Bitstamp Australia Review in 2025

Bitstamp, established in 2011, ranks as a venerable institution in the dynamic world of cryptocurrency exchanges.

As you explore the options for trading digital currencies in Australia, Bitstamp emerges as a notable choice because of its longevity and the trust it has cultivated.

It provides a reliable service and a straightforward setup, appealing to newcomers and experienced traders seeking to navigate the crypto market.

Its user-friendly platform delivers a comprehensive trading experience, facilitating the buying, selling, and transferring various cryptocurrencies.

With low fees and a robust infrastructure, you are equipped to engage with both crypto and fiat currency trading pairs.

Bitstamp’s global presence, including operations that cater to the Australian market, ensures adherence to rigorous regulatory standards, enhancing the exchange’s credibility and your peace of mind as a user.

In Australia, Bitstamp is a gateway to the vast crypto space, allowing you to access global markets and a diversified portfolio of digital assets.

It seamlessly blends a secure trading environment with valuable market insights, ensuring your crypto journey is informed and efficient.

Whether you’re looking to start your adventure with Bitcoin or diversify with altcoins like Ethereum and Litecoin, Bitstamp offers a solid platform for your trading needs.

Bitstamp Product Offerings [Futures, Spot, Options, Staking, NFTs, etc]

Futures and Spot Trading

At Bitstamp, you can trade with major cryptocurrencies through spot and futures markets. This allows you to engage in immediate trades at current market prices or enter into contracts to buy or sell assets at predetermined future dates and prices.

Options and Staking

While options trading isn’t explicitly advertised, Bitstamp offers a staking feature known as Bitstamp Earn. Through this service, you can earn rewards by supporting the security and operations of various Proof-of-Stake (PoS) blockchain networks. By participating in staking, you maintain full ownership of your crypto assets.

- Bitstamp Earn products are essentially for a specific crypto asset.

- They outline reward methods such as staking with clear terms, including APY.

- The staking service is transparent, charging a stated commission for its use.

NFTs

Bitstamp does not support trading with non-fungible tokens (NFTs) on its platform. As of now, your experience with Bitstamp will center around more traditional forms of cryptocurrency trading and staking services rather than the burgeoning NFT market.

Remember that the specifics related to staking rewards and the availability of various trading options can vary, providing flexible and fixed terms tailored to your preferences and the network involved.

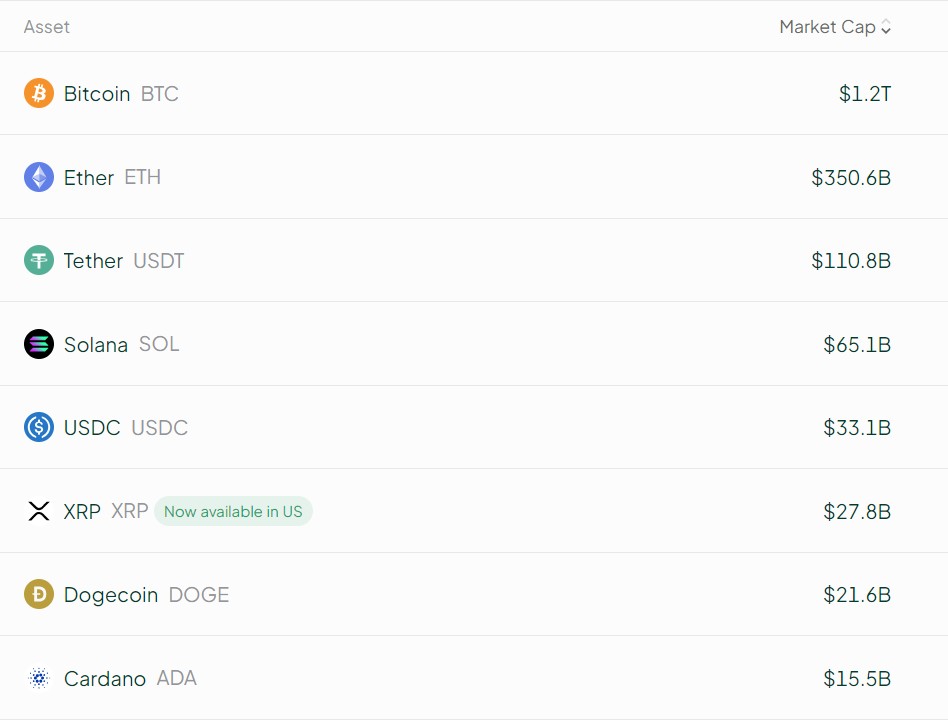

Bitstamp Supported Coin List

At Bitstamp, you can trade a diverse selection of cryptocurrencies.

This exchange, known for its longevity and reliability in crypto, provides you with a robust list of coins to engage with. Below is a non-exhaustive list of some notable coins you can trade on Bitstamp:

- Bitcoin (BTC): The first cryptocurrency, launched in 2009, remains the leading digital asset by market cap.

- Litecoin (LTC): Created in 2011, Litecoin is considered the silver to Bitcoin’s gold, offering faster transaction times.

- Tether (USDT): A stablecoin pegged to the US dollar, launched in 2014, providing reduced volatility.

- Polygon (MATIC): This token powers the Polygon network, which is aimed at scaling Ethereum and improving its infrastructure. It was introduced in 2019.

- Shiba Inu (SHIB): A meme coin that gained popularity rapidly and is now part of the ecosystem Bitstamp supports.

These selections are only a slice of the full spectrum available, with Bitstamp steadily increasing its offerings to over 70 cryptocurrencies. Each digital asset comes with its features and uses within the crypto economy.

Whether you’re looking to trade familiar names or explore new digital currencies, Bitstamp provides a platform to conduct these transactions efficiently.

Remember, when delving into cryptocurrency trading, take the time to research and understand the coins you are interested in, maintaining due diligence as a trader.

Bitstamp Order Types

When trading on Bitstamp, you can access multiple order types that cater to your specific trading needs.

-

Market Orders: These are executed immediately at the current market price. Ideal for quick trades where you’re looking to buy or sell right away without specifying the price.

-

Limit Orders: You set the price you want to buy or sell. Your order is only filled if the market reaches your specified price.

-

Instant Orders: With an instant order, you can quickly and easily specify a price in your currency of choice. This is similar to a market order but allows you to trade at a known immediate cost.

-

Stop Orders: This is your go-to option for mitigating losses. A stop order is triggered when the market hits your established price point.

Additionally, Bitstamp offers the Trailing Stop function, which adjusts your stop order automatically if the price changes favorably, maintaining a predetermined distance from the current price.

Remember that while limit and stop orders provide more control over price, they do not guarantee execution, as the market may not reach your set parameters.

Conversely, market orders assure immediate execution but not a specific price. Use these order types strategically to enhance your trading experience on Bitstamp.

Bitstamp’s Liquidation Mechanism

When trading on margin at Bitstamp, your positions are subject to liquidation to maintain platform integrity and manage risk effectively. This process is critical in preserving a stable trading environment, especially during periods of high volatility.

Automated Liquidation: Bitstamp has implemented a computerized system that monitors your real-time margin positions. This system ensures that if the market moves against your position and your margin balance falls below the required maintenance margin, the system will automatically liquidate your position at the current market price.

Margin Call: Before liquidation occurs, you’ll receive a margin call, alerting you that your account equity is approaching the minimum required level. It’s your chance to improve your margin balance or reduce your position size.

Liquidation Process:

- Notification: You’ll be notified if your account is close to a liquidation event.

- Execution: If no action is taken, the automated system will execute the liquidation.

- Order Type: Typically, the system uses market orders for quick execution to minimize risk.

Priority of Liquidation: Liquidations are executed to maintain the necessary margin level. Your open positions with the highest maintenance margin requirement may be liquidated first.

Protection Measures: To help prevent unnecessary liquidations, maintain a buffer in your margin balance, monitor your positions regularly, and set up stop orders to limit potential losses.

The liquidation mechanism serves as a safeguard for you and the broader community of traders on Bitstamp, ensuring a level of protection against negative balance in a highly volatile market.

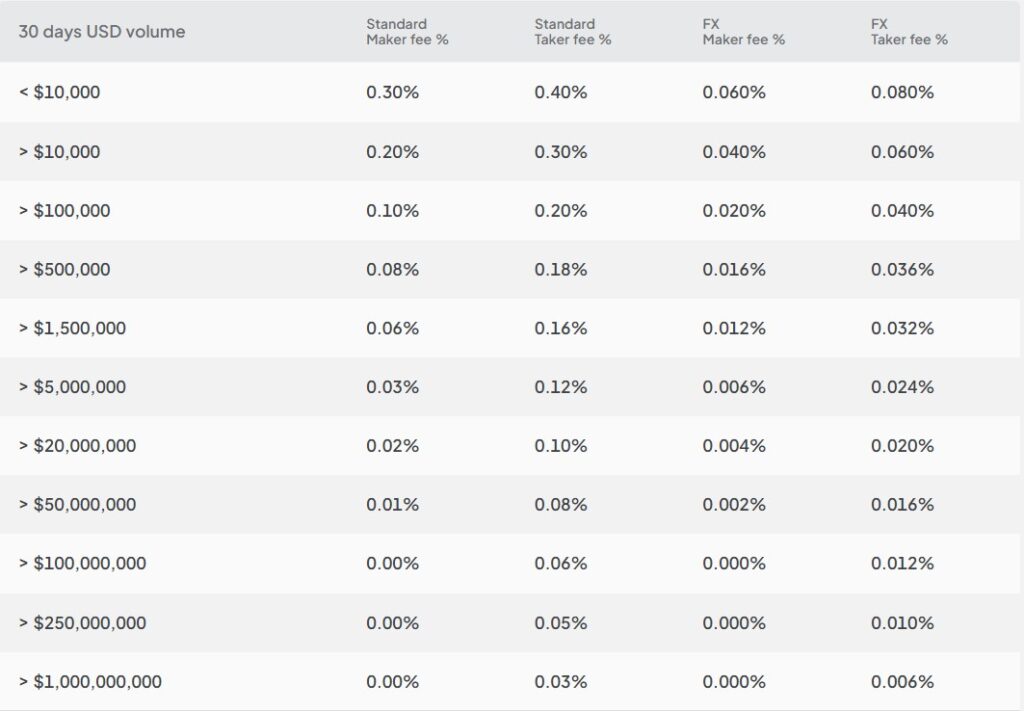

Bitstamp Trading Fees

When trading on Bitstamp, your fees are structured based on your 30-day trading volume and your role in each transaction. You’ll experience a maker-taker fee model designed to incentivize market liquidity.

As a “maker,” your fees can be lower when you place an order that adds liquidity to the market. Conversely, as a “taker,” when you place an order that matches an existing one and thus removes liquidity, your costs may be higher.

Here’s a straightforward breakdown of possible trading fees you may encounter:

- 0.0% – 0.5% range for your trading fees.

- Fees decrease as your trading volume increases.

The precise fee depends on whether you provide liquidity (maker) or take liquidity away (taker). For example:

| 30-Day Trading Volume (USD) | Maker Fees | Taker Fees |

|---|---|---|

| Up to $10,000 | 0.5% | 0.5% |

| $10,001 – $20,000 | 0.25% | 0.25% |

| … | … | … |

| Over $20 million | 0.0% | 0.10% |

It’s essential to note that fees apply to various transactions, such as deposits and withdrawals. However, for a deep dive into specific fee structures beyond trading, you must consult Bitstamp’s complete fee schedule on its website.

Bitstamp Funding Rates/Fees

Bitstamp operates using a tiered fee schedule for your trading activities. This means that the more you trade, the lower the fees you can expect to incur. The platform’s fee structure is designed to encourage high-volume trading.

The transaction fees start from 0.5% for trades under USD 10,000, dropping progressively with increased trading volume. Once your 30-day trading volume exceeds a specified threshold, market makers’ fees can be as low as 0.0%.

For deposits and withdrawals, several options are available:

- Credit/Debit cards: Depositing funds through this method typically incurs a fee.

- Bank transfers are generally a cost-effective way to fund your account, especially if you are handling more significant sums. SEPA deposits within Europe are free, whereas international wire transfers incur a minimal fee.

- Cryptocurrency deposits and withdrawals are subject to network fees, which vary depending on the blockchain load.

Please be aware of potential fees related to currency conversions if your funding currency is other than the denominated currencies of Bitstamp (USD, EUR, GBP).

Here is a summarized breakdown:

| Method | Deposit Fee | Withdrawal Fee |

|---|---|---|

| SEPA | Free | Varies |

| International Wire | 0.05% (min-max cap applies) | Varies |

| Credit/Debit cards | Based on amount | – |

| Cryptocurrencies | Network fees apply | Network fees apply |

Always check the latest fee schedule on Bitstamp’s official website for up-to-date information.

Bitstamp Deposit & Withdrawal Fees

When managing your Bitstamp account in Australia, you must know the various fees for depositing and withdrawing funds.

Deposits to your Bitstamp account are typically free of charge, except when you use a debit or credit card. A fee is applied for these transactions, which you should check directly with Bitstamp as it may change.

Withdrawal fees, on the other hand, are minimal and depend on the method you choose:

- Cryptocurrency withdrawals only require you to pay the network transaction fee, which varies according to the blockchain load.

- Fiat withdrawals via different payment methods like SEPA or Faster Payments service may have fixed fees. For instance, withdrawals in euros (EUR) using SEPA may incur a fee of 3 EUR, while withdrawals in British pounds (GBP) via Faster Payment Service are subject to a fee of 2 GBP.

The fee for other withdrawal methods and any updates to the charging structure can be found in the updated fee schedule provided by Bitstamp, effective from May 18, 2024.

Before withdrawing, Bitstamp gives you a clear view of the exact fee, ensuring no surprises.

Here’s a quick overview:

| Method | Deposit Fee | Withdrawal Fee |

|---|---|---|

| Debit/Credit Card | Variable Fee | – |

| Cryptocurrency | Free | Network Fee |

| SEPA (EUR) | Free | 3 EUR |

| Faster Payments (GBP) | Free | 2 GBP |

Always review the most current fee schedule on Bitstamp’s website to stay informed.

Bitstamp Account Types & KYC Tiers & Limits

When you register for a Bitstamp account in Australia, you are subject to Know Your Customer (KYC) verification processes in adherence to regulatory standards. The KYC stipulates different tiers for user accounts, which affect your withdrawal capabilities and trading options.

Personal Account Types:

- Standard: This is for everyday users looking to trade cryptocurrencies.

- Premium: Tailored for more advanced traders with higher volume trades.

KYC Verification Tiers and Corresponding Limits:

- Tier 0: Esta blushes your account with email verification; however, trading is prohibited.

- Tier 1: Requires personal information such as name, date of birth, and phone number; this tier grants access to limited trading functions and fiat deposits & withdrawals.

- Tier 2: Requires address verification; significantly increases deposits and withdrawals’ limits.

- Tier 3: Involves additional documentation for proof of identity, such as a government-issued ID and possibly proof of residency, further enhancing your account limits.

You need to know that each increase in the tier can potentially unlock more features and higher transaction thresholds. Your account type and verification tier will directly influence the daily and monthly limits on deposits and withdrawals.

Standard Limits Across Tiers:

- Daily Deposits: Ranges based on your tier, from limited amounts to significantly higher ceilings for top-tier users.

- Monthly Withdrawals: Similarly tier-based, with limits expanding as you provide more verification documents.

Please consult Bitstamp’s official support channels for detailed information concerning your specific limits and necessary documents for KYC verification tiers.

Bitstamp Trading Platform & Tools

Bitstamp is a resilient trading platform offering advanced tools that suit both seasoned and novice traders. Your experience is streamlined with high liquidity and reliable order execution, tailoring it to both individual and institutional traders.

With Tradeview, you gain access to a professional-grade dashboard. Here’s what you can expect:

- Real-time market insights: Stay up-to-date with the latest market movements.

- Analytical tools: Conduct thorough technical analysis with an array of charting options.

- Consequential order types: Customize your trading strategies with advanced order options.

Beginners are not left behind, with a straightforward setup process. Whether you’re looking to buy or sell cryptocurrencies, Bitstamp provides an easily navigable service paired with low fees.

Here are critical features for a practical trading experience on Bitstamp:

| Feature | Description |

|---|---|

| High Liquidity | Ensures swift transaction execution at desired prices. |

| Analytical Tools | Create and test your market theories with diverse chart types and indicators. |

| Continuous Availability | Markets never sleep, and neither does Bitstamp—trade around the clock. |

| Mobile App | Gain market access anytime, anywhere with Bitstamp Pro on mobile devices. |

| Security | Trade with confidence, knowing your digital assets are in a secure environment. |

Bitstamp’s longevity attests to its capability to provide a dependable trading platform for diving into cryptocurrencies. Whether your focus is Bitcoin, Ethereum, or an expanding array of altcoins, your trading requirements are met with precision and efficacy.

Bitstamp Insurance Fund

Bitstamp recognizes the importance of the security of your assets. That’s why they’ve rolled out measures like expanding their crime insurance policy. This initiative is a step to ensure that your digital assets are safeguarded in various situations, including criminal activities.

Insurance Partners and Coverage:

- Paragon Brokers: As a trusted partner, they are vital in providing specialized insurance services.

- Coverage Expansion: In response to growth, the coverage has been extended to foster greater peace of mind.

Protection Measures:

- Cold Storage: Approximately 95% of digital assets are stored offline, reducing the risk of online threats.

- Existing Policies: Crime insurance supplements the already robust insurance of cold storage assets managed by BitGo’s policy.

Insured Scenarios:

Your assets at Bitstamp are insured under various circumstances, including:

- Online holdings

- Assets during transit

- Other crime-related scenarios

This comprehensive approach to insurance demonstrates Bitstamp’s commitment to safeguarding your investments with a high degree of diligence and care.

Bitstamp Deposit Methods

When funding your Bitstamp account, you have multiple deposit methods to meet your needs.

Bank Transfers:

One of the most widely used methods is depositing via bank transfer. To proceed, follow these simple steps:

- Log in to your Bitstamp account.

- Select ‘Deposit’ from your menu options.

- Choose ‘Bank Transfer’ as your deposit method.

- Specify the currency and where you’d like the funds credited.

Credit and Debit Cards:

You may use your credit or debit card for faster funding. Bitstamp supports instantaneous purchases with these cards and often integrates with mobile payment services for added convenience.

Cryptocurrency Deposits:

Depositing cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), XRP, Bitcoin Cash (BCH), and Litecoin (LTC) is also an option. It can be an efficient way to move funds into your account.

Please note that specific terms for these methods may apply regarding fees, processing times, and limits. Check Bitstamp’s fee structure and deposit guidelines for the most up-to-date information.

Bitstamp Security Features

Your cryptocurrency holdings are safeguarded with Bitstamp, which employs multiple layers of security measures. This exchange takes your digital asset security seriously, utilizing technological solutions and operational protocols to minimize risks.

- Cold Storage: A significant portion of your assets on Bitstamp is held in cold storage. This method means that most funds are kept offline, providing an essential barrier against online threats, hackers and cyber theft.

- Two-Factor Authentication (2FA): You are prompted to set up 2FA for account access and withdrawal confirmations. This provides an additional layer of security to your account by requiring a second form of verification, typically through your mobile device.

- Know Your Customer (KYC) Checks: To comply with regulatory standards, Bitstamp conducts mandatory KYC checks. This process verifies your identity, adding a security level that helps prevent fraudulent activities and unauthorized access to your account.

- Data Encryption: When you transmit data over Bitstamp’s platform, it’s protected with high-grade encryption. Your personal information is securely stored, ensuring your privacy and mitigating the risk of data breaches.

To summarize, Bitstamp integrates these robust security measures to protect your investments, all the while maintaining a user-friendly trading experience.

These protocols demonstrate Bitstamp’s commitment to security, striving to keep your assets and information protected at all times.

Bitstamp Proof Of Reserves

Bitstamp, as a cryptocurrency exchange, values the importance of maintaining total reserves.

You might appreciate knowing that Bitstamp has been subject to annual audits by a reputable global accounting firm since 2016.

These audits aim to establish a comprehensive view of Bitstamp’s financial situation, ensuring that its assets align with its users’ obligations.

Transparency is a crucial aspect that you should look for in an exchange as a customer or observer. Bitstamp aims to enhance this by discussing the potential release of a proof of reserves audit. Such a report would reaffirm that your assets are securely held and managed.

Regarding Proof of Reserves (PoR), it’s typical to encounter various interpretations. Bitstamp’s approach involves accounting for the assets in reserve and also ensuring that they reflect the actual state of their financial health.

To help you grasp the scale of Bitstamp’s reserves, here are some indicative figures provided by GeckoTerminal as of March 8, 2024:

| Amount (USD) | |

|---|---|

| Total Assets | $3,626,303,836.59 |

Remember, while regular audits are instrumental in demonstrating financial responsibility, specific details about proof of reserve audits are not typically highlighted in Bitstamp’s public disclosures.

Nevertheless, these practices contribute to safeguarding your crypto and fiat assets, underpinning the security and transparency you seek from a regulated crypto exchange.

Bitstamp Customer Support

You can expect robust support options if you are using Bitstamp for your cryptocurrency transactions in Australia.

Bitstamp’s customer support is available 24/7 via email when you need assistance. For those times when an email won’t suffice, you can turn to their telephone support.

The team behind the phone support aims to respond quickly to your queries.

For general questions or basic troubleshooting, Bitstamp offers a detailed FAQ section. It’s designed to help you find answers to common issues quickly and without the need for direct contact.

Should the need arise to speak with a representative directly, here are the contact details you might use:

Telephone Support:

- International: +44 20 3868 9628

- USA toll-free: +1 800 712 5702

- Europe: +352 20 88 10 96

Telephone support is availableMonday through Saturday from 6 AM CET to 10 PM CET.

Email Contacts:

- General Support: [email protected]

- Verification Support: [email protected]

Remember, when reaching out, having your account details readily available is essential to expedite the support process. Whether you’re a beginner or a seasoned trader, Bitstamp’s customer support is designed to guide you through any challenges you might face on the platform.

Is Bitstamp Safe & Available in Australia?

When assessing Bitstamp’s legal status and safety, regulation is a cornerstone.

Bitstamp operates under the Luxembourg Financial Authority, aligning with European Union financial regulations. This ensures you engage with a platform that adheres to strict operational standards.

Your funds’ security is a top priority for Bitstamp. The exchange implements comprehensive safety measures to protect your crypto and fiat assets. These measures include:

- Two-factor authentication (2FA): Adds an extra layer of security to your account.

- Fully reserved finances: Signifying that your assets are safe and accounted for.

- Cold storage for assets: A significant portion of assets is held offline to mitigate the risk of unauthorized access.

Regarding data protection, Bitstamp encrypts personal information and leverages robust cybersecurity frameworks to guard against potential breaches. You are engaging with a platform that values transparency and regulatory compliance.

Bitstamp’s longtime presence in the market since 2011 and a growing base of more than four million users contribute to its reputation as a reliable exchange.

The platform is regularly audited and acts in total reserves, reinforcing its commitment to user safety and legal operations.

Conclusion

Bitstamp stands as a reputable name in the cryptocurrency exchange landscape, attracting both novice and experienced traders worldwide, including in Australia.

With its origins dating back to 2011, it is one of the first and longest-standing exchanges in the industry.

-

Security: You can count on rigorous security measures, including two-factor authentication and cold storage for digital assets, ensuring your investments are well-protected.

-

Products & Features: You can access a product suite, from fiat-to-crypto transactions to various trading pairs. The exchange supports multiple fiat currencies, facilitating easier transactions.

-

Regulatory Compliance: Bitstamp prioritizes compliance, adhering to regulatory standards to provide a trustworthy platform for crypto trading activities.

-

Fees: The trading fees are reasonable, striking a balance between affordability and quality service provision.

-

Accessibility: While some features may vary by region, Bitstamp maintains high accessibility across different countries, including Australia.

-

Support: Should you require assistance, the customer support team is available to guide you through any queries or issues that may arise.

In choosing Bitstamp, you align yourself with an exchange that balances tradition and innovation with a core commitment to user experience and regulatory adherence.

Discover More Reviews: