Bitpanda Australia Review in 2025

Bitpanda has established itself as a prominent player in the fintech industry, mainly known for simplifying the investment process in digital assets.

Originating from Vienna, Austria, this platform caters to your diverse investment needs, whether you are interested in cryptocurrencies, stocks, crypto ETFs, or precious metals.

With a mission to break down complex financial barriers, Bitpanda enables you to start investing with small amounts, aiming to democratize personal finance.

As you delve into the offerings of Bitpanda, you’ll discover an intuitive interface that allows you to invest around the clock with the added perk of zero commissions on various investments.

Recognizing the importance of safety in digital investments, Bitpanda ensures that your funds are secured in offline wallets, aligning with robust compliance standards.

Bitpanda has grown substantially recently, leveraging its user-friendly platform to expand its reach.

With a strong presence in Australia, you can invest in Australian stocks, among other assets.

The ease of access and commitment to providing a seamless investment experience make Bitpanda a valuable tool for novice and seasoned investors aiming to diversify their portfolios in the global market.

Bitpanda Product Offerings [Futures, Spot, Options, Staking, NFTs, etc]

Bitpanda offers a variety of financial products that allow you to engage with the digital asset market in ways that suit your strategy. Here’s an overview of what your trading options are:

- Spot Trading: You can instantly buy and sell digital assets at the current market price. The platform supports an extensive list of cryptocurrencies, precious metals, and other assets.

- Options and Futures: While detailed information about options is not provided in your search results, Bitpanda’s futures market presents an opportunity for you to speculate on the price movement of digital assets over a set period.

- Staking: With Bitpanda, staking your crypto assets is simplified. You can earn weekly rewards on supported Proof-of-Stake (PoS) cryptocurrencies. Staking involves committing your assets to support a blockchain network and validate transactions.

- NFT Marketplace: As the digital world continues to embrace NFTs, Bitpanda provides you with a platform to trade these unique digital assets. However, the specifics of NFT offerings need further verification as they were not detailed in your search results.

| Product Type | Description |

|---|---|

| Spot Trading | Instant trades of digital assets at live market prices |

| Options and Futures | Derivative products to bet on future prices of assets |

| Staking | Earn rewards by supporting PoS blockchain networks |

| NFT Marketplace | Trade in non-fungible tokens |

These offerings cater to individual and institutional investors, ensuring secure, user-friendly experiences across various asset classes.

Whether you want to invest, trade, stake, or explore the NFT space, Bitpanda presents a regulated platform to manage your digital asset portfolio.

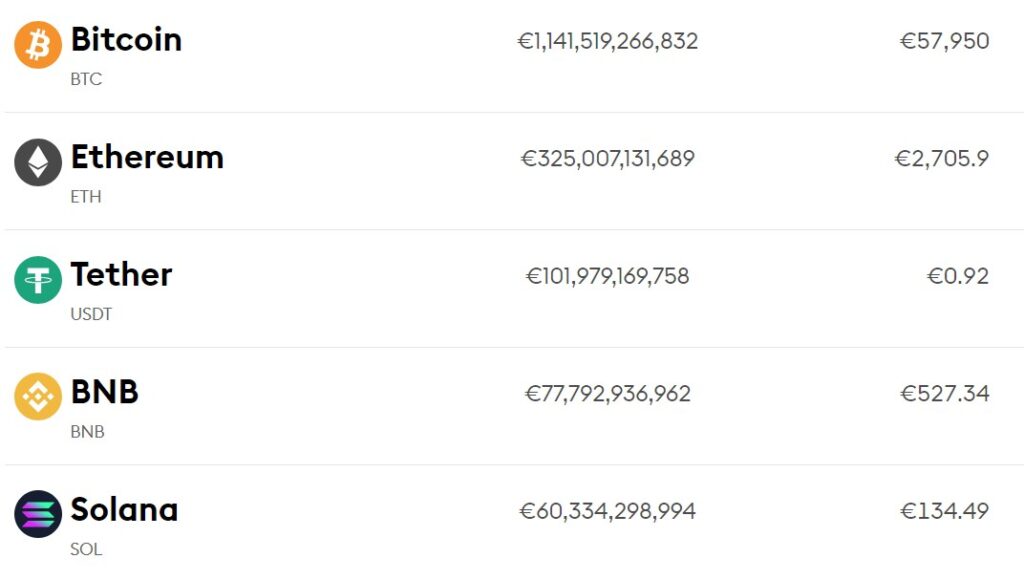

Bitpanda Supported Coin List

Here is a focused overview of the cryptocurrencies you can trade on Bitpanda. While Bitpanda offers a broad spectrum of options, availability may vary based on current market conditions and regulatory compliance.

Major Cryptocurrencies:

- Bitcoin (BTC): Bitcoin is the first and largest cryptocurrency by market capitalization.

- Ethereum (ETH): Known for its smart contract functionality.

Noteworthy Additions:

- Solana (SOL): A high-performance blockchain supporting decentralized apps.

- Cardano (ADA): A research-driven blockchain platform.

It is essential to acknowledge that Bitpanda does not currently support specific popular cryptocurrencies, such as Binance Coin (BNB) and Toncoin.

It’s always wise to consult the latest information directly from Bitpanda because the selection of digital assets is subject to change, reflecting the platform’s compliance with trading regulations and asset review processes.

For real-time updates and the complete list of supported cryptocurrencies, referring to Bitpanda’s official resources is recommended.

Bitpanda Order Types

When trading on Bitpanda, you have a variety of order types at your disposal to execute your trades effectively. Each order type offers you different benefits depending on your trading strategy.

- Market Orders: These orders are straightforward and executed immediately at the current market price. They’re suitable to buy or sell digital assets quickly without specifying the price.

- Limit Orders: give you control over the price at which you buy or sell an asset. You set the maximum price you’re willing to pay or the minimum price at which you’re ready to sell, and the order will only be executed if the market meets your price.

- Stop Limit Orders: act like regular limit orders with an added stop price trigger. Your limit order is only placed when the market price hits your specified stop price.

- Good ‘Til Cancelled (GtC): This order remains active until you execute or manually cancel it.

- Good ‘Til Time (GtT): You can specify the expiry time for your limit order with this type.

- Immediate or Cancel (IoC): The order is executed immediately; any unfulfilled part is canceled.

- Fill or Kill (FoK): This order must be executed in full immediately, or it will not be executed at all.

You can tailor your trading to your desired strategy and exposure to market movements using these orders. Remember that advanced order types are typically available for limit orders only and can help you manage your trades more precisely.

Bitpanda’s Liquidation Mechanism

In dealing with the liquidation of assets, your experience with Bitpanda is built upon clearly defined mechanisms designed to manage risk, particularly in volatile market conditions. Bitpanda adopts an approach that emphasizes both platform stability and the security of your investments.

Thresholds for Liquidation:

- Maintenance Margin: Italic_You_ must maintain a certain margin level. If your account falls below this level, Bitpanda will initiate a margin call.

- Margin Call: Receive a notification to take action by reducing position sizes or injecting more funds.

- Auto-Liquidation: If no action is taken and margins continue to decrease, Bitpanda’s system may automatically liquidate positions.

Order Execution:

- Smart Order Routing (SOR): Optimizes for the best available prices across multiple venues.

- Time-Priority Model: Ensures fairness in executing liquidation orders, prioritizing earlier orders.

User Protections:

- Risk Warnings: Regular updates on market conditions and reminders about volatility risks.

- Transparent Policies: Clear guidelines about margin requirements and liquidation protocols.

Using advanced risk management algorithms and real-time monitoring systems, Bitpanda ensures that your assets are managed with precision and care during heightened market activity, allowing for the orderly liquidation of positions where necessary. Moreover, these procedures are in place not only for the user but also for the integrity and stability of the platform.

Bitpanda Trading Fees

When trading on Bitpanda, you will encounter various fees dependent on the asset class and transaction type. Cryptocurrency trading fees are particularly notable, as they adhere to a simple yet varied structure based on the type of transaction you execute.

Cryptocurrency Trading Fees:

- Standard Trading: On average, trading cryptocurrencies on Bitpanda incurs a fee of 1.49%.

- Instant Trading Fees: Ranging between 0.2% and 0.3%, these fees are applicable on exchanges like bitFlyer and EXMO, which are similar European platforms for comparison.

Bitpanda Pro Fees:

In contrast to the standard trading fees, Bitpanda Pro operates on a maker-and-taker fee model.

- Maker Fee: 0.1%

- Taker Fee: 0.15%

Other Asset Fees:

- Platinum: Buying and selling platinum entails a premium fee of 2.5% for purchases and 2% for sales. Storage fees come into play after the first 20g of platinum, with a charge of 0.025% per week on your total platinum holdings.

Understanding these fees will allow you to make informed decisions when trading on Bitpanda.

Note that fee structures are competitive and designed to facilitate a range of trading activities, ensuring you have clear visibility over transaction costs.

Remember that all fees are subject to change, so for the most current fee rates, always refer to the official Bitpanda price index or user agreements.

Bitpanda Funding Rates/Fees

When trading on Bitpanda, it’s crucial to understand the fee structure to manage your costs effectively effectively. Bitpanda prides itself on offering a clear, transparent fee model that caters to various trading activities.

For your spot trading needs, Bitpanda Pro uses a maker-and-taker fee schedule:

- Maker Fee: 0.1% (you provide liquidity by placing an order)

- Taker Fee: 0.15% (you take liquidity by completing an order)

It is important to note that these are the highest possible fees; depending on your trading volume, they can be lower.

When it comes to your assets, storage fees vary for different commodities:

| Commodity | Weekly Storage Fee |

|---|---|

| Gold | 0.0125% |

| Silver, Palladium, Platinum | 0.0250% |

Currency conversion and overnight funding are common concerns with trading platforms. However, with Bitpanda:

- Currency Conversion Fee: No charge

By choosing Bitpanda, you are not subject to overnight funding fees, which can add up in other trading environments, especially when holding positions for more than a day.

In summary, Bitpanda ensures a straightforward fee structure to help you understand the potential costs of your trading behavior.

Always check the latest fee schedule on the official Bitpanda website or within the trading platform to get up-to-date information relevant to your transactions.

Bitpanda Deposit & Withdrawal Fees

When managing your funds on Bitpanda, you are subject to specific fees and limits, depending on your chosen deposit or withdrawal method. It’s essential to understand each so that you can make cost-effective decisions.

Deposits:

- Cryptocurrencies: Free above the minimum set requirements.

- Fiat Currencies:

- Minimum Amount: €10 (or equivalent in other currencies)

- Credit/Debit Cards: A fee of 1.5% to 1.8% is typically charged.

Withdrawals:

- Cryptocurrencies: Free if above the platform’s minimum threshold.

- Fiat Currencies:

- SEPA Transfers: Increased limits allow for up to €500,000 withdrawals.

- Credit Cards and E-Wallets: Limits may depend on the level of verification of your account.

For detailed limits on deposits and withdrawals, refer to Bitpanda’s dedicated sections in your account.

Please note that fees are subject to change and may be updated by Bitpanda at any time. For the most current fee schedule, always consult the Bitpanda website or customer support for the latest information.

Bitpanda Account Types & Bitpanda KYC Tiers & Limits

Bitpanda offers varying account types to match your investment needs, each associated with specific Know Your Customer (KYC) tiers and transaction limits.

Account Types:

- Retail Account: Ideal for individual traders

- Bitpanda Business: Geared towards businesses with higher transaction volume

- Bitpanda OTC (Over-the-Counter): Tailored for large volume trades, often utilized by institutional investors

KYC Tiers and Limits:

You must complete the necessary KYC verification to access full platform functionalities upon registering. Bitpanda has structured its KYC tiers to enhance security and comply with anti-money laundering (AML) regulations.

- Basic Verification:

- Allows limited access

- Lower transaction limits

- Full Verification:

- Grants complete access

- Higher deposit and withdrawal limits

| Verification Level | Daily Deposit Limit | Daily Withdrawal Limit |

|---|---|---|

| Basic | Standard Limit | Standard Limit |

| Full | Increased Limit | Increased Limit |

After completing primary verification, your daily limits are given, which refresh every 24 hours from your last deposit or withdrawal.

The precise limits may vary and are influenced by several factors, including documentation provided and AML considerations.

To increase these limits, integral steps include moving to a Bitpanda Business account or utilizing Bitpanda’s OTC service for substantial transactions.

It’s important to note that complete verification is necessary to unlock higher deposit and withdrawal capabilities. While the process requires thoroughness, it significantly elevates your transaction thresholds, enabling a more flexible trading experience.

Bitpanda Trading Platform & Tools

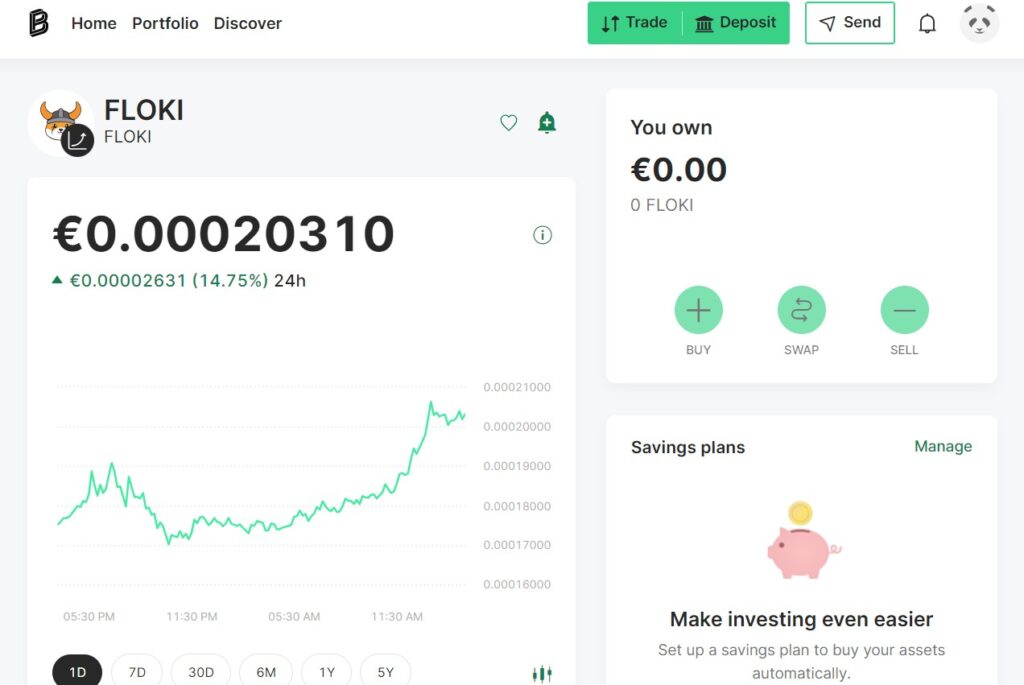

Bitpanda provides a robust trading platform with a user-friendly interface that enables you to manage your digital assets efficiently.

Whether at home on your desktop or using your phone on the go, the Bitpanda system is designed to be accessible and easy to navigate.

Key Features:

- Buy/Sell: Quickly perform trades with multiple digital assets, including Bitcoin, Ethereum, and gold.

- Swap: Seamlessly exchange one digital asset for another without complicated steps.

- Sending/Receiving: Facilitate transactions to send or store various digital assets.

Technical Tools:

For traders looking for technical analysis, you can access comprehensive charting tools that include a range of indicators and timeframes to help you make informed decisions.

- Automated Trading: Set up automated trading strategies that trigger under certain conditions. For instance, orders can be placed conditionally based on price changes.

Security and Wallets:

- Custody Wallets: Your assets are secured in custodial wallets, ensuring institutional-grade protection.

- Trading Security: Safety mechanisms are incorporated to guard your trades and investments.

Trading Minimums:

No matter the market you are interested in, Bitpanda has set a minimum required trading amount, ensuring that even beginner traders can start with a manageable investment.

Remember, the platform’s intuitive nature and sophisticated trading tools provide a balanced environment whether you’re an experienced trader or just starting. With these utilities at your disposal, you can confidently approach the market.

Bitpanda Insurance Fund

Bitpanda has established measures to enhance the security of your investments. At the core of these measures is the Bitpanda Insurance Fund.

This fund is designed to provide additional protection against specific losses that could affect your financial assets.

Security Measures:

- Risk Coverage: The insurance fund covers losses from events outside your control, such as theft or hacking.

- Financial Stability: By setting aside funds specifically for insurance, Bitpanda aims to maintain economic stability and customer trust.

Insurance Operations:

- Activation Criteria: The fund comes into effect in specific predefined scenarios, ensuring a systematic approach to loss mitigation.

- Claim Procedures: In the event of covered losses, there are clear guidelines for claiming the insurance fund.

Your Role in Safety:

While Bitpanda provides robust protective measures, you must follow best account security practices, such as using two-factor authentication and private login credentials.

In summary, the Bitpanda Insurance Fund is a part of the platform’s commitment to safeguard your assets against extraordinary circumstances, reinforcing Bitpanda’s promise of a secure and reliable investing environment.

Bitpanda Deposit Methods

Bitpanda supports a range of deposit methods to fund your account, giving you the flexibility and convenience you need to manage your cryptocurrencies and investments.

Credit/Debit Cards: One of the quickest ways to deposit is using your credit or debit card. It’s an instant method, allowing you to start trading immediately after the deposit.

Bank Transfers: You may prefer a bank transfer for more significant amounts. Though it can take longer to process, it’s a reliable way to move funds securely into your Bitpanda account.

- SEPA Bank Transfer

- International Wire Transfer

E-Wallets: Popular e-wallet services are also accepted. You can deposit directly through options such as:

- Skrill

- NETELLER

- SOFORT

Cryptocurrencies: If you own cryptocurrencies, you can deposit them into your Bitpanda wallet. Ensure you’re sending the correct cryptocurrency to the associated wallet address to avoid any loss of funds.

You can explore the deposit section within the Bitpanda platform for a visual guide and interactive options.

Please note that specific deposit limits are imposed, which vary depending on your chosen method and verification status. Check these limits before depositing to ensure your transaction is successful. You might be asked to provide additional documentation to ensure safety and compliance with international laws, especially for more significant transactions.

Bitpanda Security Features

When managing your investments on Bitpanda, you can be confident in the platform’s comprehensive security measures to protect your assets and personal information.

As a user, implementing various security protocols prioritizes your peace of mind.

- Two-Factor Authentication (2FA): To enhance your account’s security, Bitpanda enforces two-factor authentication. This means that you need your password and a second form of identification to access your account. Typically, this is a one-time password you receive on your mobile device. This significantly reduces the risk of unauthorized access.

- Cold Storage: Your digital assets on Bitpanda are primarily stored offline in cold storage. This method ensures that most of your assets are not susceptible to online hacking attempts, safeguarding your investments from internet-based threats.

- Regulatory Compliance: Bitpanda adheres to stringent European financial regulations, guaranteeing that the platform operates under strict compliance and oversight. This legal commitment to follow regional regulations further augments the security of your investments.

- Routine Security Assessments: The platform also conducts regular security assessments, including penetration tests from reputable external firms and proactive internal threat hunting. Such routine evaluations are fundamental in preventing potential attacks by identifying and mitigating risks promptly.

These layers of security demonstrate Bitpanda’s strong dedication to maintaining a secure trading environment so you can focus on managing your investments without undue concern about the safety of your funds.

Bitpanda Proof Of Reserves

As you navigate the landscape of cryptocurrency exchanges, one critical aspect you should consider is the confidence provided by a company’s proof of reserves. Bitpanda, in recognition of the necessity for transparency, has implemented a robust system for verifying its reserves. This ensures that your assets are secure and accurately denominated at any time.

Audits and Transparency

To maintain trust and reliability, Bitpanda has engaged the reputable accounting firm KPMG to conduct thorough audits of their cryptocurrency reserves. These audits are designed to:

- Verify that customer assets match the crypto funds in Bit Panda’s cold storage

- Confirm the coverage extends to the most traded tokens on their platform, including Bitcoin

Regular Reports

Bitpanda commits to regular reporting to keep you informed about the current state of your investments. This open communication is pivotal in establishing a transparent relationship between you and the exchange.

| Audit Inclusions | Description |

|---|---|

| Coverage | Extends to leading assets like Bitcoin and others. |

| Storage | Crypto funds are stored securely in cold wallets. |

| Verification by | KPMG |

| Reports | Issued post audit, detailing reserve status. |

You can use these measures as a safety check when dealing with Bitpanda, knowing that the reserves backing your crypto assets are verified by an independent third party, thus providing a significant layer of financial security and transparency in your cryptocurrency transactions.

Bitpanda Customer Support

When encountering any issues or if you have questions, Bitpanda provides a helpdesk where you can seek assistance comfortably. Below is a breakdown of what you can access:

Support Channels:

- Helpdesk Platform: A place to find help articles and submit support tickets.

- FAQ Section: Quickly get answers to commonly asked questions.

Request Assistance:

- Submit a Request: If you need personalized help, raise a support ticket.

- 2FA Issues: Specific guidance is offered for two-factor authentication problems.

Community Assistance:

- Community Team: Engage with a team ready to answer general inquiries and guide you through Bitpanda services.

To ensure a smooth experience, you’re advised to:

- Submit detailed requests: When raising a ticket, provide all necessary details to speed up the resolution.

- Check FAQs: Before reaching out, browse the FAQs, as your question might already have an answer.

- 2FA Recovery: If you encounter issues with 2FA, use your recovery code and follow the steps to resolve it.

Remember, the Bitpanda Community Team is also at your disposal to assist with general questions and will help you navigate through the app’s features. They are committed to supporting and empowering the user community.

Is Bitpanda Safe & Available in Australia?

Bitpanda operates as a registered virtual asset service provider (VASP).

Your assets are managed under strict regulatory compliance, adhering to legal frameworks enforced by several European authorities, including Austria, France, Spain, Italy, the Czech Republic, and Sweden. This multi-jurisdictional registration underscores Bitpanda’s commitment to legality and the safety of your funds.

Safety is a hallmark of the Bitpanda platform. Bitpanda employs institutional-grade security measures to protect your investments. You benefit from using custodial wallets that combine user-friendliness with robust protection. These wallets are designed to secure crypto assets through advanced technology and insurance coverage for added peace of mind.

Your transactions on Bitpanda are not only legal but also anchored in comprehensive security protocols.

The platform secures user funds predominantly in secure offline wallets, significantly minimizing the risk of digital theft. Additionally, you maintain control and ownership rights over your assets, which is not always true when using third-party or external custodians.

Regulatory Compliance: Bitpanda’s adherence to stringent regulations means you are engaging with a platform that takes your security seriously and is obligated to protect your interests.

Security Features: From offline wallets to custodial services, Bitpanda employs various security mechanisms to ensure your assets remain safe from unauthorized access.

By choosing Bitpanda, you opt for a platform that prioritizes your legal and security concerns, offering you a safe environment to manage your digital assets.

Conclusion

Bitpanda, known for its robust presence in the European fintech market, extends its services with a solid commitment to regulatory compliance and customer security.

- Regulatory Compliance: Operating under European financial legislation, you benefit from stringent adherence to legal guidelines. This provides economic safety, ensuring your investments are handled with due diligence.

- Security: Your personal and financial data are protected with advanced security measures, giving you peace of mind when trading.

- Innovation: With over 200 cryptocurrencies and other financial products, Bitpanda serves novice and seasoned traders. Their platform is engineered to offer you an intuitive trading experience, ranging from instant swaps to more complex financial tools.

Bitpanda caters to your diverse trading needs by prioritizing ease of use and offering flexible transactions. This commitment to innovation in service offerings ensures access to the latest financial solutions.

Whether you want to engage with the vast crypto market or diversify your investment portfolio, Bitpanda’s platform simplifies these complex processes.

Rest assured, you’re engaging with a platform where security and compliance are paramount.

Discover More Reviews: