Banxa Australia Review in 2025

BANXA, an Australian-based company, specializes in providing a seamless fiat-to-crypto gateway.

With many payment methods, it caters to businesses and consumers looking to transact in cryptocurrencies. Recognized for its collaboration with top wallet providers like MetaMask and Trust Wallet, BANXA is a pivotal player in the digital currency ecosystem.

Understanding the dynamic nature of the crypto market, BANXA equips you with the tools necessary for straightforward transactions.

Should you engage with cryptocurrencies, you will find their infrastructure reliable. Compliance and trust are at the forefront, as evidenced by BANXA’s certification under the Australian Digital Currency Industry Code of Conduct, ensuring you transact confidently and in peace of mind.

As the crypto landscape evolves, BANXA continues to innovate, cutting transaction times and costs dramatically with the launch of leading-edge Layer 2 solutions.

Whether you are a seasoned participant or new to the space, BANXA provides a robust foundation supporting your entrance or expansion in the crypto economy.

BANXA Product Offerings [Futures, Spot, Options, Staking, NFTs, etc.]

Futures, Spot, and Options Trading:

BANXA is not a trading platform but an enabler, connecting you with various trading opportunities through established exchange partnerships, including futures, spots, and options.

This connection allows you to engage in various forms of cryptocurrency trading according to your preference and risk appetite.

- Futures: Engage in agreements to buy or sell assets at a future date at a predetermined price.

- Spot Trading: Instantly trade cryptocurrencies at current market prices.

- Options: Purchase the ability, but not the obligation, to buy or sell an asset at a set price within a specific time frame.

Staking and NFTs:

While BANXA doesn’t directly offer staking or NFT services, it facilitates these through partner platforms.

You can access these services to stake your digital assets or to buy, sell, and trade NFTs, leveraging the interconnected ecosystem developed by BANXA’s collaborations.

- Staking: Earn rewards by locking up your cryptocurrencies.

- NFTs: Explore the burgeoning world of non-fungible tokens for digital art and collectibles.

Payment Solutions:

Your payment requirements, whether you are an individual enthusiast or a business, are comprehensively catered to.

BANXA specializes in extensive payment methods, focusing on seamless integration and exceptional product experience.

- Payment Processing: Streamline your fiat-to-crypto transactions with ease.

- Fiat and Crypto Exchange: Quickly convert between fiat and cryptocurrencies.

- Compliance: Navigate the complex regulatory landscape with BANXA’s guidance.

BANXA’s service offering is primarily as a financial technology platform, simplifying payments and trading in the crypto space.

BANXA Supported Coin List

As you navigate the cryptocurrency space, you might be exploring the digital assets supported by BANXA.

Your options are diverse, with BANXA regularly expanding its list to include various cryptocurrencies and blockchain networks. Here is a condensed list of some of the cryptocurrencies you can typically transact with through BANXA:

- Ethereum (ETH): A dominant platform for decentralized applications, Ethereum is supported in ERC20 form.

- AAVE: A decentralized finance protocol allowing people to lend and borrow crypto.

Remember that BANXA continuously adds new assets, making it essential to check for updates frequently to ensure you have the latest information.

Regarding BANXA’s support for blockchain networks, apart from the Ethereum network, BANXA also provides for the Binance Smart Chain (BEP20), which connects a range of projects and tokens within the Binance ecosystem.

For the most accurate and up-to-date list, you should visit the BANXA platform directly. This will give you a real-time view of the coins you can buy, sell, or use for transactions.

BANXA Order Types

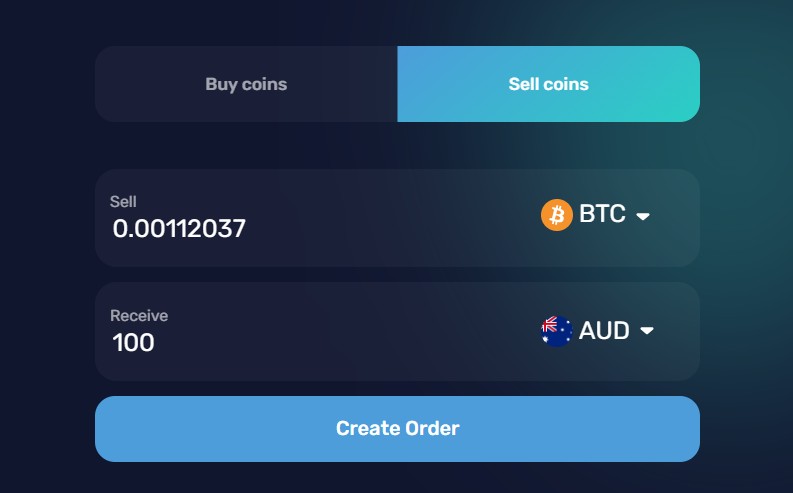

When transacting on BANXA, your experience includes a streamlined order process tailored to facilitate quick and efficient fiat-to-crypto transactions.

Familiarize yourself with the steps to enhance your understanding and manage your expectations.

- Create Order: You initiate the transaction by creating an order.

- Order Validation: BANXA validates the details of your order.

- ID Check (KYC): A Know Your Customer (KYC) check is mandatory for new customers.

- Payment Confirmation: You confirm the payment using your chosen payment method.

Below is a brief overview of what to expect during the order process:

New Customers:

- KYC Step: Necessary for your first purchase from an exchange.

- Payment Confirmation: Finalize your order by confirming your payment.

Existing Customers:

- Expedited Process: The order flow is typically faster after completing KYC.

Payment Methods include:

- POLi: Exclusive to Australian customers, allowing direct bank transfers.

- iDEAL: Available to Dutch customers, facilitating instant payments.

Here are indicators of the time frame for order completion:

- Without Intervention: Most orders are completed within approximately 30 minutes.

- External Delays: Network congestion can affect blockchain settlement times.

Factors like compliance checks or network congestion may extend the waiting period. Your patience is appreciated in such instances.

BANXA’s Liquidation Mechanism

When engaging with BANXA, you should be aware that as a fiat-to-crypto service, it is not directly involved with trading activities that require a liquidation mechanism, as seen in traditional exchanges.

Their primary role is to facilitate a secure and compliant platform for you to convert fiat currency into cryptocurrency and vice versa.

Key Points of the Service:

- Conversion: BANXA allows for the conversion of fiat (such as USD, AUD, etc.) into various cryptocurrencies.

- Payment Methods: The service offers various payment options, adapting to your preferences.

- Security: Ensures that transactions are carried out within regulatory frameworks to provide you with a trustworthy service.

Understanding the Process:

- Initiation: You start by selecting the amount of fiat currency to exchange.

- Transaction: You follow through with the conversion by choosing your preferred payment method.

- Completion: The equivalent cryptocurrency is deposited into your wallet upon successful payment.

BANXA is focused on providing a seamless bridge between fiat and cryptocurrencies without the complexity of a liquidation mechanism associated with trading platforms.

Their role streamlines your experience by minimizing the steps required to engage with the digital currency space, affirming their position as a facilitator rather than a trading entity.

BANXA Trading Fees

When you engage in transactions using Banxa, you face various fees. Let’s break down the cost structures you might encounter.

- Payment Gateway Fees: These charges stem from using the service to facilitate your transactions.

- Blockchain/Network Fees: These network-specific fees apply when conducting transactions on the blockchain.

- Banxa Fees: The company charges its service fees.

- Foreign Exchange Fees: Converting between currencies can lead to these costs.

- Taxes: Depending on your location, taxes may apply to your transactions.

Here’s a snapshot of typical fee percentages based on payment methods as provided by Banxa:

| Payment Method | Fee |

|---|---|

| Visa/Mastercard | Approx. 1.99% |

| Bank Transfer | Variable up to 4.5% |

| POLi | 2.00% |

| iDEAL | Specific to Dutch customers, the percentage may vary |

Remember, fees can fluctuate between 4-6% depending on your chosen method, which is particularly relevant if you transact directly through Banxa.

For instance, if you decide to use a Visa or Mastercard for a transaction of USD 1000, you would incur a fee of around 1.99%, leaving you with roughly $980.10 USDT after the fee deduction.

Settlement times also vary, ranging from instant to up to one business day, which can impact when your traded funds become available.

Important Note: Always refer to Banxa’s official resources for the most current fee structure, as they are subject to change.

BANXA Funding Rates/Fees

You’re provided with a transparent fee structure when using BANXA’s service to convert fiat to crypto. The quotations BANXA offers include various fees, ensuring clarity and certainty regarding the amount you will receive.

For instance, when a payment method indicates a fee of 4.5%, and you’re converting USD 1000, expect to receive $955 in USDT. This total includes:

- Payment gateway fees

- Blockchain/network fees

- BANXA fees

- Foreign exchange fees

- Tax

It’s important to note that while BANXA itself doesn’t handle funding rates directly as it doesn’t offer futures trading, the fees may be applied differently on partnered platforms that facilitate these trades.

BANXA supports multiple payment methods:

- POLi: An online payment option exclusive to Australia, with an associated fee of 2.00%, with up to 1 business day processing.

- iDEAL: A payment network for Dutch customers that provides instant transactions.

For their services in Australia, additional fees to consider that BANXA applies include:

- Credit/Debit Cards (Visa/Mastercard): A fee of 1.99% may apply to transactions when purchasing crypto with these methods.

Remember, BANXA’s fee structure transparency means you’re fully informed about the costs involved in your transactions without unexpected charges.

BANXA Deposit & Withdrawal Fees

When you transact with BANXA, your fees vary depending on the selected payment method.

For example, using POLi, an online payment option facilitating payments from your bank account to a merchant, incurs a fee of 2.00% and may take up to 1 business day for the transaction to complete. It’s important to note that POLi is exclusive to Australia.

For Dutch customers, iDEAL offers an instant payment network, aligning with the demand for swift transactions. BANXA has not disclosed the fees for iDEAL in the provided information, but being an instant service, it might be favorable for quick transfers.

Credit and debit card transactions could take up to 15 days, contingent on your bank’s processing times. The transaction fees aren’t specified, but expect a percentage-based fee that aligns with industry standards.

Transactions through BANXA may result in the following fee structure:

- POLi: 2.00%, up to 1 business day

- iDEAL: Instant (fee not specified)

- Credit/Debit Cards: Up to 15 days (fee not specified)

For exact quotes, BANXA offers a ‘what you see is what you get’ policy, ensuring that your quoted price includes all payment gateway fees, blockchain/network fees, BANXA’s fees, foreign exchange fees, and applicable taxes.

As a model, a transaction fee of 4.5% on a USD 1000 conversion to USDT would leave you with $955 USDT after all costs.

Remember that BANXA is known for its competitive rates, particularly for more significant transactions, which often involve a detailed compliance process to ensure security and legitimacy.

BANXA Account Types & KYC Tiers & Limits

BANXA offers fiat-to-crypto exchanges with multiple account types, each subject to different Know Your Customer (KYC) tiers and limits based on transaction volumes and regulatory norms. Here’s what you need to know about these account types and their requirements.

Initial KYC Tier:

Upon your first purchase with BANXA, you must provide basic personal information. This includes:

- Name

- Date of Birth

- Address

- Contact details

This tier typically allows for minor to moderate transactions.

Enhanced KYC Tier:

For higher transaction thresholds, you are required to submit additional documentation. This may include:

- Government-issued ID

- Proof of address

- A photographed selfie

Details of transaction limits for each tier are specific and can vary; check BANXA’s platform for the latest information.

Daily Transaction Limits:

| Payment Method | Daily Limit |

|---|---|

| POLi Bank Transfer | AUD 50,000 |

| Newsagent | AUD 9,000 |

The limits mentioned above are indicative and might change; always refer to the latest updates from BANXA for the most accurate information.

It’s crucial to be aware that the KYC process is a regulatory requirement meant to prevent fraudulent activities.

The completion of KYC not only enables you to make transactions but also ensures a secure and compliant trading environment. Keep in mind that processing times can vary depending on the payment method. For example, processing POLi payments may take up to 1 business day.

BANXA Trading Platform & Tools

BANXA does not operate as a traditional trading platform. However, it plays a pivotal role in the crypto ecosystem by bridging fiat currencies and digital assets.

As you engage with various cryptocurrency exchanges, BANXA’s services facilitate seamless fiat-to-crypto conversions, which are essential for trading on platforms that do not directly accept traditional currencies.

Essential Services Provided by BANXA:

-

Fiat-to-Crypto On-Ramping: You can access conversion services from fiat money to cryptocurrencies. This is particularly beneficial for developers and users on the Consensys Linea Mainnet, which BANXA has integrated.

-

Payment Infrastructure: BANXA ensures that your payment transactions are secure and efficient, and coins are received within minutes post-transaction confirmation.

-

Compliance Services: BANXA handles regulatory compliance as you transact, ensuring that your trades are practical and adhere to the pertinent laws.

Integration with Cryptocurrency Custody Platforms:

- BANXA has partnered with platforms like Qredo to enhance security and trust in transactions by providing custody solutions.

Remember, while BANXA may not be an authorized deposit-taking institution, and crypto assets are not FDIC-insured products, these services are imperative for a secure and compliant trading experience.

As a user or developer, your transactions involving digital assets are facilitated by BANXA’s financial technology platform, fostering a conducive environment for your crypto endeavors.

BANXA Insurance Fund

When considering the safety of your assets with Banxa, a key element to understand is Banxa’s approach to security and compliance.

Although no specific public information details an “Insurance Fund” offered by Banxa, the platform emphasizes its commitment to high-security standards and stringent regulatory adherence for safeguarding customer transactions.

Security Measures:

Banxa has implemented various measures to secure your fiat-to-crypto transactions. These include:

- Collaboration with trusted wallets such as MetaMask and Trust Wallet.

- Regulatory compliance across multiple jurisdictions, reassuring the integrity of their service.

Compliance Framework:

Banxa places significant emphasis on compliance with regulatory standards. This means you can expect:

- Meticulous adherence to local financial regulations to mitigate risks.

- Transparency in their operations provides a clear understanding of their processes.

It’s also worth noting that, while not specified as an “Insurance Fund,” Banxa’s operational security and compliance frameworks function to establish a level of risk mitigation that indirectly serves a role in the financial protection of its customers.

Contacts and Addresses:

For further inquiries regarding security, you may contact Banxa’s offices:

- Australia: Level 2, 2/6 Gwynne Street, Cremorne, Victoria 3121

- USA: 1 East Liberty Street Suite 600, Office 16, Reno, NV 89501

Should additional details about any form of “Insurance Fund” be released, or if you require specific information on how Banxa protects your transactions, contact Banxa directly.

BANXA Deposit Methods

BANXA offers a variety of deposit methods tailored to your needs, ensuring easy access to cryptocurrency transactions. Below is a guide to the deposit methods available to you as a BANXA user in Australia:

Online Banking Options:

- POLi: This option allows you to pay directly from your bank account to a merchant exclusive to Australia. Transactions are processed within one business day, and a fee of 2.00% is applied.

Bank Transfers:

- Bank Transfer (e.g., iDEAL, Faster Payment, SEPA): Standard bank transfer methods are also supported, taking up to two business days for the funds to be received by BANXA, especially if orders are placed on weekends.

Digital Verification:

To complete your transactions securely, BANXA integrates with various digital verification methods, including:

- Pin Code

- Touch ID

- Face ID

These options are available on your mobile device and are ideal for verifying and securing deposits.

Knowing the fees and settlement times associated with each method is essential. While digital verification methods typically result in swift transactions, traditional bank transfers can take slightly longer to process, especially outside business hours.

For the most seamless experience, ensure that your preferred deposit method aligns with BANXA’s offerings and that you’re prepared for the associated fees.

Your choice of payment method directly impacts how quickly you can complete transactions and engage with the world of cryptocurrency.

BANXA Security Features

BANXA implements strict security protocols to ensure the safety of your transactions. As your gateway into cryptocurrency, the platform integrates comprehensive compliance practices and adheres to strict regulatory standards.

Advanced Security Technologies:

- Two-Factor Authentication (2FA): Bolsters the security of your account by requiring a second form of verification.

- Encryption: Protects your sensitive data with industry-standard encryption methods.

Compliance and Regulatory Adherence:

- AML Policies: Strong anti-money laundering procedures to prevent illicit activities.

- International Standards: Compliance with global regulations to offer you a secure platform.

Your transaction safety is BANXA’s top priority.

As offerings extend to multiple payment methods globally, these security measures are continuously updated to address evolving cyber threats and regulatory requirements. When you transact with BANXA, rest assured your digital assets are safeguarded.

BANXA Proof Of Reserves

When engaging with BANXA, a leading fiat-to-crypto on-ramp, and payment service provider, you may inquire about the transparency and reliability of their operations.

It’s essential to understand that BANXA’s model prioritizes compliance and security regarding financial transactions.

While BANXA is not a cryptocurrency exchange and typically does not hold assets on behalf of customers, its dedication to regulatory adherence and customer service is paramount.

Instead of providing a Proof of Reserves—a practice more common among exchanges where customer assets are held—BANXA focuses on its core competency: facilitating secure and efficient payment processing between fiat and cryptocurrencies.

This approach ensures that your transactions are handled with due diligence, aligning with financial regulations that are in place to protect all stakeholders involved in the process.

BANXA deals primarily with transactions rather than asset storage, so the requirement to disclose proof of reserves is not applicable in their operation model.

What Does This Mean for You?

- You understand that BANXA provides payment services and does not store large reserves of crypto assets on your behalf.

- Recognizing BANXA’s focus on security and compliance, ensuring your transactions adhere to industry standards.

- Knowing that BANXA, while facilitating transactions, does not fall into the category of businesses for whom disclosing proof of reserves is typically expected or required.

Your confidence in using BANXA’s services can be attributed to their emphasis on efficient and secure payment processing, reflected in their operational practices and compliance measures.

BANXA Customer Support

When you require assistance with Banxa’s services, rest assured that their customer support is at your service. Available 24/7, 365 days a year, the support team is ready to address your inquiries with dedication and expertise.

Contact Methods

- Support Request Form: Accessible through Banxa’s website for direct communication.

- Email: Reach out to the team at [email protected] for personalized support.

Types of Support Offered

- Order Status: Inquiries about the progress of your orders.

- Payment Assistance: Guidance on making payments, fee clarifications, and transaction help.

Supported Transactions

Banxa supports a variety of payment methods, ensuring you can transact easily:

- Bank accounts via POLi Payments

- Cash transactions at participating newsagency shops

Remember, the support team’s goal is to respond swiftly and effectively, delivering resolutions that ensure your satisfaction with their services. For any concerns regarding transactions or the platform, your first step is to contact Banxa’s capable support team. They’ll provide the information and solutions you need to use Banxa confidently.

Is BANXA Safe & Available in Australia?

When evaluating whether BANXA is a legal and safe platform for purchasing and selling digital assets, it is crucial to consider its commitment to regulatory compliance and security.

Regulatory Compliance:

- BANXA has been certified under the Australian Digital Currency Industry Code of Conduct, marking its adherence to established best practices.

- The platform’s operations are subject to change in response to the evolving legal framework, reflecting their commitment to compliance.

Security Measures:

- Secure Transactions: BANXA provides secure transactions, employing robust security protocols to protect your information and assets.

- Compliance with Payment Standards: Multiple payment methods supported by BANXA adhere to rigorous security standards to ensure safe transactions.

Customer Experience:

- Payment Platform: Described as a leading global payment platform, BANXA provides a user-friendly transaction interface.

Regional Support:

- While BANXA broadly supports transactions in various countries and territories, it currently does not support certain US states and territories, indicating a cautious approach in jurisdictions that may not guarantee full compliance.

Your use of BANXA’s services implies a reliance on their active role in following regulatory expectations. Their engagement with Australian digital asset standards suggests a straightforward, legally responsible service for their customers.

Conclusion

Your examination of BANXA Holdings Inc. reveals an organization determined to solidify its standing as a prominent on- and off-ramp service provider within the Web3 space.

As you consider their operations, it’s evident that they prioritize security, compliance, and user experience, recognizing these elements as fundamental to their business model and maintaining trust with their global user base.

The year 2023 financial audits and subsequent quarterly reports indicate that BANXA is poised to capture growth opportunities in the fluctuating cryptocurrency market.

Their adaptability through market challenges, such as the noted “crypto winter” of 2022, showcases a resilience that you may find reassuring.

Remember their strategic positioning. As you navigate your cryptocurrency transactions, BANXA’s trajectory towards strengthening infrastructure should instill confidence in their service reliability in present and future contexts.

| Notable Financial Milestones | Details |

|---|---|

| FY 2023 Audited Results | Demonstrated financial integrity and stability |

| Q2 FY24 Unaudited Results | Positive performance, maintaining operational efficiency |

BANXA holds the potential to leverage market developments to its advantage. As they do so, they continue to emphasize the value of a compliant and convenient platform, underpinning your transactions with security and ease.

Discover More Reviews: