Bybit Australia Review in 2025

Bybit has become one of the significant cryptocurrency exchanges offering services in Australia.

As an innovative trading platform, Bybit focuses on derivatives trading, where you can use futures and options for various cryptocurrencies.

Leveraging advanced technology, the exchange aims to provide users with a seamless and efficient trading experience.

Navigating the intricacies of cryptocurrency trading can be challenging, but Bybit’s presence in Australia is tailored to ease this process.

With features like the Bybit Card, they’re expanding their offerings to include convenient spending and managing your digital assets.

This integration allows for a more comprehensive approach to handling cryptocurrencies in your daily transactions, leveraging digital currencies‘ freedom and flexibility.

Security and low-fee structures are also cornerstones of Bybit’s service.

The platform supports multiple payment methods, including credit cards and third-party payment services, ensuring that you have various options to manage your funds.

Whether you’re looking to trade cryptocurrencies or actively use them in everyday transactions, understanding Bybit’s framework and features in Australia is essential for making informed decisions in the evolving digital finance landscape.

Bybit Product Offerings

Bybit has expanded its product offerings in Australia to cater to diverse crypto trading and investment preferences. Your options include:

- Futures and Perpetual Contracts: You can engage in traditional and perpetual futures trading, with the option to leverage up to 125x. This provides you with the flexibility to trade according to your risk tolerance.

- Spot Trading: A selection of cryptocurrencies is available for spot trading. Direct trades are facilitated on a user-friendly platform, allowing you to exchange digital assets seamlessly.

- Options Trading: Experience the USDC-settled options market on a variety of cryptocurrencies. This financial derivative gives you the right to buy or sell at predetermined prices without obligation.

- Staking and Earn Products: Enhance your asset holdings by earning interest on your cryptocurrencies. Bybit’s staking and earning products allow you to grow your investments passively.

- NFT Marketplace: Delve into non-fungible tokens (NFTs) with Bybit’s NFT marketplace. This platform allows the trading of unique digital assets across various collections.

For Australians, Bybit’s strategy to integrate crypto more deeply into everyday life is now well-evidenced by the introduction of the Bybit Card. This Mastercard debit card simplifies the spending of your cryptocurrencies for daily transactions.

The Bybit Card offers a reliable and convenient way to on-ramp and off-ramp your crypto assets.

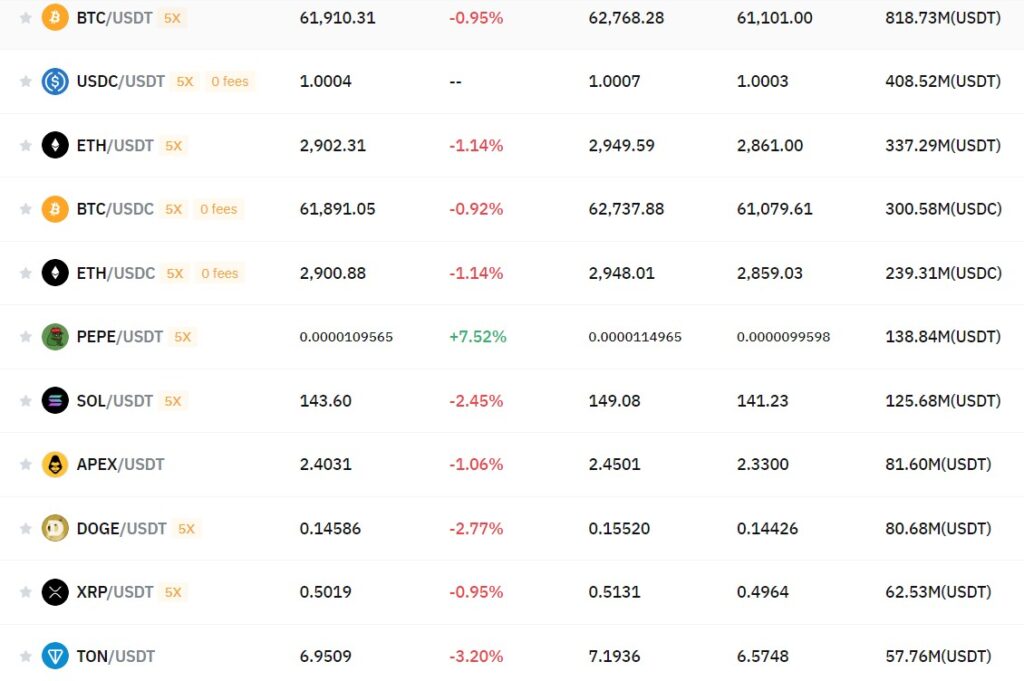

Bybit Supported Coin List

Bybit provides a diverse range of cryptocurrencies for your trading needs.

You can access digital assets to diversify your investment portfolio as an Australian user. Below is a representative list of the critical cryptocurrencies supported:

- Bitcoin (BTC): Bitcoin is the progenitor of cryptocurrencies and is a critical part of any trading platform’s offerings.

- Ethereum (ETH): Renowned for its smart contract functionality, Ethereum is a staple in the digital finance space.

- Ripple (XRP): Commonly used for international transactions, Ripple is known for its speedy transfers.

- EOS (EOS): A decentralized applications platform, EOS is another coin featured on Bybit.

- Litecoin (LTC): Litecoin offers fast payment solutions as a peer-to-peer cryptocurrency.

- Polkadot (DOT): This multi-chain protocol connects various blockchains into a unified network.

- Polygon (MATIC): Aimed at scaling and infrastructure development, Polygon is another digital asset available.

This list is not exhaustive, as Bybit regularly updates its offerings to include additional coins and tokens. For specific limits and details on Auto-Savings and other investment strategies for these cryptocurrencies, you should refer to Bybit’s comprehensive guidelines on their platform.

Bybit Order Types

When trading on Bybit, you can utilize various order types to enhance your trading strategy. Here’s an overview:

- Market Orders: This type allows you to buy or sell at the best available current price.

- Limit Orders: You can set a specific price to buy or sell an asset.

- Conditional Orders: These are executed only when certain conditions are met. They are like a combination of market and limit orders with added conditions.

Additionally, Bybit offers advanced order types for more sophisticated trading approaches:

- Close on Trigger: This ensures that your order will close a position and not open a new one.

- Scaled Order: Scaled Order can be used to distribute your orders at different prices and quantities for a more flexible trading plan.

- Chase Limit Order: This enables you to follow the market price within a predefined distance to catch favorable movements.

Here is a tabulated representation for clarity:

| Order Type | Description |

|---|---|

| Market Order | Executes immediately at the current market price. |

| Limit Order | Executes at a pre-specified price if the market reaches it. |

| Conditional Order | Triggered only when set conditions are fulfilled. |

| Close on Trigger | Explicitly used to close positions, averting new openings. |

| Scaled Order | Spreads orders across a price range for diversified entry. |

| Chase Limit Order | Follows market price up to a set threshold for capturing moves. |

By understanding and applying these order types effectively, you can refine your trading decisions and manage your positions more precisely on Bybit.

Bybit’s Liquidation Mechanism

Bybit employs a liquidation mechanism to manage risk and ensure market stability on its trading platform. As a user of Bybit, your understanding of this process is crucial for effective risk management in derivatives trading.

The process begins with what is known as the Auto-Deleveraging (ADL) system. When your position is at risk of liquidation, the Bybit liquidation engine initially takes over.

If your position cannot be closed at a price that’s better than the bankruptcy price, and the insurance fund can’t cover the losses, ADL comes into play, affecting those opposite positions with the highest ADL ranking.

Another critical component is the maintenance margin requirement. When you trade futures on Bybit, your positions are subject to this requirement.

You’ll need to maintain a certain amount of funds in your account to keep your trades open. If the market price reaches a specific threshold where your margin no longer supports the position, liquidation is triggered.

For a more controlled risk approach, Bybit also offers an Isolated Margin mode:

- Your margin for each position is isolated from the rest of your account balance.

- The maximum loss from liquidation is confined to the margin you’ve allocated for that single position.

Liquidation alerts serve as an early warning. Bybit provides notifications — through emails, SMS, or app notifications — to inform you when the market price moves close to your liquidation price, allowing you to adjust your strategies and manage your position.

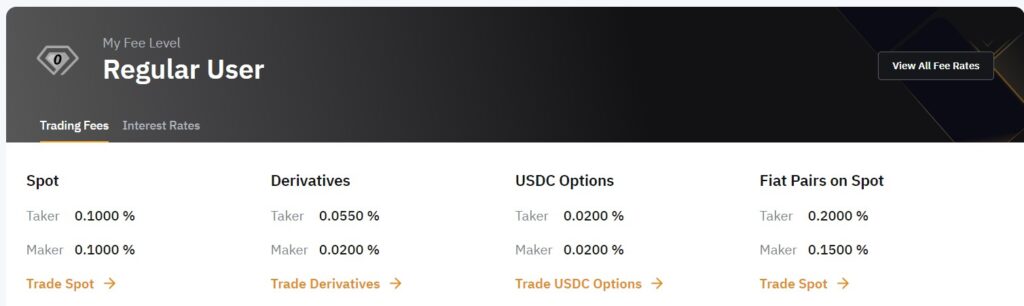

Bybit Trading Fees

When trading on Bybit, you’ll encounter different fee structures depending on the trading activity you’re engaged in. The platform’s fee policy is structured to cater to various traders by offering competitive fees that can decrease with increased trading volume.

Spot Trading Fees:

For crypto-to-crypto pairs, Bybit has a maker-taker fee model. As a trader, you’ll pay a fee when you remove liquidity from the market (taker fee) and be credited with a fee when you add liquidity (maker fee). Here is a simplified breakdown:

- Maker Fee: A small percentage is returned to you for orders that add liquidity.

- Taker Fee: A slightly higher fee is deducted for orders that take liquidity away.

Futures Trading Fees:

Bybit also offers futures trading with a different fee structure. The fees are similarly designed with maker-and-taker principles and may include funding rates exchanged between buyers and sellers, which can vary depending on market conditions.

Volume-Based Discounts:

For high-volume traders, Bybit provides discounts on trading fees, which means that your costs can decrease as your trading activity increases. It’s designed to incentivize higher trading volumes by reducing costs and promoting more trading activity.

To give you a clearer picture, here’s an illustrative breakdown:

| Trading Volume (Last 30D) | Maker Fee | Taker Fee |

|---|---|---|

| < $10,000 | 0.10% | 0.10% |

| $10,000 – $100,000 | 0.09% | 0.09% |

| > $100,000 | Varies | Varies |

Remember that different fees may apply for trading involving fiat currencies, such as USDT/EUR. Consult Bybit’s detailed fee schedule for the most accurate information.

Bybit Funding Rates/Fees

When trading perpetual contracts on Bybit, funding rates are a crucial aspect that you need to understand.

These funding rates act as payments exchanged between the buyers (long positions) and sellers (short positions) and serve as a mechanism to ensure the perpetual contract prices are anchored to the spot market price.

The funding rate is composed of two main components:

- Interest Rate (I)

- Premium Index (P)

The rate reflects the cost of holding a leveraged position and is periodically exchanged between long and short traders. Here’s how you can calculate the funding fee:

- Find the Position Value: The quantity of your contract multiplied by the mark price.

Position Value = Quantity of Contract × Mark Price - Determine the Funding Rate: It involves the premium index and the interest rate difference, usually capped within a range to prevent extreme funding fees.

- Calculate the Funding Fee: The amount you will pay or receive during the funding timestamp.

Funding Fee = Position Value × Funding Rate

Example:

For 10 BTC contracts with a mark price of $50,000 and a funding rate of 0.01%, the funding fee would be:10 BTC * $50,000 * 0.01% = $50

Remember, the funding fee is directly deducted or credited to your account at the specified funding timestamps, typically occurring every eight hours.

It’s worth noting that funding rates can fluctuate based on market conditions and the level of leverage being used. Monitor these rates, as they can impact your trading profitability.

Bybit also implements a tiered fee structure for spot and futures trading, where the rate you’re charged can differ if you’re a maker (providing liquidity) or a taker (taking liquidity). The fee rates are typically lower for higher-volume or VIP traders, incentivizing consistent trading on their platform.

Bybit Deposit & Withdrawal Fees

Bybit, as a cryptocurrency trading platform, ensures you have a seamless experience managing your funds. For deposits, you are not charged any fees, which means you can transfer cryptocurrencies into your Bybit account free of cost.

Bybit sets specific withdrawal fees to account for the network costs of transferring digital assets.

It’s important to know that withdrawal fees are not fixed; they fluctuate based on the current network congestion of the respective blockchain. Below is a concise table outlining the typical withdrawal fees for popular cryptocurrencies:

| Cryptocurrency | Minimum Withdrawal | Fee |

|---|---|---|

| Bitcoin (BTC) | 0.002BTC | Depends on current network congestion |

| Ethereum (ETH) | 0.02ETH | Depends on current network congestion |

| Ripple (XRP) | 20XRP | Depends on current network congestion |

| EOS (EOS) | 0.2EOS | Depends on current network congestion |

Withdrawal processing times are also crucial for your planning. Bybit processes withdrawal requests three times daily, which helps balance timely access to your funds and the security of your assets.

Additionally, Bybit’s fee structure includes a flat fee for ATM withdrawals made using the Bybit Card, a convenient option for converting crypto holdings into spendable cash. After the first free limit of 100 EUR/GBP or 100 USD monthly, your ATM withdrawals are subject to a 2% fee.

Remember to stay updated with the latest fee schedule on Bybit’s official website or user dashboard, as these fees can change in response to market conditions or Bybit’s policy adjustments.

Bybit Account Types & KYC Tiers & Limits

Bybit offers a structured approach to account verification through different KYC (Know Your Customer) levels. These levels determine your access to various products and services and set the withdrawal limits on your account.

Tier 0 – Basic Account:

You can create a Bybit account as a baseline without completing any KYC procedures immediately. This Basic Account allows you to explore Bybit’s offerings with the following conditions:

- Withdrawals up to 2 BTC per day without KYC verification

- Access to standard trading functions

Tier 1 – Verified Account:

For increased limits and access, you will need to complete Level 1 KYC verification:

- Mandatory for usage of all Bybit products and services

- Enhanced daily withdrawal limit

- Access to Bybit Card and additional features

Tier 2 – Advanced Verification:

Completing a more advanced KYC is required for those who need even higher limits and full utilization of Bybit’s ecosystem.

Advantages of completing higher KYC tiers:

- Higher withdrawal limits

- Access to advanced trading products

- Improved account security

Note: Each tier has specific documentation requirements you’ll need to submit, like a government-issued ID and a selfie for identity verification.

Please refer to Bybit’s official guidance for each KYC level’s limits and requirements.

Remember that completing these verification steps enhances your capabilities on Bybit and assists in the global fight against money laundering and fraudulent activities.

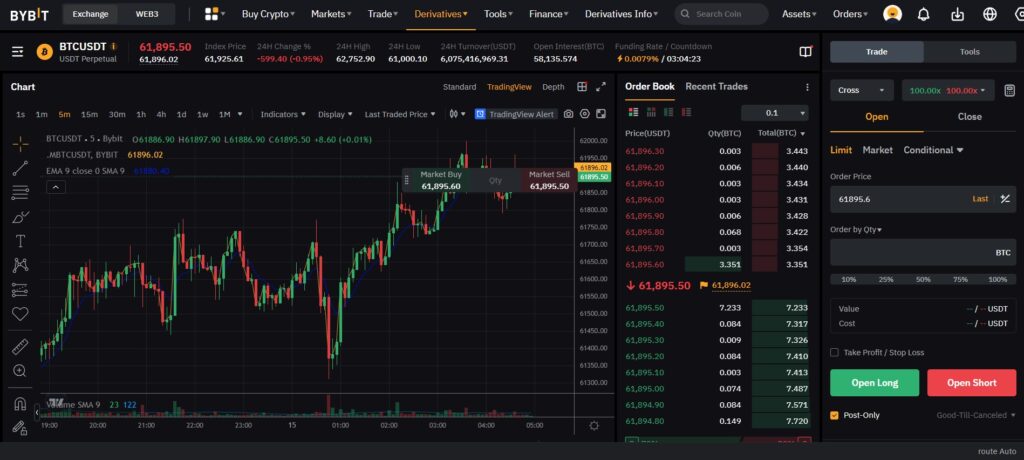

Bybit Trading Platform & Tools

Your experience with Bybit’s trading platform is tailored to accommodate your expertise level, whether you’re a beginner or a seasoned trader.

The platform flaunts an intuitive user interface that simplifies navigation and trade execution.

For in-depth analysis, Bybit integrates advanced charting tools from TradingView, giving you access to sophisticated technical analysis instruments.

Key Features:

- User-Friendly Interface: Navigate easily through a straightforward platform layout.

- Advanced Charting: Leverage TradingView’s robust charting solutions.

You can also make use of various trading bots provided by Bybit. These bots are designed to automate your trading strategies, allowing you to capitalize on market opportunities around the clock without constantly monitoring the markets.

Automated Trading Tools:

- Trading Bots: Set up bots to trade based on predefined conditions.

Bybit’s platform efficiency is complemented by various trading tools and solutions specifically engineered to enhance your trading endeavors.

Comprehensive Tool Suite:

- Copy Trading: Follow the trades of top performers on Bybit.

- Risk Management: Benefit from real-time monitoring and enhanced security protocols during withdrawals.

Bybit’s commitment to providing robust support tools and a secure trading environment ensures that you have a reliable foundation for your trading activities.

Bybit Insurance Fund

When you trade on Bybit, an insurance fund safeguards you against the financial risks of derivatives trading. This reserve pool is a crucial component designed to protect traders like you from potential negative equity and to avoid accountability for excessive losses.

The Function of the Insurance Fund:

- Prevention of Auto-Deleveraging (ADL): The fund decreases the chance of Auto-Deleveraging in liquidation events.

- Coverage for Poor Execution Prices: If your liquidated order closes at a price less favorable than the bankruptcy level, the insurance fund covers the shortfall.

Usage Breakdown:

- Successful Liquidations: Should the closing price be better than the bankruptcy price, any remaining margin from your position may be directed into the fund.

- Insufficiency Scenario: If the insurance fund’s balance is not sufficient to handle the poor execution price, ADL will be activated.

The Bybit Insurance Fund operates as a financial safety net, protecting your trading experience against volatility and unexpected occurrences that might otherwise lead to significant financial exposure.

This feature underscores Bybit’s commitment to providing a secure trading environment for its clients.

Bybit Deposit Methods

Bybit offers multiple deposit methods to cater to your diverse needs. You can fund your account using either cryptocurrency or fiat currency.

Cryptocurrency Deposits:

You can transfer cryptocurrencies directly from an external wallet or other exchanges. The process involves:

- Selecting the cryptocurrency you wish to deposit.

- Scanning the QR code or copying the deposit wallet address.

- Initiating the transfer from your external wallet.

Supported Cryptocurrencies Include:

- Bitcoin (BTC)

- Ethereum (ETH)

- USDT

- And more

Fiat Currency Deposits:

If you prefer fiat currency, Bybit has partnered with payment providers to facilitate these transactions. The available options are:

-

Credit/Debit Card Payments: Directly purchase cryptocurrencies using your cards.

-

Third-Party Payment Providers: Use services like Moonpay and Banxa for transactions.

-

P2P Trading: Engage in peer-to-peer trading to buy cryptocurrencies from other users.

-

Digital Wallets: Google Pay is also an option for deposits on Bybit.

Please note that the fees, limits, and processing times may vary depending on your chosen method and service provider.

Always ensure you know the terms and conditions of each deposit method to make informed decisions and transactions.

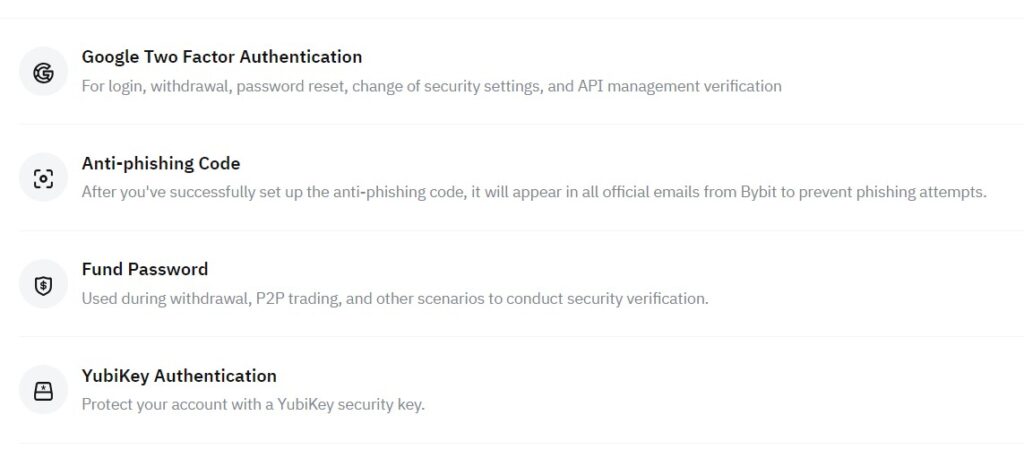

Bybit Security Features

When you engage with Bybit’s platform, your asset security is backed by a robust framework.

Multi-signature cold storage wallets ensure that most funds are not subject to online vulnerabilities. This solution requires multiple keys to authorize transactions, adding an extra safeguard against unauthorized access.

You also benefit from Two-Factor Authentication (2FA), an additional checkpoint. 2FA verifies your identity through two separate channels before granting access to your account or validating transactions. This significantly reduces the risk of unauthorized account usage.

To combat deceptive attempts to steal your sensitive information, Bybit implements anti-phishing measures.

These consist of verified communication channels and warnings against suspicious activity, helping you quickly distinguish legitimate operations from potential fraud.

Moreover, Bybit’s dedication to your protection spans across:

- Security Protocols:

- SSL encryption

- Continuous risk assessment

Compliance: Bybit works with international regulators to assure adherence to evolving security standards.

Bybit’s commitment to these measures exhibits a confident and knowledgeable approach to platform safety. They focus on securing your experience, placing you at the forefront of safeguarding assets in the dynamic world of digital currency exchanges.

Bybit Proof Of Reserves

Bybit implements various measures to ensure the safety of your funds on their platform. The proof of Reserves (PoR) concept relates to the transparency in holding and managing users’ assets.

Bybit has indicated a commitment to maintaining a 1:1 ratio of reserves, meaning they aim to hold an equivalent reserve amount for every token you and other users possess.

Transparency Efforts:

- Bybit has publicly published wallet addresses.

- A Nansen dashboard is available for you to view these addresses.

- Regular PoR audits take place, enhancing trustworthiness.

Furthermore, Merkle Tree technology is used by Bybit, which allows you—the user—to verify your assets’ balance in the exchange. Verifications are facilitated through a PoR process that Bybit has developed, aiming to give you peace of mind regarding the safety of your assets.

Here’s what you can expect:

- Trading Accounts: Your assets in Spot, Futures, Options, and Unified Margin accounts.

- Funding Accounts: Includes your crypto holdings and financial balances.

For users based in Australia, Bybit also mandates identity verification for Bybit Card applications, which underlines their emphasis on security measures.

Reserve Ratios for Major Cryptos: (As per latest transparent release)

- BTC: 116%

- ETH: 106%

- SOL: 111%

- USDT: 107%

- USDC: 129%

These ratios indicate that Bybit maintains reserve holdings over user deposits for these cryptocurrencies, offering a buffer and showcasing their approach toward financial stability.

Bybit Customer Support

You can rely on their customer support team to assist your Bybit account in Australia. Bybit offers customer support 24/7, ensuring your concerns are addressed promptly, regardless of the time of day.

The primary means of getting support are through:

- Live chat: Available directly on their platform for real-time assistance.

- Email support: For less urgent issues or detailed inquiries.

Unfortunately, Bybit does not provide customer support via phone. If you require immediate help, the live chat is the most efficient method. Email is your best action for queries needing thorough investigation or documentation.

Here’s a quick reference for contacting Bybit’s customer support:

| Method | Description |

|---|---|

| Live Chat | Instant support is available on the platform |

| For detailed inquiries, at, [email protected] |

Remember, Bybit does not offer a phone number for direct contact or a 24/7 live chat specific to Australian users.

For alternative platforms with more localized support, such as phone or dedicated live chat, consider comparing the features of CoinSpot or other exchanges operational in Australia.

Is Bybit Legal in Australia?

When considering the legality of Bybit in Australia, you should understand that Bybit does not possess an official Australian license.

However, Australian laws now do not strictly ban the use of offshore crypto derivatives platforms. This means you can participate in trading on Bybit without directly contravening any Australian laws.

Regulatory Status

- License: No official license in Australia.

- Legality: Not explicitly illegal; operates in the legal gray area.

Safety Measures

- Encryption: Advanced SSL-level to protect funds.

- Insurance: Insurance funds are implemented for additional security.

- Security Level: Comparable to significant banks.

Regarding Bybit’s safety, the platform strives to protect your funds with robust security measures.

It employs advanced encryption, similar to the ones used by banks, ensuring their users’ personal and financial information is well-guarded.

Moreover, Bybit has set up insurance funds to provide a safety net in exceptional circumstances.

While Bybit is unavailable in the U.S., the platform sits in a flexible jurisdiction for Australians, allowing it to operate openly. If you trade on Bybit, stay informed about evolving regulations that can impact your trading activities.

Always keep personal safety measures in mind, such as using strong, unique passwords and enabling two-factor authentication when available.

Conclusion

Bybit, as you may have gathered, has positioned itself as a formidable player in the cryptocurrency exchange arena.

Established in 2018, Bybit’s growth has been notable, crossing the 10 million user threshold, a testament to its appeal among traders.

You have access to a range of markets on Bybit, including spot, derivatives, and margin trading with leverage up to 100x, which aligns with the needs of serious traders.

In Australia, Bybit’s offerings are not locally regulated.

However, Bybit provides a suite of trading options and benefits, such as various payment methods for AUD deposits—Credit card, Debit card, Moonpay, P2P, Banxa, and Google Pay.

The exchange fees involved are competitive, which can make a discernible difference in your trading experience. Additionally, your trading strategies can be diverse and flexible with over 600 trading pairs and features like Copy trading and Options trading.

Despite these benefits, it’s crucial to consider the challenges.

The lack of local regulation requires you to practice due diligence and evaluate your comfort level with the legal uncertainties in this market environment.

Bybit, through its extensive product offerings, including futures and advanced security measures, has rightly earned its spot among the top contenders in the global exchange space. Your decision to trade with Bybit should weigh both the potential of its advanced platform and the considerations that come with any unregulated exchange.

Remember, continuous learning about market changes and platform specifics will empower you to make informed trading decisions.

Discover More Reviews: