KuCoin Australia Review in 2025

KuCoin has made a name for itself in the cryptocurrency exchange landscape, operating since 2017 to offer a comprehensive list of services catering to novice and experienced traders.

As a user, you can access an assortment of cryptocurrencies, with the platform supporting over 700 different coins.

The exchange extends beyond simple trading by featuring advanced financial instruments such as futures and leveraged tokens, and the platform has integrated tools like a trading bot to automate and refine your investment strategy.

For Australian users, KuCoin provides an opportunity to engage with a global marketplace. The exchange’s interface is designed to be intuitive, easing your journey into crypto trading.

Whether you are looking to trade spot markets or explore the more complex futures trading, the platform’s suite of trading tools and detailed charts can help to inform your decisions.

It’s essential to remain aware of the local regulations that impact your trading activities. Australian laws and financial regulators dictate specific compliance measures for cryptocurrency exchanges nationwide.

As such, KuCoin adheres to these regulations to offer a service that aligns with the Australian Securities & Investments Commission requirements, ensuring that your trading is secure and in line with local legislative standards.

Kucoin Product Offerings [Futures, Spot, Options, Staking, NFTs, etc.]

KuCoin, as a cryptocurrency exchange, provides you with a robust suite of investment tools tailored to various trading preferences. Below is an overview of the different offerings available to you on their platform:

-

Futures Trading: You can access USDT-margined futures contracts, enabling trading with leverage to enhance gains potentially. KuCoin Futures are designed to allow for both speculation on the future price of cryptocurrencies and hedging against market volatility.

-

Spot Trading: The exchange offers a broad selection of cryptocurrencies for immediate purchase or sale at current market rates. This traditional form of trading is suited for immediate transactions without the complexity of derivatives.

-

Options Trading: Catering to more sophisticated strategies, KuCoin provides options and other derivatives, expanding your trading capabilities beyond the spot and futures markets.

-

Staking: With KuCoin Staking, you can earn rewards by locking in particular cryptocurrencies. This process supports the network, and, in return, you receive a passive income, often with a flexible or fixed term.

-

NFTs: KuCoin embraces the burgeoning world of Non-Fungible Tokens by supporting both their trade and management on the platform, allowing you to buy, sell, or hold various digital collectibles and art pieces.

-

Lending: If you hold cryptocurrencies, you can utilize KuCoin’s lending feature to earn interest. By lending your digital assets on the platform, you generate an additional income stream akin to gaining interest in a traditional savings account.

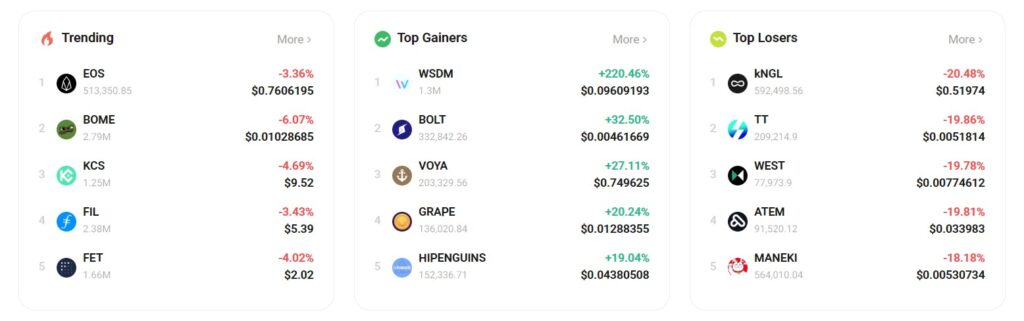

Kucoin Supported Coin List

KuCoin offers a comprehensive selection of cryptocurrencies for trading, boasting an assortment of over 700 digital assets.

This diversity caters to both seasoned traders and newcomers within the cryptocurrency market. You can find significant market-cap coins such as Bitcoin (BTC), Ethereum (ETH), and many altcoins.

Some of the prominent coins that you can trade on KuCoin include:

- Bitcoin (BTC): The original cryptocurrency was established in 2009.

- Ethereum (ETH): A decentralized smart contract platform launched in 2015.

- Litecoin (LTC): Known as the silver to Bitcoin’s gold, it was introduced in 2011.

- Bitcoin Cash SV (BSV): A Bitcoin Cash fork from 2018.

In addition, KuCoin is committed to updating its supported coins list frequently to ensure that it provides the latest trading options.

To make informed trading decisions, you can explore the supported cryptocurrencies and consider their features, such as launch year, market position, and technology.

The platform’s user-friendly interface and regular updates to the coin list facilitate a trading environment where you can stay contemporary with the dynamic cryptocurrency market.

Please note that the availability of certain products may differ based on your location due to local regulatory requirements.

For up-to-date information on the coins available in your region, it’s advisable to consult the official KuCoin website or reach out to customer support.

Kucoin Order Types

When you trade on KuCoin, you can access various order types that facilitate different trading strategies. Understanding each order type is crucial for making informed trading decisions.

Market Orders: The most basic type is the market order, which allows you to buy or sell a cryptocurrency at the current market price. With this order, execution is prioritized over the cost.

- Usage: Use this to enter or exit the market quickly.

- Example: If KCS is valued at 0.96263 USDT, and you wish to purchase KCS immediately, you would execute a market order.

Limit Orders: Limit orders let you set a specific price at which you want to buy or sell a cryptocurrency.

- Usage: Unlike market orders, opt for a limit order to control the price.

- Example: If you want to buy KCS at no more than 0.95000 USDT, place a limit order at that price, and the order will only execute if the market reaches your set price.

Stop Orders: Stop orders are designed to limit losses or lock in profits by converting to a market order once a specified price level is hit.

- Usage: Use stop orders as a risk management tool.

- Example: Set a stop-sell order at a price below the current market value to mitigate potential losses.

Each order type serves a different purpose and offers control over your trading activities. By combining these order types strategically, you can manage your trades more effectively and adapt to the dynamic cryptocurrency market.

Kucoin’s Liquidation Mechanism

KuCoin, a prominent cryptocurrency exchange platform, implements specific mechanisms to manage liquidation in margin trading. This process is crucial to protect the trader and the platform from excessive losses due to high market volatility.

Isolated-Margin Trading Liquidation: When engaging in isolated-margin trading on KuCoin, you should be aware that when your debt ratio climbs to 97%, liquidation is initiated by the system.

Your debt ratio reflects the level of risk about borrowed funds in your account. If it hits or exceeds the liquidation threshold, your positions are automatically liquidated to mitigate further losses.

Cross-Margin Trading Liquidation: Similarly, KuCoin has a set liquidation mechanism to safeguard its users’ investments in cross-margin trading. A precaution is taken to prevent your entire margin account from being liquidated due to a single position.

Debt Ratio Monitoring:

- Updates every 5 seconds.

- Warning alerts are sent out at a 95% debt ratio.

- Liquidation takes place at a debt ratio of 97%.

Regarding futures trading on KuCoin, it is essential to maintain your balance above the maintenance margin requirement to avoid automatic liquidation. Positions are liquidated if the maintenance margin is not met to prevent the potential amplification of losses.

Rebalancing Mechanism: KuCoin Leveraged Tokens employ a daily rebalancing mechanism to maintain leverage levels within the intended range. This consistent approach ensures your exposure level aligns with your trading intentions and that the inherent market risks are managed efficiently.

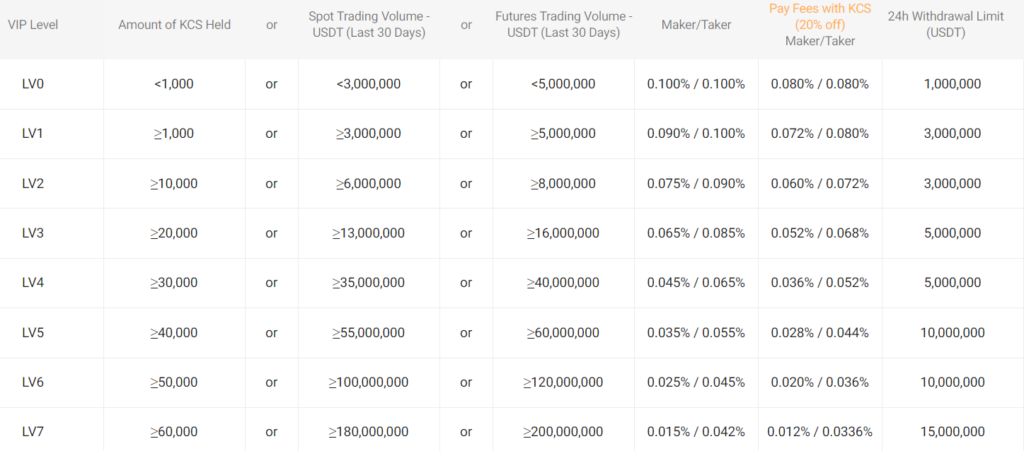

Kucoin Trading Fees

When trading on Kucoin, the platform’s fees are competitive within the cryptocurrency exchange landscape.

Your trading fees depend on factors such as your trading volume and whether you utilize KuCoin’s native token (KCS) to pay transaction fees.

For standard spot trading, the base fee starts at 0.1% for both market makers and takers. Should your monthly trading volume exceed 2000 BTC, or if you opt to pay the fees with KCS, you are eligible for reduced costs.

With substantial trading volume, it’s possible to lower the maker fees to -0.005%—0.100%, which is quite attractive.

The platform’s fee structure changes when dealing with leverage or derivatives. To be well-informed of the exact trading fees that will apply to your transactions, it’s advisable to check KuCoin’s fee schedule on their official website.

Here’s a breakdown to help you understand the basic fee structure:

-

Spot Trading Fees:

- Maker: 0.1% (can decrease with higher trade volume or KCS payment)

- Taker: 0.1% (similarly reducible)

-

Derivatives Trading Fees:

- Depends on the specific product – refer to the official fee schedule

Remember, keeping an eye on your trading volume and how you pay your fees can be beneficial in optimizing your costs when trading on KuCoin.

Kucoin Funding Rates/Fees

In cryptocurrency exchanges, Kucoin’s structure for funding rates and fees is a critical factor in your trading strategy, mainly when dealing with futures.

Within these markets, funding rates act as periodic payments that compensate or charge traders. These rates fluctuate, influencing positions in perpetual futures contracts.

Funding Rate Calculation

Your funding rate payment is calculated by multiplying the funding rate by the value of your position. This value adjusts based on the perpetual contract markets and the prevailing spot prices.

For example:

- Long Position: If you hold a long position and the funding rate is positive, you pay the funding rate to those in a short position.

- Short Position: Conversely, if you’re in a short position under the same conditions, you receive funds from those holding long positions.

Example of Funding Fee:

- Position Value: 2 BTC

- Funding Rate: 0.0250%

- Funding Fee:

2 BTC * 0.0250% = 0.0005 BTC

As a Kucoin user, monitoring these rates regularly is essential due to their dynamic nature.

Fees Overview

Kucoin’s fees are known to be competitive in the market. The platform maintains a base fee rate for spot trading, supporting its reputation for low fees across various trading operations.

Remember to review the specific fee structures for activities such as derivatives trading and consider the impact of such costs on your trading outcomes. Keeping these factors in mind can help manage your expectations and trading expenses effectively.

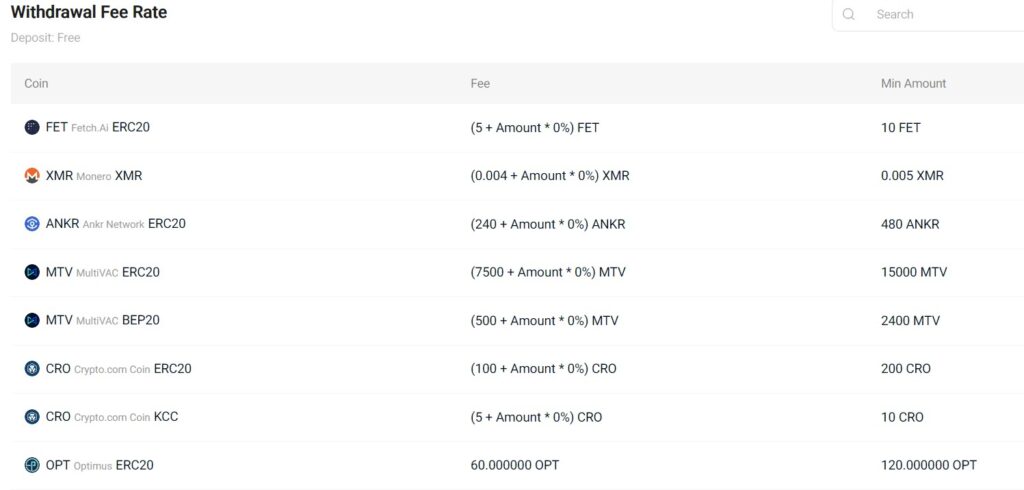

Kucoin Deposit & Withdrawal Fees

When interacting with the KuCoin platform in Australia, you’ll find that cryptocurrency deposits are typically made without any fees.

This allows you to transfer your digital assets into KuCoin without incurring extra costs. It is noteworthy that while deposits are free, withdrawing funds from KuCoin entails specific fees that vary depending on the cryptocurrency you choose to cancel.

Deposit Fees:

- Cryptocurrency: $0

Withdrawal Fees:

Withdrawal fees differ from one coin to another. For an up-to-date and specific breakdown, you’ll want to consult the relevant KuCoin fee scheduleat the time of your transaction. Here’s a general structure you can expect regarding withdrawal fees:

| Cryptocurrency | Withdrawal Fee |

|---|---|

| BTC | Dynamic Fee |

| ETH | Dynamic Fee |

| Altcoins | Dynamic Fee |

Note: Dynamic fees mean that the cost may change based on network conditions and coin value at withdrawal time.

The KuCoin trading fees also maintain a competitive edge with a base rate of 0.1% for market makers and takers in spot trading.

These low trading and withdrawal fees make KuCoin an attractive option for trading and managing your cryptocurrency portfolio.

Always confirm the current fees directly through your KuCoin account or the official fee structure statement to stay informed about any changes.

KuCoin Account Types & KuCoin KYC Tiers & Limits

When you register on KuCoin, you can undergo identity verification or KYC (Know Your Customer) to enhance your account features.

Each verification tier grants you different withdrawal limits and trading capabilities.

Non-Verified Accounts

- Daily Withdrawal Limit: Low

- Trading: Access to basic trading features

Verified Individual Accounts

- Daily Withdrawal Limit: Increased significantly over non-verified accounts

- Trading: Access to advanced trading features, including margin and futures markets

Verified Institutional Accounts

- Daily Withdrawal Limit: Highest

- Trading: Access to OTC (Over-the-Counter) trading and other exclusive services

Verification Process Tiers:

- Basic Verification:

- Requirements: Email, phone number

- Benefits: Enables crypto-to-crypto trading and deposits

- Advanced Verification:

- Requirements: Government-issued ID, selfie verification

- Benefits: Higher withdrawal limits, margin trading

Note: KYC completion will increase your withdrawal limits and can also enable additional customer service support. The process includes providing personal information, ID photos, face verification, and review.

KuCoin has tailored its services to comply with regulations, ensuring a secure trading environment for you. By completing the KYC process, you also help KuCoin in mitigating risks such as fraudulent activities and money laundering.

Kucoin Trading Platform & Tools

KuCoin’s trading platform caters to both beginners and seasoned traders with a suite of advanced tools.

The exchange offers spot trading, where you can buy or sell cryptocurrencies at current market prices, and margin trading, giving you the leverage to trade with more than your current balance.

For those interested in futures, KuCoin’s futures trading allows you access to speculative contracts on the price of popular cryptocurrencies. It brings the potential for profit in both rising and falling markets.

- Spot Trading: Trade at real-time prices

- Margin Trading: Gain leverage up to 10x

- Futures Trading: Speculate on crypto prices

KuCoin features advanced order types, which afford you a high level of control over your transactions.

This includes limit, market, stop, and iceberg orders. Additionally, its platform is unique in offering a trading bot, which simplifies trading by automating it based on your specified criteria.

This can be particularly useful for managing trades 24/7 without constantly monitoring the markets.

Comprehensive trading charts and tools complement the trading bot and advanced order options. Whether you’re analyzing trends or planning your next move, these tools help you make informed decisions.

| Feature | Description |

|---|---|

| Advanced Order Types | Limit, market, and stop orders for precise trade execution |

| Trading Bot | Automates trading and strategy implementation |

| Trading Charts | Detailed analytics for informed trading decisions |

KuCoin’s platform ensures you have the necessary tools at your fingertips to navigate the cryptocurrency market with confidence.

Whether trading casually or looking to implement more complex strategies, these tools are designed to enhance your trading experience.

Kucoin Insurance Fund

KuCoin’s Insurance Fund serves as a safety net to protect your investments on the platform against exceptional losses.

It is designed to mitigate the risk of auto deleverage if a forced liquidation does not achieve a price above the bankruptcy price. The fund’s balance is increased using surplus from liquidated positions executed successfully.

Key Points:

- Protection: The fund provides coverage for systemic losses not caused by users.

- Utility: It is used primarily after forced liquidations when the liquidation price is worse than the bankruptcy price.

- Funding: The surplus from liquidations contributes to the fund’s balance.

If a shortfall occurs, such as in the case of the 2020 security breach where KuCoin was hacked, the insurance fund may step in to cover the deficits.

As reported, no users incurred losses due to this incident, as 84% of the stolen funds were recovered, and the remaining 16% were compensated through the insurance fund.

Benefits for You:

- Security: Increases confidence in the platform’s resilience.

- Stability: Helps maintain the integrity of the trading environment.

- Continuity: Ensures operations can continue smoothly after disruptive events.

KuCoin has also enhanced its security measures and platform architecture post-incident, showcasing its commitment to user protection and continuous improvement.

Remember:

- Your investments have a layer of protection through the insurance fund.

- The fund is integral to KuCoin’s strategy for managing systemic risks and ensuring platform stability.

Kucoin Deposit Methods

KuCoin offers several deposit methods to cater to your needs. When you are ready to deposit funds into your KuCoin account, you can choose from the following options.

Cryptocurrency Transfers:

- Fee: $0 for cryptocurrency deposits.

- Process:

- Navigate to the “Assets” column.

- Click “Deposit”.

- Choose or search for the cryptocurrency you wish to deposit.

- Select the corresponding account.

Credit Cards:

- Partner services like Simplex provide convenience when using credit cards.

- The credit card option is available directly on the deposit interface.

Bank Transfers:

- Bank transfer is available as a deposit method.

- Depending on your bank and region, this method may come with varying processing times.

When depositing, always ensure that the deposit service for the asset is operational. Some cryptocurrencies may have specific deposit fees or minimum amounts, which are detailed on the deposit page.

For smooth transactions, checking these conditions before initiating a transfer is advisable. Moreover, be aware that pop-up windows and highlighted instructions are used on KuCoin to guide you through the deposit process.

Remember, while KuCoin does not charge deposit fees for cryptocurrencies, third-party services such as credit card processors may impose their costs. Always review the terms and conditions of your deposit method to avoid surprises.

KuCoin Security Features

KuCoin prioritizes your asset safety and personal data security by incorporating several robust security measures.

Encryption & Protocols:

- Industry-standard encryption protocols safeguard your sensitive information during transit and at rest.

- Critical data is stored using bank-level security practices.

Multi-Factor Authentication (MFA):

- MFA adds an extra layer of security beyond just a password. It requires multiple forms of identification before granting access or performing transactions.

- You can enable MFA through various means such as SMS, calls, or authenticator apps.

Trading Password:

- For crucial actions such as making trades, withdrawals, or creating API keys, a separate 6-digit trading password is required.

- This feature provides an additional safeguard specifically for transaction-related processes.

Insurance Fund:

- KuCoin maintains an insurance fund intended to protect your assets from unexpected losses, adding another level of financial safety.

Continuous System Optimization:

- KuCoin continuously enhances system security to protect against emerging threats and vulnerabilities.

- Up-to-date technology is deployed to keep the platform secure in a rapidly evolving digital environment.

Security Best Practices:

- Stay vigilant against unsolicited communications that might request your login information or MFA codes.

- Regularly update your trading password and review your account’s security settings.

You can confidently manage your digital assets on the platform by staying informed about KuCoin’s security features and following recommended security practices.

KuCoin Proof Of Reserves

KuCoin has introduced a transparent mechanism known as Proof of Reserves (PoR) to verify its assets. This system provides assurance that your investments are fully backed on a 1:1 reserve basis.

Understanding Proof of Reserves (PoR)

Proof of Reserves is an audit mechanism in which the exchange uses cryptographic methods and third-party verifications to prove that its holdings are equivalent to user deposits.

How to Verify Your Holdings on KuCoin

To verify your assets:

- Go to the KuCoin homepage.

- Access the Proof of Reserves page, which is typically found at the bottom of the page.

- Once there, you will find options to select a PoR snapshot time that suits you.

- Scroll to the “Verify Account Assets” section.

- Click “Verify Now” for the desired Period Proof of Reserves.

Benefits of KuCoin’s PoR

- Offers a transparent view of the exchange’s holdings.

- Provides cryptographic proof of wallet address ownership.

- Involves periodic audits by third parties for additional trust.

Remember, the Proof of Reserves system not only helps in affirming that your assets are secure but also enhances the exchange’s transparency, contributing to a more trustworthy cryptocurrency ecosystem.

KuCoin Customer Support

KuCoin dedicates itself to providing around-the-clock customer service, ensuring that your inquiries and issues are addressed at any time. Regardless of your time zone or location, you can rely on constant access to assistance through various channels.

Contact Methods:

- Live Chat: Available for immediate responses to urgent matters.

- Email Support: Useful for detailed queries that may require thorough investigation.

- Help Center: A comprehensive resource for self-service assistance.

The Help Center is detailed and categorized to help you quickly find the answers to common questions. The customer service team also guides you efficiently through more complex situations that might require specialized assistance.

Availability:

- 24/7 Support: Your needs are catered to at all hours.

Using KuCoin’s customer support, you can swiftly resolve trading issues, account queries, and get clarity on any operational changes. For instance, if new regulatory requirements affect your trading experience in Australia, like changes in available products, the support team can help you navigate these updates.

With the confidence from a reliable support structure, you can trade and engage with KuCoin’s platform, ensuring a smooth and informative user experience.

Is KuCoin Safe & Available in Australia?

KuCoin operates in compliance with the laws and regulations of the jurisdictions in which it offers its services.

Specifically, in Australia, KuCoin has taken steps to align with local regulations set forth by the Australian Securities & Investments Commission (ASIC). As of mid-May 2024, KuCoin has adjusted its offerings to Australian users to adhere to these requirements.

Security Measures:

- Know Your Customer (KYC): To use KuCoin services, you must complete KYC verification, which adds a layer of security by ensuring all users are correctly identified.

- Anti-Money Laundering (AML): KuCoin follows AML guidelines to prevent financial crimes, reinforcing platform integrity.

However, it’s important to note that KuCoin does not currently hold a license in the United States, which may cause concern for U.S. residents considering using the platform.

Compliance with Regulations:

- Australian Law: Complies with ASIC regulations for local users.

- International Standards: Adheres to international KYC and AML regulations.

When assessing the safety of KuCoin, consider the platform’s robust security protocols, such as encryption and multi-factor authentication, which help protect your assets and personal information.

Despite the absence of a U.S. license, KuCoin’s international compliance with security practices instills trust in its operations. Always stay informed about the legal status of any cryptocurrency platform in your respective country.

Conclusion

KuCoin has solidified its presence in Australia as a reliable cryptocurrency exchange. Security and affordability are prominent, with its security measures instilling confidence and a competitive fee structure catering to a cost-conscious audience.

Your trading experience is enhanced with advanced tools and an extensive selection of over 779 cryptocurrencies.

- Variety: You have access to a vast array of cryptocurrencies.

- Tools: Advanced trading tools and charts are at your disposal.

- Fees: Benefit from low trading fees.

- Innovation: Unique features such as trading bot and fractionalization of digital assets are available to you.

- Community: Join a growing user base of over 20 million customers globally.

Remember to stay informed about region-specific changes, such as the cessation of specific products, by June 25, 2024, for Australian users.

By keeping abreast of these updates, you ensure continued compliance with local regulations and smooth operation of your trading activities on KuCoin.

Whether you’re just starting or scaling up your cryptocurrency portfolio, KuCoin offers a comprehensive platform that meets diverse trading needs.

Discover More Reviews: