Coinbase Australia Review in 2024

Coinbase has established itself as a significant platform in the cryptocurrency space, catering to users looking to engage with digital currencies such as Bitcoin, Ethereum, and others.

In Australia, the platform has relaunched to offer a range of services, including the ability to deposit and withdraw Australian Dollars (AUD), enhancing your accessibility to cryptocurrency trading in the region.

With a user-friendly interface, Coinbase offers a secure online platform emphasizing ease of use and trust. This allows you to buy, sell, and manage a diverse portfolio of cryptocurrencies.

Additionally, educational resources are available to help you understand the intricacies of the market and make informed decisions.

Recognizing the importance of security and trust in financial transactions, Coinbase operates transparently.

It provides you with advanced trading tools, a wallet for digital assets, and Prime services designed to cater to beginners and experienced traders.

By being the only publicly traded crypto exchange in the U.S. and with a broad and growing user base, Coinbase offers you a platform backed by a commitment to reliability in the cryptocurrency exchange sphere.

Coinbase Product Offerings [Futures, Spot, Options, Staking, NFTs, etc.]

Spot Trading: You can directly purchase and sell cryptocurrencies on Coinbase. The spot market is frequently chosen for its ease of use and immediate transaction capabilities.

Futures and Options: As an advanced trader, you can dive into derivatives trading with futures and options. These products allow you to speculate on the future prices of cryptocurrencies.

- Futures: Engage in contracts that speculate on the future price of crypto.

- Options: Purchase the right, not the obligation, to buy/sell crypto at a predetermined price.

Staking: You receive rewards for participating in the network by staking certain Proof of Stake (PoS) cryptocurrencies. It’s a way to earn additional crypto just by holding specific assets.

NFTs (Non-Fungible Tokens): The platform enables you to buy, sell, and trade NFTs, offering you a gateway to the burgeoning world of digital collectibles and art.

Advanced Trading Tools:

- Real-time analytics to track market trends.

- Charting tools for technical analysis.

- Transaction history to review your past trades.

Staking, Futures, and NFTs are subject to regulatory approval and may vary based on your location. Always ensure you are compliant with local laws and regulations.

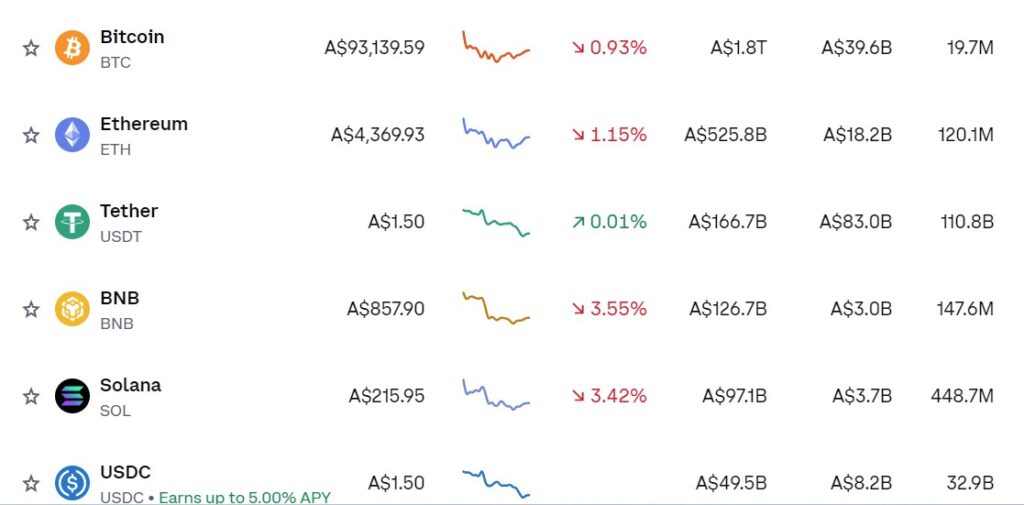

Coinbase Supported Coin List

Coinbase offers a diverse selection of cryptocurrencies, with roughly 240 tradable assets. As a user in Australia, you can trade various coins and tokens.

Some of the premier cryptocurrencies available on the platform include the long-standing Bitcoin (BTC), the programmable Ethereum (ETH), and alternate currencies like Litecoin (LTC) and Bitcoin Cash (BCH). Below is a list of some notable coins you can trade:

- Bitcoin (BTC): The first and most well-known cryptocurrency.

- Ethereum (ETH): A decentralized platform enabling smart contracts and applications.

- Litecoin (LTC): Designed to be a lighter and faster alternative to Bitcoin.

- Bitcoin Cash (BCH): A spin-off or altcoin created in 2017 intended to allow more transactions to be processed.

Coinbase also supports various stablecoins, which are pegged to stable assets like the U.S. dollar, producing a less volatile experience in trading:

- USD Coin (USDC): A stablecoin pegged to the U.S. dollar on aU.S.:1 basis.

- DAI: A decentralized stablecoin that aims to keep its value as close to one U.S. dollar as possible through an automated intelligent contracts system on the Ethereum blockchain.

Additionally, the platform caters to a range of emerging and innovative cryptocurrencies:

- Cosmos (ATOM): A cryptocurrency that operates a network of independent blockchains designed to scale and interoperate with each other.

- EOS: A platform designed to develop decentralized applications (dapps).

For a comprehensive list of supported cryptocurrencies and trading pairs, consider checking the Coinbase mobile app or their support website. Remember to research before trading to understand the risks and trade within your means.

Coinbase Order Types

When trading on Coinbase, you can access several order types, each with a unique purpose.

Market Orders: You utilize a market order for immediate execution at the best available market price. However, there’s no guarantee the order will be filled at the exact price you see upon order placement due to fast-moving markets.

- Pros: Immediate execution

- Cons: Possible price variations from the seen market price

Limit Orders: With a limit order, you set the minimum or maximum price you are willing to buy or sell. This order will only execute if the market reaches your specified price.

- Pros: Control over the execution price

- Cons: No guarantee of execution if the price doesn’t meet your threshold

Stop-Limit Orders: A stop-limit order allows you to specify a stop price that, once reached, will trigger your limit order.

- Pros: Control over the price after the stop is triggered

- Cons: The order may not be executed if there’s no match for your limit price within the market

Here’s a quick reference for the order types:

| Order Type | Immediate Execution | Price Control | Guaranteed Execution |

|---|---|---|---|

| Market | Yes | No | No |

| Limit | No | Yes | No |

| Stop-Limit | No (Trigger First) | Yes | No |

Remember, each order type carries its distinct advantages and limitations. Choosing the one that aligns with your trading goals and strategies is essential.

Coin base’s Liquidation Mechanism

When trading futures on Coinbase, you may encounter what is known as the liquidation buffer. This mechanism is crucial for managing the risks associated with leveraged trading. Here’s how it functions:

-

Margin Requirements: To maintain a futures position, you must meet specific margin requirements. The margin acts as collateral to cover potential losses.

-

Liquidation Buffer: The liquidation buffer activates if the market moves against your position and your margin falls below the maintenance margin. This buffer is designed to give you some leeway to increase the margin or close the position before forced liquidation occurs.

-

Forced Liquidation: Should your account’s margin remain below the required level and the buffer is exhausted, Coinbase will initiate a forced liquidation. This is to prevent your account balance from turning negative, which would be a loss for you and the exchange.

Coinbase, as a National Futures Association (NFA) member, adheres to strict regulatory oversight. However, it’s important to note that NFA’s oversight does not extend to the spot virtual currency products or transactions on Coinbase’s platform.

- Risk Mitigation: You can mitigate the liquidation risk by closely monitoring your trades and maintaining adequate margin. Being proactive in managing your positions is the key to safeguarding against unexpected market turns that could trigger the liquidation process.

Coinbase Trading Fees

Your transactions are subject to specific exchange fees when you trade cryptocurrencies on Coinbase in Australia.

These fees are determined by multiple factors, including the type of trade you are executing — whether you are a maker or a taker — and the size of your order and the prevailing market conditions.

Types of Fees:

- Maker Fee: This is applicable when you add liquidity to the market, meaning your order is not immediately matched against an existing order. Maker fees range from 0.00% to 0.40%.

- Taker Fee: This fee is incurred when you remove liquidity, which equates to your order being matched immediately against an existing order. Taker fees can fall between 0.05% to 0.60%.

These percentages reflect a tiered pricing structure, where more significant transactions may attract different fees than smaller ones.

Further, the method you choose to fund your purchase, such as bank transfer or credit card, may also impact the fees charged.

Example:

| Order Type | Fee Percentage |

|---|---|

| Maker | 0.00% – 0.40% |

| Taker | 0.05% – 0.60% |

Coinbase is transparent about its fee structure, providing the total amount that includes spread and fees when you preview a trade and your transaction history.

This ensures that there are no hidden charges and you remain informed about the costs associated with your trades.

Coinbase Funding Rates/Fees

Coinbase operates on a maker-taker fee model for spot market trading, where transactions involve an immediate settlement. Your fees for these transactions depend on your trading volume over 30 days.

When you make an instant purchase, the fees vary. They are generally calculated as a flat rate or a transaction volume percentage. The structure is as follows:

- Instant Buy/Sell: If your transaction is below $200, the fees can range from $0.99 to $2.99. For more significant transactions, a percentage fee of 0.50% applies.

- Credit/Debit Card Purchases: A 3.99% fee is typically levied on all transactions.

In addition to trading fees, you should also account for the spread, which is about 0.50% of the transaction value when buying or selling cryptocurrency.

For USD Coin (USDC) transactions, there are benefits like 0% commission fees on Coinbase and the ability to earn rewards for holding USDC, with an annual percentage yield (APY) of 1.0%.

Here’s a simplified fee table for quick reference:

| Transaction Type | Fee Structure |

|---|---|

| Instant Buy/Sell | $0.99 to $2.99 (below $200), 0.50% (above) |

| Credit/Debit Card | 3.99% |

| USDC Transactions | 0% commission, potential for 1.0% APY rewards |

Remember, the total amount you pay, including spread and fees, will be clearly shown when you preview a trade and will be reflected in your transaction history.

Remember that fees may vary based on your payment method and the specifics of your transactions and are subject to change over time.

Coinbase Deposit & Withdrawal Fees

You are subject to specific fees when you trade with Coinbase in Australia.

These fees differ based on the transaction you are conducting. When you deposit or withdraw funds, the costs can vary depending on the currency and the payment method you choose.

For your convenience, here’s a brief layout of possible fees that you might encounter:

- Deposits: Typically, you might not incur fees for crypto deposits; however, AUD deposits could have associated costs, especially if using methods apart from bank transfers.

- Withdrawals: Withdrawing your funds to an Australian bank account may attract fees. The exact cost can depend on factors such as the withdrawal amount and the speed of the transaction.

Commission Fees

- Standard buy/sell: Variable percentage depending on your order size.

- Cryptocurrency conversion: A margin may be added to the exchange rate.

Remember that Coinbase provides the total amount—incorporating both spread and fees—every time you preview a trade, and this information will also be visible in your transaction history.

Use this table as a quick reference for fee estimation:

| Transaction Type | Fee Structure |

|---|---|

| AUD Deposit | Variable* |

| AUD Withdrawal | Variable* |

| Crypto Deposit | Free |

| Crypto Withdrawal | Blockchain Fees Apply |

*Variable fees depend on the chosen payment method. Ensure to review the fee details before finalizing your transaction.

Coinbase Account Types & KYC Tiers & Limits

Coinbase offers varied account options tailored to match your investment needs. Whether you’re new to cryptocurrency or an experienced trader, understanding the KYC tiers and associated limits is crucial to managing your transactions effectively.

KYC Requirements

To use Coinbase services, you must pass specific identity verification processes. The initial steps typically include providing the following:

- A government-issued ID

- A selfie for identity verification

- Personal information such as your full name and date of birth

Account Limit Tiers

- Tier 1: This is the introductory level. After completing primary identity verification, your purchase and deposit limits may be relatively low.

- Tier 2: You can often increase your limits by providing additional identity information or enabling certain security features.

- Tier 3: This tier is for the most verified accounts, usually requiring thorough documentation. Higher limits are a crucial benefit at this level.

Regional Differences

Your location can also influence your transaction limits. In Australia, the limits may vary compared to other regions, reflecting local regulations and payment methods.

Payment Method Impact

The type of payment method you choose affects your deposit and purchase limits:

- ACH Transfer: Generally, there is a maximum daily limit.

- Wire Transfer: Often allows for higher deposit amounts beyond the ACH limit.

- Debit/Credit Card: This may have lower limits due to processing restrictions.

To view and manage your specific limits, navigate to the Account Limits section within your Coinbase settings. Here, you can also find instructions on how to increase your tier and corresponding limits.

Coinbase Trading Platform & Tools

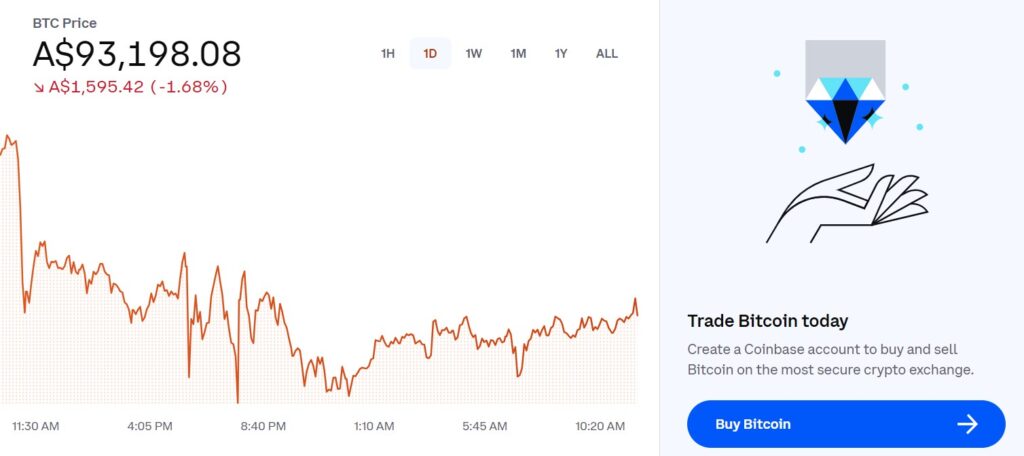

Coinbase provides a secure and reliable online platform that caters to both newcomers in cryptocurrency and experienced traders. You can easily buy, sell, transfer, and manage a diversity of cryptocurrencies.

Beginner-Friendly Interface

If you’re starting, the platform offers a straightforward, no-frills interface. You can confidently conduct transactions thanks to the intuitive design and clear instructions.

- Buying and Selling: Effortlessly purchase or offload your digital assets.

- Storage: Keep your cryptocurrencies safeguarded within the platform’s wallet.

- Tracking: Monitor your assets with real-time price updates.

Advanced Trade for Professional Traders

For those seeking more sophisticated trading tools, Coin Base’s Advanced Trade delivers an enhanced experience:

- Advanced Charting: Utilize tools powered by TradingView for deep analysis.

- Order Types: Access Market, Limit, Stop Limit, and Auction Mode orders.

- Real-Time Order Books: Gain insight into market depth and liquidity.

- API Access: Automate your trading by connecting to Coinbase’s developer APIs.

Security & Trust

With a commitment to safety, Coinbase secures its platform using strong encryption and security practices. Additionally, Coinbase Australia is registered with AUSTRAC, ensuring compliance with local regulations.

Whether you’re here to make a straightforward transaction or engage with an extensive array of trading tools, Coinbase in Australia aims to offer a reliable and efficient service to foster your investment journey.

Coinbase Insurance Fund

Coinbase has instituted an Insurance Fund to enhance the security and assurance of your investments on their platform.

If you’re an account holder with negative equity, this fund is designed to cover your losses. Moreover, it serves to compensate participants in the Liquidity Support Program.

Initially funded by Coinbase International Exchange, the Insurance Fund’s maintenance is sustained through a portion of transaction fees collected over time.

Here are the essential aspects of the insurance policy:

- Fraud Protection: Coinbase’s crime insurance safeguards against theft, which includes cybersecurity breaches.

- Policy Limits: As confirmed by Coinbase, customers’ funds up to a value of $255 million are insured.

- Insurance Providers: The coverage is sourced from a consortium of insurance companies in the US and UK, registered through LlU.S.d’s bU.K..S.er AoU.K.

Remember, despite these measures, Coinbase’s insurance does not extend to losses from unauthorized access to your personal Coinbase or Coinbase Pro accounts. It’s crucial to keep your login information secure to prevent such situations.

| Insurance Fund Detail | Description |

|---|---|

| Initial Funding Source | Coinbase International Exchange |

| Ongoing Financing | Transaction fees |

| Covers | Accounts with negative equity, Liquidity Support |

| Fraud Protection | Crime insurance against theft, cyber breaches |

| Insurance Cap | $255 million for protected assets |

| Providers | US and UK insurance companies viU.S.Aon |

BU.K.staying iU.S.ormedU.K.bout the Coinbase Insurance Fund, you can invest with more confidence and understanding of the protections in place.

Coinbase Deposit Methods

Coinbase offers several deposit options to fund your account, ensuring convenience and flexibility. Below is an overview of the deposit methods supported by Coinbase in Australia:

- PayID: A service that allows for prompt deposits using an email-like identifier.

- BSB and Account Number: Traditional bank transfer method using specific details assigned to your Coinbase account.

When using the mobile app, you can add cash to your balance by:

- Tapping: Add some money to the home screen.

- Alternatively, go to Assets, select Australian Dollar, and then choose Add some cash.

For bank account additions:

- Link your bank account by depositing funds through PayID or using the BSB and account number uniquely associated with your Coinbase account.

- Due to bank security processes, the first deposit may take up to 24 hours to reflect in your Coinbase account.

In addition to these methods, Coinbase ensures that secure and trusted transaction techniques are used. Remember to verify transaction limits and fees that may apply to each deposit method.

Coinbase Security Features

Coinbase ensures your digital assets are safeguarded with a suite of security measures.

Two-factor authentication (2FA) is automatically enrolled for all users, adding an extra layer of security to your account. This is complemented by security critical support and password protection, making unauthorized access exceedingly tricky.

-

Coinbase Vault: Offers enhanced protection through multi-approval withdrawals, requiring multiple verifications before funds can be moved.

-

Cold Storage: Many cryptocurrency funds are held in cold storage, isolated from online threats.

-

Theft Insurance: In the unlikely event of a security breach or hack, Coinbase’s theft insurance policy covers assets stored in cold wallets.

- Security Best Practices: Coinbase educates its users on security with resources like “Security 101 with Security Experts”. This initiative underscores the importance of strong password management and understanding the nuances of different 2FA types.

| Feature | Description |

|---|---|

| 2FA & Security Key | Additional verification steps for accessing your account. |

| Cold Storage | Storage of assets offline to protect from online threats. |

| Theft Insurance | Compensation for lost funds in case of a breach. |

| Security Education | Resources and expert advice for maintaining account safety. |

Coinbase Proof Of Reserves

Coinbase, as a significant player in the cryptocurrency exchange landscape, recognizes the importance of financial transparency. Coinbase has indicated through public communications that it provides proof of reserves in alignment with this commitment.

Proof of Reserves Methodology:

- Audited Financial Statements: Coinbase is a publicly listed company, and its reserves are validated through audited financial statements.

- Crypto-Native Methods: They are exploring crypto-native methods for proof of reserves, which are anticipated to include advanced cryptographic techniques.

Developer Grant Program:

- Purpose: To enhance on-chain accounting and transparency.

- Budget: $500,000 allocated for grants to developers working on these technologies.

Techniques Explored:

- On-chain accounting methods

- Privacy-preserving proof of assets and liabilities, including zero-knowledge proofs

Coinbase’s commitment to proof of reserves aims to ensure that your assets are accounted for and that the exchange operates with integrity in its reporting.

To stay updated on the latest regarding Coinbase’s proof of reserves, monitoring their official channels and statements is recommended.

Coinbase Customer Support

Coinbase provides several avenues to support your needs effectively. These support channels are designed to address and resolve any issues quickly.

- Phone Support: For immediate assistance, you can access 24/7 phone support. This service ensures you can speak to a customer service expert anytime for urgent help with your account or transactions.

- Email and Chat: If you prefer written communication, you can email. Additionally, live chat support is available for real-time assistance. This allows you to resolve more straightforward queries conveniently and efficiently.

- In-App Support: Coinbase has integrated support features within the iOS and Android apps. This enhancement provides a seamless way to receive personalized, intelligent self-service options.

- Help Center: The Coinbase Help Center is a comprehensive source for general inquiries and educational resources. Here, you can find articles and guides on how to use, manage, and secure your account.

For Australian customers: An update in August 2022 reflected Coinbase’s commitment to maintain a safe and regulated platform in the Australian market. Refer to the Help Center for specifics on these operational changes.

Quick Access Tip: Signing in to your Coinbase account is recommended if you require personalized support. This step significantly streamlines the support process, enabling a more tailored resolution approach.

Is Coinbase Safe & Available in Australia?

When considering Coinbase as a platform for cryptocurrency transactions, your concerns regarding legality and safety are paramount.

As a platform that has been operational since 2012, Coinbase has established itself in the industry with a commitment to legal compliance and security protocols.

Coinbase adheres to the legal standards outlined in its jurisdictions. As an Australian user, Coinbase has structured its services to align with Australian cryptocurrency regulations.

It’s vital to recognize that regulatory scrutiny is an industry-standard in the crypto world, and Coinbase has not been exempt.

Their commitment to engaging with legal processes and responding to official documentation requests is integral to their operations.

- Registered Agent: Coinbase has a designated Registered Agent for Service of Process to handle legal documents in respective states.

- Legal Addresses: Legal documents can also be directed to the Coinbase Legal Team.

Safety Measures

Your security is a central focus for Coinbase, which provides:

- Two-factor authentication (2FA)

- Biometric fingerprint logins

- AES-256 encryption for digital wallets

These measures are in place to protect your investment and personal information, reducing the risk of unauthorized access and ensuring peace of mind.

In your dealings with Coinbase, you can be assured that while no platform can guarantee absolute safety, Coinbase takes extensive precautions to protect your interests and remains a prominent, secure service provider in the cryptocurrency market.

Conclusion

Coinbase’s expansion into Australia marks a significant milestone for the company and Australian crypto traders.

With the introduction of AUD deposits and withdrawals, trading on Coinbase has become more accessible for you as an Australian user. The enhancements made by the platform include PayID deposits and withdrawals, which are tailored to streamline your experience.

Coinbase has affirmed its commitment to the Australian market, identifying it as a critical area for growth.

As a locally incorporated entity, Coinbase Australia Pty Ltd operates with complete registration and enrolment with AUSTRAC, ensuring compliance with Australian regulations.

The partnership with payment providers to target high-volume traders indicates a strategic approach to cater to a diverse range of needs within the cryptocurrency space.

Your assurance in using Coinbase is backed by its international reputation and user-friendly platform designed to lower entry barriers for investing in cryptocurrencies.

The platform’s collaboration with regulators demonstrates a focus on your security and the broader integrity of the crypto market.

By enhancing its services in Australia, Coinbase reiterates its role as a reliable gateway for you to engage with digital currencies.

Whether you’re starting or looking to expand your portfolio, Coinbase’s ecosystem is equipped to support your cryptocurrency journey.

Discover More Reviews: