Changelly Australia Review in 2024

Changelly is an established name in cryptocurrency exchanges, having served millions of customers since its inception in 2015.

In Australia, it presents a unique offering of quick and efficient crypto-to-crypto exchanges.

Catering to the diverse needs of its users, Changelly ensures that both seasoned traders and those new to cryptocurrencies can easily navigate the process of buying and exchanging digital assets.

For Australians looking to enter the cryptocurrency market, your range of options within Changelly permits Bitcoin purchases using various payment methods, including local currency AUD.

The service prides itself on offering transactions that are not only fast but also incur low processing fees. This makes Changelly a notable option for your crypto transactions, be you a budding enthusiast or a savvy investor in the Australian market.

Changelly distinguishes itself by aggregating cryptocurrency exchange rates from multiple platforms, ensuring you are provided with some of the best possible prices for your exchanges.

This ecosystem connects users and exchanges in one seamless flow, which allows you to manage your digital assets efficiently. Whether opting for fixed or floating rates, you can choose the rate that aligns with your investment strategy.

Changelly Product Offerings [Futures, Spot, Options, Staking, NFTs, etc.]

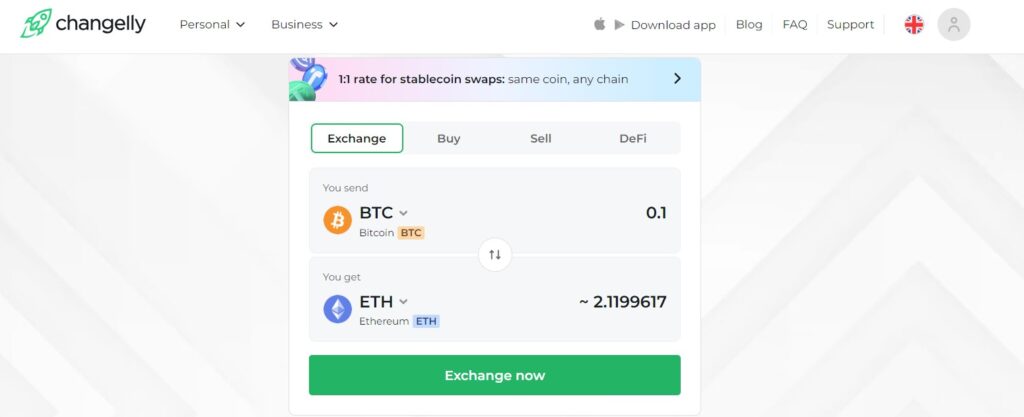

When you explore Changelly’s services, you’ll primarily encounter their instant exchange platform, designed for crypto-to-crypto transactions.

This trading app empowers you to choose between fixed and floating rates.

Fixed rates allow you to lock in the exchange price at the start of the transaction, providing predictability amidst the volatility of cryptocurrency markets.

Conversely, floating rates may vary due to market fluctuations during the transaction period.

For users seeking a more advanced trading experience, Changelly PRO offers an avenue for engaging in spot and futures trading.

This platform serves your needs if you plan on more traditional exchange activities with added tools and features supporting in-depth trading strategies.

- Spot Trading: In immediate trades, buying or selling cryptocurrency at current market prices.

- Futures Trading: Participate in contracts to buy or sell digital assets at predetermined dates and prices, potentially optimizing your trading strategies.

Currently, services such as options trading, staking, and trading in NFTs (Non-Fungible Tokens) are not explicitly highlighted as offerings by Changelly.

It’s focused on producing an accessible crypto exchange experience rather than a broader financial suite that includes derivatives or digital collectibles trading platforms.

Remember that these offerings reflect the current state of Changelly’s services and could expand their offerings to include additional investment and trading instruments.

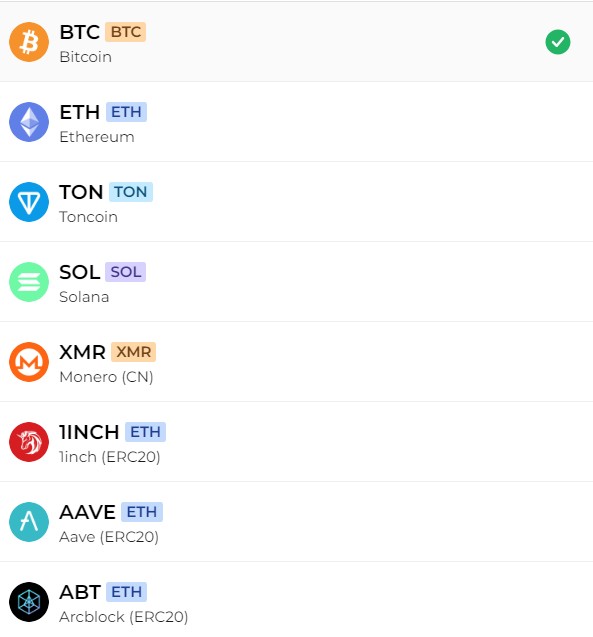

Changelly Supported Coin List

Changelly, a popular cryptocurrency exchange platform, offers you a robust selection of digital assets for your trading needs.

With support for over 680 cryptocurrencies, you can access a diverse and extensive portfolio to engage in crypto exchanges. Below is a snapshot of some of the prominent coins you can find on Changelly:

- Bitcoin (BTC): Bitcoin is the pioneer cryptocurrency that introduced blockchain technology worldwide.

- Ethereum (ETH): Known for its smart contract functionality, a foundation for decentralized applications.

- Ripple (XRP): A digital asset focused on cross-border payment solutions with fast transaction processing.

- Litecoin (LTC): Often considered silver compared to Bitcoin’s gold, Litecoin is aimed at being a lighter and faster alternative.

- Tether (USDT): A stablecoin pegged to the US dollar, offering minimized volatility compared to other cryptos.

For a comprehensive outline of supported assets, you can always view the current list available on the Changelly platform.

It’s important to know that the exchange regularly updates its offerings to keep pace with the evolving market, ensuring you have the latest options at your fingertips.

The availability of such a wide array means you can diversify your portfolio as you see fit, trading established cryptocurrencies or exploring emerging coins and tokens.

Changelly Order Types

When trading on Changelly, you’ll encounter two primary order types that facilitate cryptocurrency transactions.

These order types cater to different trading strategies and provide flexible options for novice and experienced traders.

- Market Order: This order type allows you to execute a trade immediately at the current market price. Your trade is filled at the best available price when you order. It is helpful for a quick exchange without waiting for a specific price.

- Limit Order: Contrasting with market orders, limit orders give you control over the price you buy or sell. You set the exact price at which you want the transaction to occur. The order will only be executed when the market price meets your specified price, offering precision in your trading strategy.

-

Fixed Rate: A fixed-rate order protects you from market fluctuations. Your exchange rate is locked in, ensuring the amount you receive is the same as the quoted amount, contingent on the timeliness and accuracy of your fund transfer.

-

Floating Rate: This type of order means the exchange rate is subject to real-time market conditions. The final amount you receive may differ from the quoted amount due to price movements between when you initiate the transaction and when it is completed.

These order types are available without the complexity of an order book, which is standard in traditional exchanges.

You’re empowered to swap cryptocurrencies instantly and at rates that are clear from the outset, whether fixed or subject to the ebb and flow of the market.

Changelly’s Liquidation Mechanism

When engaging with cryptocurrency exchanges, understanding their liquidation mechanisms is vital.

However, in the context of Changelly in Australia, a different framework is applied as Changelly does not facilitate margin trading, which typically involves such mechanisms.

What is Margin Trading?

Margin trading allows you to borrow funds to increase your buying power, with the potential for higher profits and increased risks, including the possibility of liquidations.

Changelly’s Stance

Changelly provides a straightforward exchange service rather than margin trading. Thus, you will not encounter liquidation processes in the traditional sense here.

Instead, you should be aware of the following regarding their operation:

- Exchange Fees: A fixed fee of 0.25% is applied to crypto exchanges, emphasizing simplicity.

- Direct Trading: You can directly swap between hundreds of cryptocurrencies without worrying about margin calls or liquidation prices.

- User Responsibility: You maintain control over your cryptos, negating the risk of sudden liquidation due to market volatility.

- Non-Custodial: Changelly doesn’t hold your funds, so you don’t have to stress over balance requirements typical in margin accounts.

Always adhere to safe trading practices and understand the rules of your platform. With Changelly, you can confidently exchange, knowing that there’s a transparent fee structure with no complications of liquidation mechanisms tied to leveraged positions.

Changelly Trading Fees

When you conduct crypto-to-crypto exchanges on Changelly within Australia, you incur a fixed trading fee of 0.25%. This fee structure is straightforward and transparent, ensuring you always know the cost associated with your transactions.

For your clarity, here’s how Changelly’s fee applies:

- Crypto-to-Crypto Transactions: A consistent rate of 0.25% is applied.

This fee is integrated into the final quote provided before you confirm a transaction, so you do not encounter any hidden charges post-execution.

Additionally, it is essential to be aware of the fact that for fiat-to-crypto transactions, the fees can start from 4% and vary based on certain factors such as:

- The currency pair selected

- Market rates and volatility

- Competition among fiat providers

It is critical to note that Changelly’s fees do not include network fees—these are separate charges set by the blockchain network and are not controlled by the exchange. The total cost of your transaction will be the sum of Changelly’s service fee plus the applicable network fee.

By keeping a keen eye on these fee structures, you can manage your cryptocurrency transactions effectively on Changelly, ensuring you are informed about the costs associated with your trading activities.

Changelly Funding Rates/Fees

When you use Changelly for cryptocurrency exchanges, you’ll encounter two main types of fees: exchange fees and network fees.

Exchange Fees

Changelly charges a flat 0.25% commission fee for crypto-to-crypto transactions. This fee is consistent across all transactions, providing predictability when trading between digital assets.

Network Fees

Network fees, also known as miner fees, are dictated by the blockchain network itself and are outside Changelly’s control. These fees ensure the blockchain network processes your transactions.

- BTC Network Fee: Determined by the network’s current congestion

- ETH Network Fee: Variable based on Ethereum congestion

- Other Cryptocurrency Network Fees Vary per asset and network load

It’s important to note that Changelly does not charge funding rates. The concept of funding rates is typically associated with margin or futures trading, where traders borrow funds to leverage their positions. Since Changelly offers a straightforward swap service without leverage, funding rates are not applicable.

Fixed vs. Floating Rates

- Fixed Rate: Secures the rate at the time of the transaction, protecting you from market fluctuations during the exchange process.

- Floating Rate: Reflects real-time market rates, meaning the final amount you receive might slightly differ from the quoted amount due to market volatility.

Always check the current network fees and choose between fixed and floating rates best suit your transaction preferences.

Changelly Deposit & Withdrawal Fees

When handling cryptocurrencies, you must be aware of associated fees.

At Changelly, no additional fees are charged on deposits or withdrawals. However, it would be best if you were aware of network fees determined by the blockchain you’re using.

Deposit Fees

When you deposit currency into Changelly, you won’t face any extra charges from the platform. The only cost incurred will be the standard network fee, which varies depending on the cryptocurrency involved.

Withdrawal Fees

For withdrawals, Changelly practices a unique approach. Like deposits, Changelly does not impose its fees for withdrawals. The only expense you’ll be responsible for is the fixed network fee, which is necessary to process the transaction on the blockchain network.

Please Note: Changelly does not control the network fees and can fluctuate based on the blockchain’s workload and market conditions.

Remember, for residents of Australia, your first transaction has a limitation. You’re limited to just $50 for that initial transaction.

Here’s a simple breakdown:

- Deposits: No Changelly fees; only network fees apply

- Withdrawals: No Changelly fees; fixed network fees apply

Understanding these details ensures transparent and effective management of your cryptocurrency transactions. Always make sure to check the current network fees to estimate the total cost of your transaction.

Changelly Account Types & KYC Tiers & Limits

Changelly provides a streamlined process for trading cryptocurrencies. Depending on your needs and the level of verification you’re comfortable with, there are different account types, each with its own KYC requirements and limits.

Starter: When you first register with Changelly using your email, you’re automatically assigned the Starter level. This level doesn’t require rigorous KYC checks, allowing you to start trading immediately with basic features. It is suitable if you prefer minimum verification processes.

Trader: To access additional features and higher transaction limits, you can become a Trader. This tier requires you to complete a KYC process that includes providing personal identification details and documents and enhancing the security of your transactions.

Pro: The Pro account is aimed at users looking for the highest limits and an array of advanced trading tools. To qualify for this tier, you must complete a more comprehensive KYC procedure, ensuring full compliance with international AML and KYC regulations.

Here’s a simplified overview of the account tiers:

| Account Type | KYC Required | Limits |

|---|---|---|

| Starter | No | Low |

| Trader | Yes | Medium |

| Pro | Advanced KYC | High |

To trade on the Changelly PRO platform, you must pass the primary verification to obtain higher limits, better fees, and additional security features. This is essential to ensure that Changelly complies with legal requirements and adequately protects your account.

Changelly Trading Platform & Tools

Changelly offers an instant-execution cryptocurrency exchange service recognized for its competitive fees. Transactions can incur fees as low as 0.25%, making it an economical choice for exchanging digital assets.

For those looking for more advanced trading capabilities, Changelly PRO provides a comprehensive trading platform. Here are some of its key features:

- Spot and Margin Trading: Engage in classic spot trading or leverage your trades with margin options, increasing potential gain (and risk).

- Futures Trading: Expand your trading strategy by making use of futures contracts.

- Multi-Currency Wallet: Securely store various cryptocurrencies within Changelly PRO’s integrated wallet.

- Interactive Terminal: Customize your trading experience with an adaptable and user-intuitive interface.

The platform is designed to support both novice and experienced traders. Getting started with Changelly PRO involves transferring assets to your trading account, and a straightforward process allows for easy trading.

Your journey into cryptocurrency trading with Changelly can be rapid and secure, emphasizing user control with flexible trading tools. Whether you prefer direct exchanges or engaging with market charts and trading strategies, Changelly caters to diverse trading preferences within the crypto space.

Changelly Insurance Fund

Changelly, an instant cryptocurrency exchange, operates on a non-custodial model.

This means you are not required to deposit your funds on the platform. Instead, your transactions occur directly between your wallet and the exchange.

With this structure, there’s no traditional insurance fund, as seen in some custodial exchanges where funds are held and managed by the exchange itself.

Key Points Regarding Transactions on Changelly:

- Direct Trades: Your crypto trades are executed in real-time, connecting you with other exchanges.

- Non-custodial: Unlike some platforms, Changelly doesn’t hold your assets, minimizing the need for an insurance fund.

- Personal Wallets: You maintain control of your cryptocurrencies, storing them in your wallet.

While Changelly does facilitate margin trading through Changelly PRO, the details regarding their insurance fund mechanism for their margin trading service outline specific rules:

- Maximum Net Notional Position: The insurance fund has a cap to the net notional position.

- Position Notional Limits: The fund will not exceed a predefined notional position in the market.

- Exceeding Maximum Positions: There are mechanisms to handle such situations if a position’s size might increase beyond the set maximum.

Remember, it’s essential that you stay informed about the safety protocols and features the platform offers for margin trading, as the dynamics of a non-custodial exchange differ significantly from those holding user funds.

Changelly Deposit Methods

Various methods are available to suit your needs when you want to deposit Changelly. Changelly supports multiple fiat currencies, which means you have the flexibility to deposit in a currency that’s most convenient for you.

Fiat Currency Deposit Options

If you’re in Australia, you might prefer to use AUD for your transactions. You can deposit using:

- Credit Cards: Easily use your Visa or Mastercard for quick deposits.

- Bank Transfers: If you prefer a more traditional method, you can transfer funds from your bank account.

- Apple Pay: Apple Pay is also accepted as a fast and secure option.

Cryptocurrency Deposit Options

You can also deposit digital assets directly into your Changelly account. Here’s how:

- Go to your Wallet.

- Click the ‘Deposit’ button in the upper right corner.

- Use the ‘Search’ feature to find the cryptocurrency you want to deposit.

- Generate your deposit address by clicking the appropriate button in the ‘Deposit’ column.

- Send your funds to this generated address from another wallet or exchange.

For new users in Australia, please note that your transactions have initial limits. Your first purchase is capped at $50, followed by a $100 limit on the subsequent transaction.

Always ensure the correctness of deposit addresses and be aware of the network you’re using to avoid any transaction issues. Remember that transaction times can vary based on the method and network congestion.

Changelly Security Features

Changelly has implemented several robust security measures to protect your transactions and personal information. Here’s a breakdown of the key features you can expect for a secure trading experience:

Two-Factor Authentication (2FA):

- Activation: Mandatory for enhanced account security.

- Providers: Support for Authy/Google Authenticator.

Email Confirmations:

- Purpose: To confirm significant account activities and ensure that you make changes or transactions.

KYC Procedures:

- Basic Level: Often only requires a valid email.

- Advanced Level: In certain situations, transactions may require additional identification.

Withdrawal Allowlists:

- Functionality: By listing safe withdrawal addresses, you safeguard your assets from unauthorized transfers.

Changelly’s non-custodial service enforces your peace of mind by keeping your funds under your control, not in an exchange wallet. This approach significantly diminishes the risk of your digital assets being stolen.

Account Monitoring and Alerts:

- Monitoring: Continuous oversight of account activity to detect suspicious behavior.

- Alerts: Immediate notifications if unusual activity is detected, allowing for rapid response.

_Remediation Steps:**

- Should you stumble upon any issues with 2FA or other security features, prompt customer service is available to resolve your concerns.

Remember, the power of account safety lies in your hands as well. Always use the security tools provided and remain vigilant when managing your digital assets.

Changelly Proof Of Reserves

When engaging with cryptocurrency exchanges, you need to understand the concept of proof of reserves. This refers to the verification process that ensures an exchange holds the funds it claims to possess.

However, Changelly’s status as a non-custodial exchange fundamentally changes the relevance of this practice.

- Non-custodial nature: As a non-custodial service, Changelly does not hold onto your funds; thus, it doesn’t manage a reserve in the traditional sense that custodial exchanges do. When you make a transaction, Changelly facilitates the exchange between different cryptocurrencies on your behalf.

In light of this, the proof of reserves is not directly applicable to Changelly for a couple of reasons:

-

Direct transactions: Your transactions are directly processed, seldom necessitating the need for Changelly to store substantial funds that would require auditing.

-

Security: A key advantage for you is security. With Changelly not holding onto your funds, there’s a minimal risk of loss due to potential exchange hacks that would affect the reserves.

-

Transparency: Although traditional proof of reserves might not apply, Changelly does prioritize transparency in its operations. The swift processing of your orders and the visibility of transaction records provide a form of accountability.

-

Trading process: Your trading experience consists of selecting cryptocurrencies to swap, after which Changelly’s algorithm finds the best available rate among various exchanges. Once you confirm the transaction, the assets move directly between the wallets involved.

In summary, as you work with Changelly, the conventional concern over proof of reserves is displaced by the inherent security of immediate transfers without interim holdings.

This aspect continues to build a trustful environment for users like you to trade cryptocurrencies.

Changelly Customer Support

When you need assistance with your transactions or account on Changelly, you have multiple support options. You can confidently reach out anytime, as customer support is available 24/7.

How to Contact Support:

- Email Support: Send your issues directly to [email protected] with a clear description and your transaction ID when relevant.

- Live Chat: Use the live chat feature on the website to get immediate help from a support assistant.

- Submit a Ticket: Navigate to support.changelly.com and submit a ticket with detailed information about your concern.

What to Provide:

When contacting support, ensure you include the following:

- Transaction ID: If your issue is regarding a specific transaction.

- Detailed Description: Explain your problem clearly to expedite the resolution.

For guidance and frequently asked questions, refer to the Help Center or watch video guides provided by Changelly.

If you’re a Changelly PRO user, a dedicated support section is available after you click the “Submit a ticket” button and select “Changelly PRO” as your platform.

Remember that Changelly is committed to offering robust support and takes the security of your transactions seriously. Whether you are new to cryptocurrency exchanges or an experienced trader in Australia, the support team is ready to assist you with your inquiries.

Is Changelly Safe & Available in Australia?

When engaging with cryptocurrency exchanges, your safety is crucial. Changelly has been operational since 2015 and is recognized for its commitment to security and privacy.

The platform is designed to facilitate cryptocurrency trades with minimal need for personal information, allowing you to exchange digital assets anonymously.

Security Features:

- Non-custodial nature: Your assets are not held by Changelly, reducing the risk of loss through exchange hacks.

- 2-Factor Authentication: To enhance account security, Changelly supports 2FA, often through Google Authenticator.

Legal Compliance:

Regarding legality, it’s essential to consider your local regulations as they apply to cryptocurrency transactions. Changelly, while being globally accessible, complies with international standards for financial operations, although it’s always wise to ensure compatibility with Australian laws.

Privacy:

- No extensive KYC: You are not required to undergo rigorous identity checks for typical transactions.

- Data protection: Personal data provided is handled to protect user privacy.

Remember, staying informed about security measures and regulatory compliance can help to ensure a safer trading experience.

Conclusion

In Australia, you benefit from Changelly’s non-custodial service, which facilitates cryptocurrency exchanges. The platform is designed with your convenience in mind, providing a straightforward user interface that caters to your varying levels of expertise.

Key Points:

- Regular services have no mandatory identity verification, but certain situations may require complete verification.

- Offers access to over 150 cryptocurrencies.

- A first transaction limit of $50 applies to you in Australia, with a progressive increase on subsequent purchases.

| Transactions Cap (AUD) | Timeline |

|---|---|

| $50 | First transaction |

| $100 | After four days |

| $500 | After seven days |

Remember, these limits ensure your cryptocurrency transactions’ security and regulatory compliance. The staged increase in transaction limits lets you gradually get accustomed to the platform.

Changelly’s integration with various trading platforms ensures you receive competitive trade rates. Combined with enhanced security due to its non-custodial nature, you have an experience that balances ease of use and safety.

If you aim to trade multiple small altcoins or have a diversified portfolio of digital assets, Changelly’s service in Australia is structured to meet your needs effectively.

Remember that your trades are subject to a 0.5% fee, which aligns with industry standards. This fee structure supports the integrity and sustainability of the service you’re receiving.

Hence, your experience with Changelly in Australia should be a direct and efficient means to manage your cryptocurrency assets.

Discover More Reviews: