Binance Australia Review in 2025

Binance has established itself as a significant platform in the world of cryptocurrency, offering you a range of services for trading Bitcoin, Ethereum, and numerous altcoins.

Launched in 2017, the exchange has quickly ascended to the forefront of the crypto industry with its extensive list of supported currencies and competitive trading volumes.

Serving over 180 countries, it has become a go-to exchange for new and seasoned traders looking to navigate the digital currency market.

In Australia, Binance operates with considerations for local regulations, providing Australian users with opportunities to trade and invest in cryptocurrencies.

The platform supports using Australian Dollars for transactions, and users can deposit funds using credit or debit cards, among other payment methods.

It’s essential to be aware that certain features of Binance might be restricted due to Australian regulatory requirements, which can affect the services available to you compared to users in other regions.

Your interaction with Binance’s platform can include various trading options like spot trading and provides a secure environment with user-focused services.

Whether you want to start your journey in the crypto space or diversify your existing portfolio, Binance’s presence in Australia offers a comprehensive and user-friendly platform tailored to meet your trading needs.

Binance Product Offerings [Futures, Spot, Options, Staking, NFTs, etc.]

Spot Trading: Experience the immediate exchange of digital assets with spot trading, where you can buy or sell cryptocurrencies instantaneously at current market prices. This is the most direct form of trading and gives you high flexibility to manage your assets in real-time.

Futures and Options: Engage with contracts that enable you to bet on the future prices of cryptocurrencies. Futures let you agree on a price to buy or sell an asset at a later date, while options grant you the right, but not the obligation, to engage in these trades.

Staking and Savings: Maximize your crypto assets by utilizing staking or savings accounts. With staking, you can earn interest on your holdings by participating in the network’s operations. Alternatively, savings products allow you to accrue interest passively.

- Staking: Hold onto your cryptocurrencies and earn staking rewards.

- Savings: Secure your assets in a savings account to gather interest over time.

NFTs: Dive into the world of non-fungible tokens (NFTs) with Binance’s NFT marketplace. Here, you can collect, buy, and sell unique digital items ranging from art to music and in-game.

Launchpad and Launchpool: Explore new tokens and crypto projects through the Launchpad and Launchpool platforms. These platforms offer you early access to innovative projects in the cryptocurrency space.

- Launchpad: A gateway for newly launching tokens.

- Launchpool: A platform for yield farming new assets.

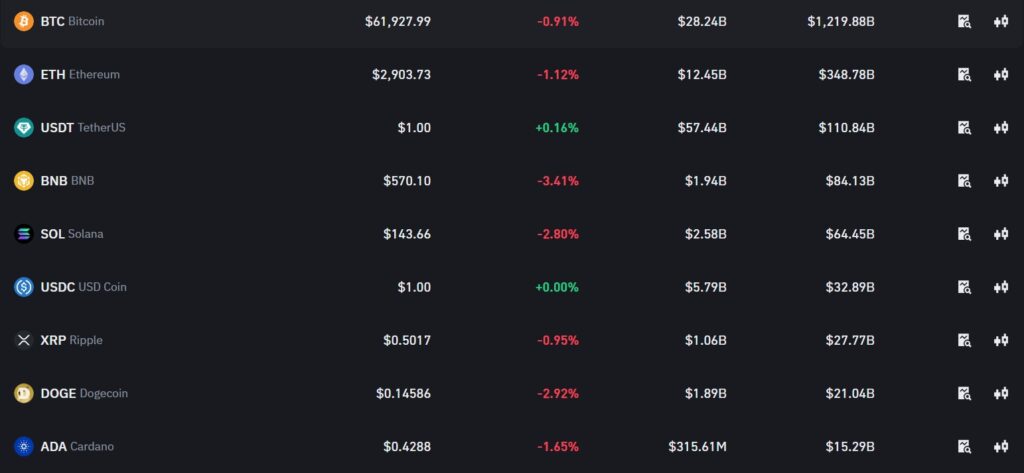

Binance Supported Coin List

Binance, a prominent cryptocurrency exchange, offers an extensive array of crypto assets for trading. You can find a variety of coins and tokens to suit diverse investment strategies and interests.

The following list provides a snapshot of some of the critical cryptocurrencies that Binance supports:

- Bitcoin (BTC): Launched in 2009, Bitcoin is the first and most widely recognized cryptocurrency.

- Ethereum (ETH): Ethereum is a decentralized platform that enables smart contracts and decentralized applications (DApps).

- Litecoin (LTC): Created in 2011, Litecoin is a peer-to-peer cryptocurrency often considered the silver to Bitcoin’s gold.

- Cosmos (ATOM): Cosmos aims to create an “Internet of Blockchains,” allowing them to communicate and scale.

- EOS (EOS): EOS offers a platform for developing decentralized applications like Ethereum.

These assets are part of a more extensive list that Binance reviews and updates regularly. Selection criteria include team credibility, product utility, user base, and compliance with relevant regulations.

Due to regulatory requirements, trading pairs and availability may vary depending on your geographic location.

For instance, Binance has had to adjust its offerings in Australia to align with local laws. Always check the most current information on the Binance platform relevant to your region to ensure you have the latest details on supported coins and services.

Binance Order Types

When trading on Binance, you can access various order types that cater to your trading needs and strategies. These tools are designed to allow you to execute trades based on specific conditions and desired price levels.

- Limit Order: You set a specific price for buying or selling. The order will only be executed if the market reaches your defined price.

- Market Order: This order type is executed immediately at the current market price. It is the fastest way to enter or exit a trade.

- Stop-Limit Order: A stop-limit order combines the features of stop and limit orders. You place a stop price that triggers a limit order when reached. For example, if BTC is trading at $40,000 and you want to minimize losses, you could set a stop price at $39,500 and a limit price at $39,000.

- Stop Market Order: Similar to a stop-limit order, a stop market order will sell or buy at the best available market price once the stop price is hit.

- Trailing Stop Order: This order allows you to place a pre-set order at a trailing distance from the market price. It moves with the market price, helping to protect profits or limit losses.

- Post Only Order: This ensures your limit order is added to the order book and not immediately matched with an existing order.

Binance’s advanced trading features, including these order types, enable you to manage your trades in a dynamic market effectively. Use them to enhance your trading strategy, whether you prefer to set precise price points or need the immediacy of market orders.

Binance’s Liquidation Mechanism

You must understand the liquidation mechanism when trading on Binance’s margin and futures markets. This process is a critical risk management measure that prevents you from falling into negative equity. Here’s how it works:

Liquidations in Margin Trading:

- Your margin account has both collateral assets and liabilities.

- If your account value falls to a certain threshold, liquidation is triggered.

- All your assets and liabilities are transferred to the Binance liquidation account.

- The liquidation engine then sells the assets to cover the liabilities and interest repayments.

Futures Trading Liquidation:

- Risk management includes liquidation to handle excessive leverage when you engage in futures trading.

- Liquidation ensures your balance is not harmful by auto-closing positions at the liquidation price.

- The liquidation price is where your margin balance is depleted.

- Before reaching this point, Binance will cancel open orders to prevent further losses.

Portfolio Margin Accounts:

- Binance uses a unique Maintenance Margin Ratio (uniMMR) system.

- If your uniMMR falls below 1.05, meaning 105%, liquidation is initiated.

- You can’t perform transactions during this process.

Understanding these mechanisms helps you to manage your risks effectively when trading on Binance Australia. It’s essential to monitor your margin and leverage levels to avoid liquidation.

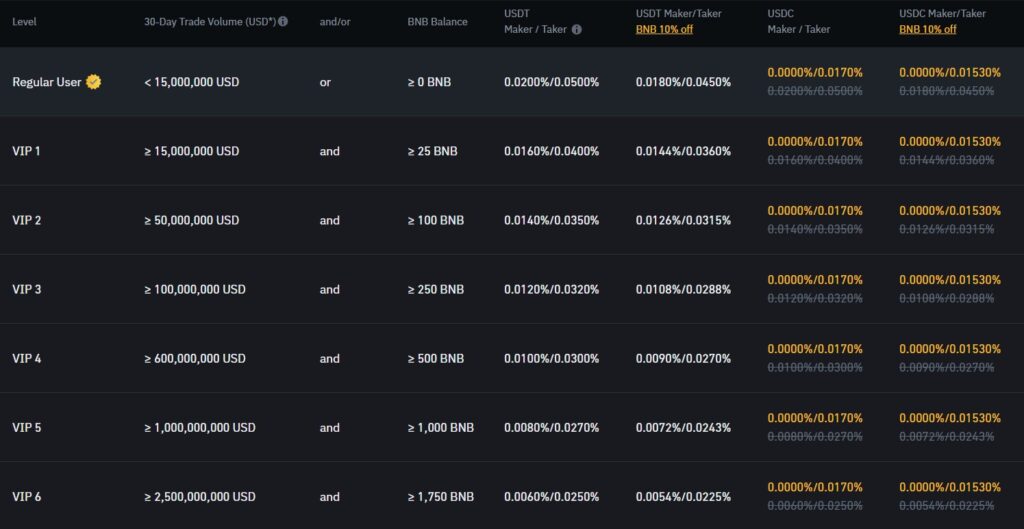

Binance Trading Fees

Binance, as the world’s leading cryptocurrency exchange, offers you a detailed and competitive fee structure for trading digital assets. Whether you are engaging in spot trading or derivatives, you’ll find the fees to be one of the most compelling aspects of the platform.

Transaction Types & Fee Rates

Spot Trading: You’ll encounter a maker-taker fee model when trading on the Binance Spot Market. As a maker who adds liquidity to the market, your fees are typically lower than a taker who takes liquidity away.

| Level | Maker Fee | Taker Fee |

|---|---|---|

| VIP 0 | 0.1% | 0.1% |

| VIP 1 | 0.09% | 0.1% |

| … | … | … |

Derivative Trading: Fees for futures and other derivatives, while slightly different, maintain competitive rates specific to those products.

Discounts & Fee Reduction

Using Binance Coin (BNB), the platform’s native cryptocurrency affords you a significant discount on trading fees. Holding BNB in your account automatically enrolls you for reduced transaction fees.

Additional Savings: By increasing your trading volume or holding higher amounts of BNB, you can unlock even lower fees, moving up the VIP tiers. Besides, specific promotions and programs might offer additional fee reductions periodically.

Remember, your trading fees contribute significantly to the cost-effectiveness of your trading strategy. Always review the current fee structure through your account dashboard to stay informed about any updates or changes to the fees you’re subject to.

Binance Funding Rates/Fees

You’re subject to funding rates when you trade perpetual contracts on Binance. These rates, representing the cost of maintaining a position, are exchanged between traders rather than paid to Binance directly.

Funding Interval Adjustments:

Historically, funding settlements occurred every eight hours. However, as of October 12, 2023, certain USDⓈ-M perpetual contracts now settle funding rates every four hours.

Impact on Your Trades:

- Positive Funding Rate: If you hold a long position when the rate is positive, you pay the funding fee.

- Negative Funding Rate: Conversely, you receive funds when holding a long position, and the rate dips into the negative.

Calculating Your Funding Fees:

To estimate the rates you’re likely to encounter, use this simple step:

- Enter the current funding rate into the Binance Funding Fee Calculator.

- Remember, the rate at the funding interval’s end is crucial for determining what you’ll pay or receive.

Fee Considerations:

Trading fees on Binance start at 0.1%. Holding BNB (Binance Coin) or increasing trading volume can provide additional fee reductions.

Binance’s competitive fee structure and funding rate mechanisms make it essential to stay informed on how these factors might affect your positions. Keep a close watch on the funding rate, especially as the next funding time approaches, to efficiently manage your trading costs.

Binance Deposit & Withdrawal Fees

When managing your funds on Binance, deposits are typically executed without charges. However, when you withdraw funds, your fee will depend on the specific cryptocurrency being transferred.

The fee structure is designed to align with network transaction charges, which are influenced by factors such as blockchain congestion.

For withdrawals, the fees fluctuate, mirroring the dynamic nature of the blockchain network. Each cryptocurrency has its individual fee schedule. Below is a hypothetical representation of a few cryptocurrencies’ withdrawal fee structure. Note that these numbers are solely for illustrative purposes:

| Cryptocurrency | Withdrawal Fee |

|---|---|

| Bitcoin (BTC) | 0.0004 BTC |

| Ethereum (ETH) | 0.003 ETH |

| Ripple (XRP) | 0.25 XRP |

The minimum withdrawal amount and transaction fees may also change over time, reflecting the varying network operations costs for each coin.

Always consistently check the Deposit & Withdrawal Fees page on the Binance website for updated rates to plan your transactions accordingly.

Binance prides itself on maintaining transparency and providing precise and detailed information so that you can manage your transactions smartly and effectively.

Binance Account Types & Binance KYC Tiers & Limits

When you sign up for Binance in Australia, your account falls under different types based on the extent of identity verification, known as Know Your Customer (KYC), you have completed.

These KYC tiers dictate your withdrawal limits and access to various features.

Tier 1 – Basic Verification

- Withdrawal Limit: Up to 2 BTC equivalent in 24 hours

- Services: Access to essential trading services and crypto deposits

- Requirements: No documents, only provide personal information

Tier 2 – Intermediate Verification

- Withdrawal Limit: Up to 100 BTC equivalent in 24 hours

- Services: Access to advanced trading options, AUD deposits, and withdrawals

- Requirements: Government-issued ID verification, residential information

Tier 3 – Advanced Verification

- Withdrawal Limit: Higher than 100 BTC equivalent in 24 hours

- Services: Full platform access, including high trading volumes and OTC desk

- Requirements: Additional proof of address documents and possibly a background check

To complete KYC verification with Binance, enter your details as they appear on your identification documents. You may also be required to upload a photo of the document or go through an in-app verification process to strengthen the platform’s security by ensuring all accounts are authentic and reducing the risks of illegal activities.

Remember, undergoing KYC with Binance enhances your account’s security and expands your access to Binance’s trading capabilities and services. Each KYC tier provides a greater level of involvement with the platform.

Binance Trading Platform & Tools

Binance offers robust platforms and tools designed to cater to your trading needs regardless of your expertise level. As an Australian investor, you can choose from various interfaces, including the Basic, Classic, Advanced, and Over-The-Counter (OTC) trading platforms.

- Primary Platform: Ideal for beginners, offering an intuitive interface with simple trading functions.

- Classic Platform: This suits the majority of traders looking for a balance between functionality and ease of use.

- Advanced Platform: Provides experienced traders with in-depth analysis tools and a comprehensive trading experience.

- OTC Trading Platform: Facilitates large trades directly between two parties without affecting the market price.

Trading Tools at Your Disposal:

- Comprehensive Charts: Access real-time trading data with interactive charts to monitor markets effectively.

- Technical Indicators: Utilize various indicators to analyze trends and make informed decisions.

- Trade History: Review past trades for a better strategy with a detailed history log.

- Order Types: Execute various order types, such as limit, market, stop-limit, and OCO (One Cancels the Other).

Furthermore, Binance enhances your trading experience with:

- Secure Wallets: Safeguard your digital assets with industry-leading security.

- Mobile App: Trade on the go with the Binance mobile app, available on iOS and Android.

- API Access: Automate trades and integrate your trading applications via Binance’s powerful API.

You have the necessary tools to take full advantage of the expansive cryptocurrency market with Binance’s platform offerings.

Binance Insurance Fund

When trading with Binance in Australia, you benefit from a protective layer known as the Secure Asset Fund for Users (SAFU).

This emergency insurance fund was established by Binance in 2018 with a clear purpose: to safeguard your interests in unprecedented situations, such as system failures or security breaches.

Operation and Purpose

The operation of the SAFU is relatively straightforward. Binance allocates a portion of trading fees to this fund, which is there to provide an additional safety net. Specifically, it helps to:

- Protect your capital from adverse losses

- Ensure the payout of profits to winning traders

Financial Safety

Given the volatile nature of cryptocurrency markets, the fund’s value fluctuates accordingly. However, Binance ensures that a robust mechanism is in place to respond to market needs and challenges.

Claims and Limitations

While Binance has taken strategic steps to fortify security measures, including developing a sizeable insurance fund, remember that no platform can assert a complete guarantee against losses.

Your fund’s safety is a primary concern, necessitating continuous advancements in risk mitigation measures.

The SAFU acts as your shield in extreme scenarios where counterparty liquidations might otherwise impact your holdings.

Keep in mind that the existence of this fund represents Binance’s commitment to user security and operational integrity within the digital asset space.

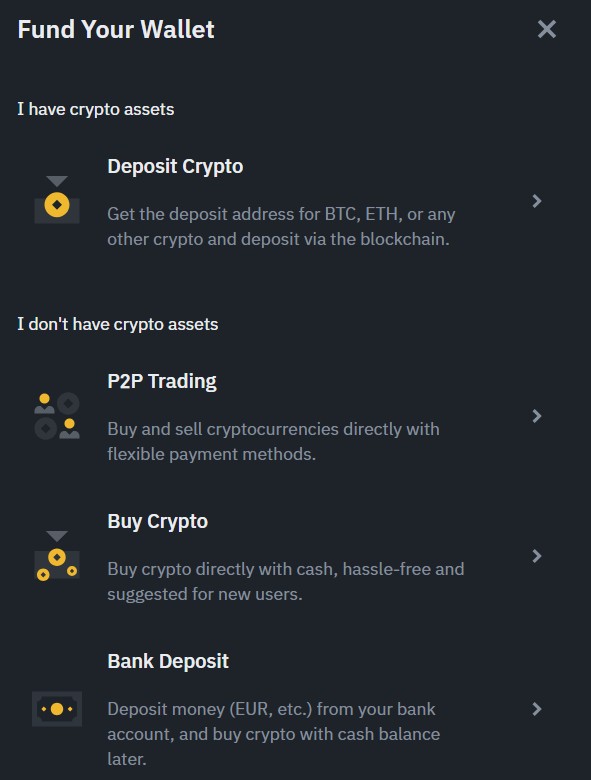

Binance Deposit Methods

Binance, a leading cryptocurrency exchange, provides multiple deposit options to fund your account. Here’s an outline of the methods you can use:

- Bank Transfer: Easily transfer funds directly from your bank account.

- Credit/Debit Card: Use your Visa or Mastercard for immediate deposits.

- Cryptocurrency: Deposit various cryptocurrencies from external wallets.

For each option, follow these steps:

Bank Transfer

- Navigate to your ‘Fiat and Spot’ wallet.

- Select ‘Deposit’ adjacent to the Australian Dollar (AUD).

- Choose ‘Bank Transfer’ and follow the on-screen instructions.

Credit/Debit Card

- Again, head to the ‘Fiat and Spot’ wallet.

- Click on ‘Deposit’ and pick the card option.

- Enter your card details and the amount to deposit.

Cryptocurrency

- Select ‘Deposit’ in your ‘Fiat and Spot’ wallet.

- Find the cryptocurrency you wish to deposit.

- Utilize the provided QR code or address to transfer from another wallet.

Always verify transaction details before confirming to ensure a smooth deposit process.

Binance Security Features

Your account security on Binance is fortified using a multi-tier and multi-cluster system architecture. Binance integrates a range of security measures designed to provide a robust trading environment.

- Two-Factor Authentication (2FA): An essential feature you have is 2FA, which adds an extra layer of protection to your account. Typically, you use this feature when you sign in or perform sensitive operations.

-

Device Management: You can manage and review devices with access to your Binance account, ensuring that only authorized devices can make trades or access your crypto holdings.

-

Address Allowlisting: This feature allows you to create a list of withdrawal addresses that are the only ones permitted for transactions. By enabling this, you safeguard your funds, as withdrawals can only be made to the pre-approved addresses.

Your commitment to maintaining security on your individual Binance account enhances the overall safety of your online investment activities.

Binance Proof Of Reserves

Binance, a leading digital currency exchange, has implemented a Proof of Reserves (PoR) system. This system verifies that Binance holds sufficient assets to cover its users’ funds. When you deposit cryptocurrencies on Binance, the exchange must maintain enough reserve funds to match these deposits.

- Objective: Ensure a 1:1 reserve ratio for user assets.

- Coverage: Initially started with Bitcoin (BTC).

Here’s how Proof of Reserves operates:

- Binance takes a snapshot of user balances at a specific point in time.

- The exchange’s holdings are compared against user balances to confirm that funds are fully backed.

Binance’s commitment to transparency in Australia is evident as Binance Australia operates a digital currency exchange registered with AUSTRAC. Their services primarily include spot conversion between fiat and digital currency.

As you use Binance:

- Be assured that your assets are being held responsibly.

- PoR is an ongoing process validating the exchange’s consistent custody over user assets.

PoR functions as a trust mechanism within cryptocurrency, aiming to create a transparent environment for users like you.

With Binance’s Proof of Reserves, the exchange’s financial health regarding user deposits is openly documented and subject to third-party audits. This transparency addresses the need for trust and accountability in the digital currency.

Binance Customer Support

When you require assistance with services on Binance Australia, you can access a range of customer support options tailored to your needs. The platform’s support system primarily includes a live chat feature, the quickest way to get help with any questions or issues you might encounter.

Live Chat Availability

- Nearly 24/7 support

- Access directly through the Binance app

For less urgent inquiries or more detailed support, email communication is available. This allows you to outline your issue comprehensively and await a detailed response from customer support experts.

In addition to direct contact methods, Binance Australia hosts an extensive FAQ section within their Support Center. This resource is helpful for immediate answers to common questions, ranging from account setup to complex trading queries.

- Common Topics in FAQ Section:

- Account Management

- Trading and Orders

- Wallet Maintenance

- Cryptocurrency Listings and Delistings

Binance Australia takes pride in its support team’s knowledgeable and practical problem-solving approach.

Rest assured that when you reach out, your concerns are taken seriously and handled carefully, allowing you to continue using the platform confidently.

Is Binance Available & Regulated in Australia?

When considering Binance’s status in Australia, it is essential to recognize that the platform is registered with AUSTRAC (Australian Transaction Reports and Analysis Centre).

AUSTRAC registration underscores Binance’s commitment to adhering to local financial regulations and anti-money laundering guidelines, demonstrating its legal operations within the country.

Regarding safety, Binance employs robust security measures to protect your assets. Here’s an overview of Binance’s security protocols:

- Two-Factor Authentication (2FA): Increases account security by requiring a second verification form alongside your password.

- Device Management: You can review and manage devices that can access your account.

- Address Allowlisting: Adds an extra layer of security by only permitting withdrawals to pre-approved addresses.

However, as with any cryptocurrency platform, there are risks.

Like all global exchanges, you should remain vigilant about security and be aware that Binance faces regulatory scrutiny. Know that Binance actively updates its security requirements to comply with local regulations.

In summary, Binance is a legal cryptocurrency trading platform in Australia that emphasizes compliance with AUSTRAC and user protection.

While Binance continues to operate across various jurisdictions, it works within a framework to maintain a safe environment for trading cryptocurrencies. Please exercise due diligence and maintain reasonable security hygiene while engaging with the platform.

Binance in Australia: Conclusion

Binance, operating in Australia, seeks to address your cryptocurrency trading needs through its significant selection of over 600 coins and a user-friendly interface for novice and veteran traders.

Reliability is underscored by its commitment to regulatory adherence and offering a trading environment that emphasizes security.

Platform Highlights:

- Competitive Fees: At just 0.1% for trading, you can enhance your trading margins, with further discounts available for higher volume trades.

- No Deposit or Withdrawal Fees: Your transactions with Australian dollars are free from any deposit or withdrawal fees.

- Advanced Trading Options: You have access to margin trading and derivatives, expanding your trading capabilities.

Binance Australia’s progressive growth is marked by milestones like reaching over AUD 130 million in trading volume in a single day within its first six months.

This growth is a testament to the platform’s strength and your trust in its services. Your options for capitalizing on market movements are broad, with various financial instruments at your disposal.

Binance’s significant efforts to remain compliant with local regulations attest to its dedication to creating a secure platform. You benefit from robust educational resources, which empower you to make informed trading decisions.

By choosing Binance, you align yourself with a continuously evolving platform, ensuring security measures and trading tools that cater to your cryptocurrency trading pursuits in Australia.

Discover More Reviews: