protect you from further losses and prevent your account from falling into a negative balance. Here’s how Phemex calculates the liquidation price:

Liquidation Price = Liquidation Value / (Contract Quantity x Contract Size)

Where:

Liquidation Value = Open Value - Maintenance Margin + Initial Margin

You need to understand this formula as it can help you manage your positions more effectively, maintaining an awareness of the thresholds that could trigger a liquidation.

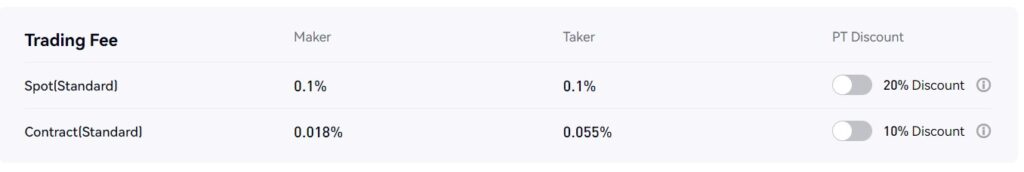

Phemex Trading Fees

When you trade on Phemex, you’ll encounter a fee structure designed to be competitive.

Futures trading sees meager costs, with makers being charged a fee of 0.01% and takers facing a fee of 0.06%. For those engaged in spot trading, the fee is set at 0.1% for both sides.

Your trading costs can decrease with a high 30-day trading volume or holding a certain quantity of Phemex tokens. Here are some specifics on how your exchange fees are determined:

- Trading Volume: Your past 30-day spot trading volume is accounted for daily.

- Phemex Tokens: Holding these can qualify you for discounted rates.

- Premium Membership: Offers the benefit of zero transaction fees under certain conditions.

| Trading Type | Maker Fee | Taker Fee |

|---|---|---|

| Futures | 0.01% | 0.06% |

| Spot | 0.1% | 0.1% |

Remember that rates and incentives are subject to change based on your account activity and market conditions. If you are a frequent trader or invest in Phemex tokens, monitor your fee reductions to maximize your trading sessions.

Phemex Funding Rates/Fees

When trading futures contracts on Phemex, you’ll encounter two main types of fees: the maker fee and the taker fee. As a maker, when you add liquidity to the market, your cost is typically lower than that of a taker, who removes liquidity from the market.

Contract Trading Fees:

- Maker Fee: 0.01%

- Taker Fee: 0.06%

These rates apply to your transactions involving contracts. Phemex employs a competitive pricing model to ensure you can trade effectively and efficiently.

Spot Trading Fees:

- Both Maker & Taker: 0.1%

Spot market fees are uniform for makers and takers. With a flat fee, you can calculate potential costs easily.

Funding Rate:

- Funding is exchanged between longs and shorts over fixed intervals.

- Funding Interval: Every 8 hours

The funding rate ensures that future prices are anchored to spot market prices. Be mindful that the funding rate can fluctuate based on market conditions.

Remember that participating in Phemex’s VIP program can provide additional fee discounts, so it’s worth checking out if you plan to trade frequently or with significant volume. Keep an eye on any updates from Phemex, especially if you’re approaching the settlement time, to stay informed of any adjustments to the funding rate calculations.

Phemex Deposit & Withdrawal Fees

When managing your digital assets with Phemex in Australia, understanding the structure of deposit and withdrawal fees is crucial for a cost-effective trading experience.

Deposits:

Phemex takes a customer-friendly approach by not imposing any fees for depositing cryptocurrencies into your trading account. You can transfer your crypto assets to Phemex without incurring additional charges.

| Transaction Type | Fee |

|---|---|

| Deposits | 0% (Free) |

Withdrawals:

Withdrawal fees on Phemex are necessary to cover the standard blockchain network fee. These fees vary according to the digital asset you’re withdrawing and network congestion.

- Bitcoin (BTC) withdrawals typically incur a network fee of 0.0004 BTC, which is standard across the industry.

- Altcoins/Erc-20 Tokens: Each comes with a set fee, reflecting the network demands and costs.

To access the latest and specific fee amounts for various cryptocurrencies, refer to the Phemex platform’s wallet section. Your withdrawals are processed with transparency in fees, keeping you informed on the blockchain fees applied to your transactions.

It is important to note:

- Phemex does not add extra withdrawal fees on top of the standard blockchain network charge.

- Keep an eye on network congestion, as this can affect the fee due to fluctuating demand on the network.

Always verify the applicable fees in the wallet section before executing a withdrawal to ensure you’re current with the latest charges.

Phemex Account Types & KYC Tiers & Limits

Phemex provides a spectrum of account types tailored to meet various trading preferences. Understanding and choosing the right account type is pivotal for your trading activities as you engage with the platform.

Basic Accounts

You can create entry-level accounts without completing any Know Your Customer (KYC) verification process. It’s a quick start option, allowing you privacy and access to essential trading features.

- Withdrawal Limits: Limited daily withdrawals

- Privacy: No personal information required for basic operations

Standard and Premium Accounts

Premium accounts unlock advanced features, while standard accounts balance functionalities and accessibility.

- Trading Features: Enhanced tools and order types

- Withdrawal Limits: Higher than basic accounts, varies by tier

Completing the KYC process is mandatory for increased limits and functionalities. Phemex implements a structured KYC system to adhere to regulatory standards while providing you with upgraded account privileges.

KYC Tiers & Limits

The process segregates tiers with corresponding verification requirements and limits.

- Tier 0: No KYC – Basic functionalities with a low withdrawal limit

- Tier 1: ID Verification – Increased withdrawal limit

- Tier 2 and beyond Additional identity proof – Access to the platform’s full capabilities with the highest withdrawal limits

To perform KYC verification on Phemex:

- Register or log in to Phemex.

- Click your account icon.

- Select “Verification” for profile information.

- Follow on-screen instructions to complete respective KYC tiers.

Ensure you choose the correct account type, complete the necessary KYC tier to suit your trading needs, and unlock the desired limits.

Phemex Trading Platform & Tools

Phemex provides a comprehensive trading experience, ensuring you have access to various tools for efficient and strategic trading. Your dashboard gives a clear overview of the markets, allowing you to make informed decisions quickly.

Advanced Charting: The platform’s integration with TradingView guarantees high-level charting capabilities. You can use many indicators and drawing tools to analyze market trends and pinpoint trade opportunities.

Mobile Trading: With the Phemex mobile App, your trading doesn’t need to stop when you’re away from your desk. You can easily buy, sell, and trade assets and closely monitor your investments in real time.

- Trading Options: Phemex supports:

- Spot trading with multiple crypto pairs

- Contracts and derivatives trading for a more diverse trading strategy

User Interface: Phemex is recognized for its intuitiveness and simplicity, and it is designed to be accessible for new traders yet robust enough for seasoned investors. It is highly customizable, allowing you to tailor the layout to your trading style.

Mock Trading: A standout feature is mock trading, which offers 5,000 m-USDT in virtual funds to practice without financial risk, enhancing your trading skills in a simulated environment.

Fees & Verification: Phemex stands out in terms of competitively low trading fees. Additionally, the platform is among the few that maintain a no-KYC standard, simplifying the account setup process and preserving your privacy.

Each feature enhances your trading efficiency and effectiveness on the Phemex platform.

Phemex Insurance Fund

Phemex maintains an insurance fund that benefits you by safeguarding your trading positions from unforeseen losses. It’s an integral part of Phemex’s risk management system, designed to prevent positions from being automatically deleveraged.

How It Works:

- The fund is used to absorb unfilled liquidation orders before auto-deleveraging kicks in.

- In volatile markets, this offers your trades an added layer of financial protection.

- No extra payments are charged from traders, thanks to the structure of Phemex’s platform.

Utilization of the Fund:

- Alleviation of unfilled liquidation orders

- Protection from auto-deleveraging

Benefits to Traders:

- Enhanced Security: Your positions have added protection, especially during extreme volatility.

- Precise Risk Management: You can trade confidently, knowing there’s a system in place to mitigate unexpected market movements.

In essence, the insurance fund is positioned as a cushion against the unpredictable nature of crypto markets, providing you with a more secure and dependable trading experience on Phemex.

Phemex Deposit Methods

Phemex provides you with multiple methods to deposit funds into your account. Bank transfers and an assortment of cryptocurrencies facilitate the funding of your trading activities. Crucially, the platform adheres to advanced security measures to protect your assets during the deposit process.

Cryptocurrency Deposits

- Onchain Deposit: Directly transfer cryptocurrency from your external wallet to your Phemex account.

- Web3 Wallet Deposit: Use a Web3 wallet, like Metamask, to deposit funds.

To make a cryptocurrency deposit:

- Log into Phemex.

- Navigate to the “Deposit” section.

- Choose your deposit method—either Onchain or Web3 Wallet.

- Follow the on-screen instructions to complete the transaction.

Please be aware that different types of cryptocurrencies may have specific network requirements for deposits. Always confirm the network compatibility before initiating a transfer to avoid losing funds.

Bank Transfers

- Deposit fiat currency through a linked bank account.

- Depending on your bank’s policies and the transaction’s size, this method might have different processing times.

For a smooth experience:

- Select the bank transfer option on the deposit page.

- Complete the necessary verification steps, if any.

- Follow your bank’s procedure to finalize the deposit.

By keeping abreast of Phemex’s updated listings, you ensure that your deposits align with the latest options available on the platform.

Remember, for any method chosen, always check the minimum deposit amounts and associated fees to maintain transparency in your financial activities on Phemex.

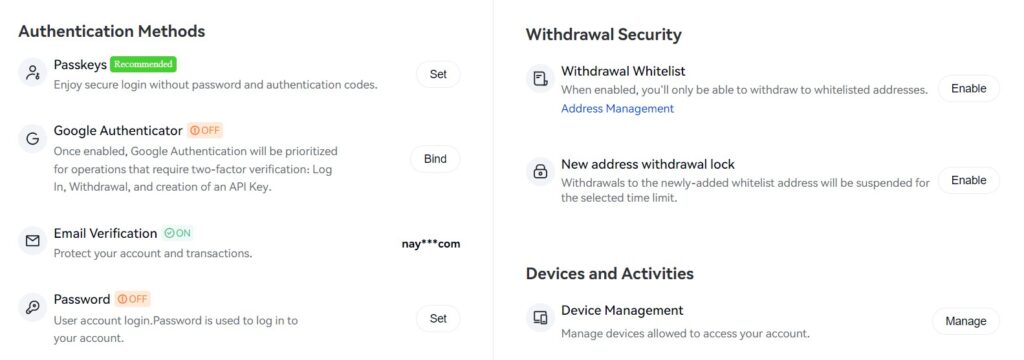

Phemex Security Features

Your cryptocurrency’s safety is a top priority when trading on any platform. Phemex takes this seriously by integrating robust security features to protect your assets and personal information.

Hierarchical Deterministic Cold Wallet System: Phemex uses a cold storage system where each user is assigned a unique deposit address. Your funds are not stored online but offline to minimize risks.

Multisignature Cold Wallets: Funds aggregated in Phemex’s wallet are protected with multisignature technology, which requires multiple keys to authorize a transaction. This adds an extra layer of security against unauthorized access.

Two-Factor Authentication (2FA): Every time you perform critical account activities, Phemex demands a second form of verification using:

- SMS verification

- Google Authenticator

Encryption: All system data, including personal info and transaction history, are fully encrypted, ensuring your trades and information remain secure and confidential.

In addition, Phemex maintains 100% reserves, meaning all user funds are available for withdrawal at any time, enhancing trust and reliability.

Remember, while Phemex employs rigorous security measures, you should also practice good security hygiene by keeping your authentication details private and your devices secure.

Phemex Proof Of Reserves

Phemex, a cryptocurrency exchange, seeks to provide transparency and instill trust in its operations by implementing a Proof of Reserves (PoR) system.

This rigorous measure ensures that Phemex’s actual reserves back your assets.

The exchange builds this confidence through a Merkle tree structure, a specific data set offering comprehensive verification without compromising private details.

The procedure is straightforward; all Phemex user accounts are hashed with a random nonce (a number used once) and aggregated to create a holistic view of the exchange’s balances. You can thus confirm that the assets you hold are accurately represented and secured.

Phemex is committed to maintaining regular communication regarding its PoR and setting a monthly schedule for this data update. Expect these updates around the 25th of each month, informing you of the latest reserve status.

The adherence to updating proof of reserves monthly is a testament to Phemex’s dedication to operational transparency:

- Monthly Updates: Establishes a predictable and regular trust verification cycle.

- Non-Invasive Verification: Utilizes hashed account IDs to protect your privacy while proving assets.

- Confidence in Assets: Assures you that Phemex’s reserves fully back your balances.

By continuously enhancing its PoR approach, Phemex complies with auditing standards and reassures you, the user, of the platform’s reliability and security.

Phemex Customer Support

Phemex provides an extensive customer support system to assist you with inquiries or issues. The platform offers 24/7 customer support, ensuring help is available anytime. You can access support through various channels:

- Live Chat: For immediate assistance, Phemex offers a live chat service where you can converse with support agents in real time.

- Support Tickets: If your query is less urgent, submit a support ticket through their system. Phemex aims to respond promptly to all tickets raised.

- Help Center: Phemex has a comprehensive Help Center that contains guides, frequently asked questions (FAQs), and articles on different topics to help you find answers quickly.

Here’s how you can navigate Phemex’s customer service:

| Service | Description |

|---|---|

| Live Chat | Instant support for urgent matters. |

| Support Tickets | Ideal for detailed inquiries that are not time-sensitive. |

| Help Center | A self-service portal with information to help you resolve common issues. |

Phemex emphasizes the safety and security of its processes, including its Know Your Customer (KYC) procedures, which are designed to be straightforward and protect your identity.

Should you experience any issues or require guidance, remember that Phemex’s customer support team is ready to assist you, day or night.

Is Phemex Safe & Available in Australia?

When considering Phemex in Australia, you’re dealing with a cryptocurrency exchange that has taken significant steps to establish itself as a legal and safe platform for traders. Phemex, headquartered in Singapore, operates in various jurisdictions with adherence to local regulations.

Legal Compliance:

- Headquarters: Singapore, a jurisdiction known for its clear crypto regulations.

- Global Operations: Adjusts compliance based on regional laws.

Safety Measures:

- Security Protocols: Implements advanced protections such as SSL encryption and cold wallet storage.

- Proof of Reserves: Offers transparency with regular proof of reserve audits.

Pheme, drawn from the Greek Goddess of Fame and Good Reputation, symbolizes the platform’s commitment to maintaining a reliable standing in the crypto community.

User Protection: Phemex incorporates measures aiming to safeguard your digital assets:

- Two-Factor Authentication (2FA): An additional layer of security for your account.

- Withdrawal Safeguards: Automated checks to prevent unauthorized transfers.

In Australia, where financial and digital asset regulations are robust, Phemex’s legal standing hinges on complying with stringent standards set by Australian authorities. While the company’s regulatory status may vary across countries, your experience on Phemex is backed by their dedication to legality and security.

However, always check Australia’s latest regulations and compliance status, as this field is subject to frequent changes.

Conclusion

Phemex presents itself as a reliable player in the world of crypto exchanges, which is beautiful to traders in Australia seeking a secure and dynamic trading environment.

Your experience with Phemex will likely be marked by the platform’s commitment to solid security protocols, ensuring your investments are well-protected.

With a broad array of trading instruments available, you have the flexibility to engage in spot trading and futures, which could be a valuable addition to your trading strategies.

The exchange has built a reputation for providing a user-centered interface, simplifying the complex trading processes for new and experienced users.

Your trading costs are maintained at competitive levels, with the option for premium membership offering added benefits and reduced fees.

This demonstrates Phemex’s dedication to providing cost-effective trading solutions that cater to yoIncludingclusion of features such as the Phemex Earn program allows you to generate revenue from your crypto assets, allowing you to enhance your relatively passively manner.

As with any platform, it is imperative for you, as a user, to consider your specific trading needs and preferences when evaluating the value Phemex could bring to your trading activities.

While the platform boasts a formidable offering, continued growth in services and evolving user support will be vital in maintaining its appeal among traders in Australia.

Discover More Reviews: