Huobi Australia Review in 2025

Huobi has expanded its reach into the Australian market, signaling its commitment to adhering to regulatory frameworks while providing digital asset services.

With its roots dating back to 2013 and an established worldwide presence, Huobi brings a strong reputation as a veteran cryptocurrency exchange to the Australian financial landscape.

Their entry into Australia follows a successful registration with the Australian Transaction Reports and Analysis Centre (AUSTRAC), which allows Huobi to operate legally as a digital currency exchange provider.

With Huobi’s entry, Australian traders have access to a platform with a history of providing robust trading options and a secure environment for cryptocurrency transactions.

The move is a testament to Huobi’s continuous expansion and reflects Australia’s growing embrace of digital currencies.

By ensuring compliance with local regulations, Huobi is a trustworthy choice for Australian users looking to interact with the global cryptocurrency market.

Huobi Product Offerings [Futures, Spot, Options, Staking, NFTs, etc]

Futures, Spot, and Options Trading

At the core of Huobi’s offerings, you’ll find a robust platform that caters to various types of crypto trading:

- Futures: Huobi allows you to trade futures with leveraged positions, potentially amplifying your trading outcomes.

- Spot Trading: You can execute immediate trades with the current market price on a wide range of cryptocurrencies.

- Options: This derivative product enables you to buy or sell at a predetermined price, providing opportunities for strategic trading.

Each trading type is designed with ease of use and efficiency, ensuring your trading experience is as smooth as possible.

Staking

With Huobi, staking is made remarkably accessible, allowing you to earn rewards by holding specific cryptocurrencies. The platform supports staking for various assets, providing another avenue to potentially increase your holdings.

NFTs

Huobi embraces the world of digital collectibles with:

- NFT Platform: A dedicated space for buying, selling, and managing NFTs. This marketplace offers a range of digital assets, from art to gaming items.

Whether you’re an experienced trader or new to the crypto space, Huobi’s suite of products is designed to meet your trading needs with precision and reliability.

Huobi Supported Coin List

Huobi offers a comprehensive list of cryptocurrencies, ensuring you can access over 500 tokens and coins for your trading endeavors.

This broad selection is regularly updated to maintain relevance with the cryptocurrency market trends. Below is a table highlighting some of the prominent cryptocurrencies supported by Huobi:

| Name | Ticker | Launch Year |

|---|---|---|

| Bitcoin | BTC | 2009 |

| Bitcoin Cash SV | BSV | 2018 |

| Cosmos | ATOM | 2019 |

| EOS Token | EOS | 2017 |

| Litecoin | LTC | 2011 |

Please note that this is not an exhaustive list, and you are encouraged to visit the Huobi platform to find a complete and updated list of supported coins.

Including various cryptocurrencies reflects Huobi’s commitment to catering to diverse trading preferences and strategies.

To keep your investments up-to-date, it’s advisable to frequently check Huobi’s listings since the platform is known for adding new cryptocurrencies in response to user demand and market evolution.

Remember, staying informed of the supported coins and their launch years can help you make educated decisions in your trading activities on Huobi.

Huobi Order Types

As you navigate the Huobi Australia platform, you’ll encounter a suite of order types designed to cater to varying trading strategies and experience levels.

Here’s a brief guide to the primary order types you might use:

Market Orders: Execute your trade immediately at the best available current price. This is the most straightforward order type, suitable for when you want to buy or sell cryptocurrency promptly.

Limit Orders: With a limit order, you specify the price you want to buy or sell a cryptocurrency. Your order will only be executed if the market reaches your specified price.

- Example: You can set a buy limit order at a lower price than the current market value, and it will only execute if the market price drops to your set price.

Stop Orders: A stop order, also known as a stop-loss order, is designed to limit potential losses. It converts to a market order when a specified price level is reached.

- Example: If you want to minimize potential losses, you could set a stop order to sell your crypto at a price lower than the current market value; it will be triggered if the price falls to that level.

When used effectively, these order types can help you precisely manage your trades and investment strategy. Remember to acquaint yourself with each order’s specifics, as this knowledge will be integral to your trading success on the Huobi Australia platform.

Huobi’s Liquidation Mechanism

Huobi implements an automated liquidation system designed to manage margin calls efficiently efficiently. This process is crucial in mitigating potential risks associated with leveraged trading.

If your margin level falls below the required maintenance margin, Huobi activates the liquidation mechanism to close your positions, preventing further losses.

Here’s how it works:

- Automated process: The system continuously monitors your margin level.

- Threshold alerts: If your margin is approaching the liquidation level, you receive notifications.

- Partial Liquidation: Instead of a complete account liquidation, Huobi’s system may execute a partial liquidation to reduce your position’s size, lower the required maintenance margin, and, consequently, the risk of further loss.

Huobi’s liquidation system aims to protect your interests and the platform’s integrity.

Introducing partial liquidations is a significant feature, reducing the possibility of total account liquidation and allowing you to recover from unfavorable market movements.

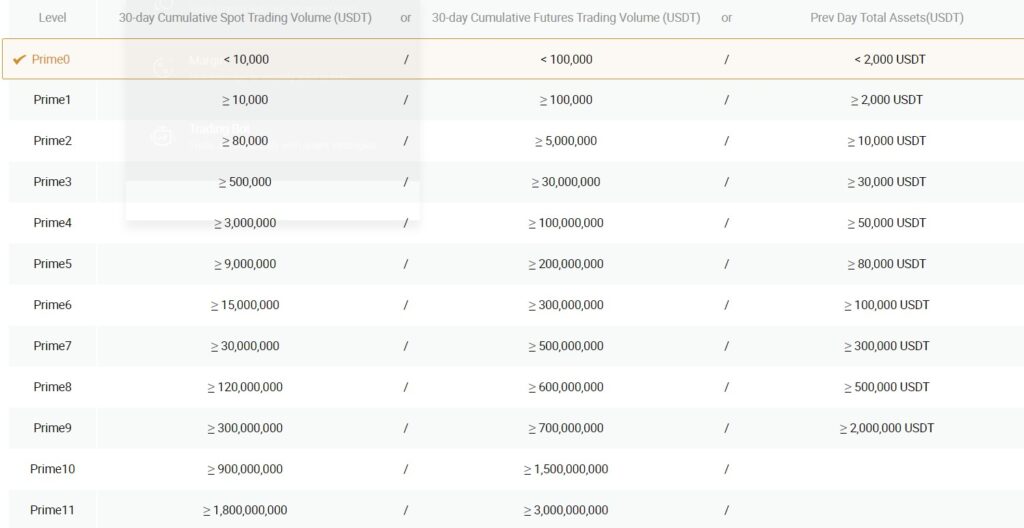

Huobi Trading Fees

When trading on Huobi Australia, you’ll encounter a tiered fee structure designed to be competitive within the digital asset exchange market.

The platform uses the maker-taker model, incentivizing market liquidity through differentiated fees for makers (those providing liquidity) and takers (those taking liquidity).

Fee Structure

- Makers: Fees start at a low of 0.036%

- Takers: Fees begin at 0.046%

Your trading volume over 30 days determines your fall tier, potentially lowering your fees. Larger trade volumes lead to further fee reductions, rewarding high-volume traders with more preferential rates.

Fee Payment

Fees are deducted from the total executed for your trade. For example, if you’re trading assets for BTC, you pay fees in BTC.

Discount Opportunities

Holding Huobi Token (HT), the exchange’s native token, grants eligibility for trading fee discounts. Your HT number correlates with the discount rate applied to your trading fees.

| HT Holdings | Fee Discount |

|---|---|

| 10 HT | Reduced fees based on current tier |

| 100 HT | Further reduced fees as per the tiered structure |

Remember to manage your digital asset portfolio while monitoring the fee structure, which can impact your overall trading cost efficiency.

Huobi Funding Rates/Fees

When trading on Huobi Australia, you will encounter various fees associated with your transactions. Understanding how these apply to your trades is essential, particularly with digital asset pairs and futures contracts.

Spot Trading:

Huobi Global charges a % default trading fee of 0.20% for most crypto-to-crypto trades. Holding Huobi Token (HT), the platform’s native cryptocurrency, entitles you to fee discounts. Ownership of HT reduces the cost in tiered amounts, depending on the holding size.

Futures Trading:

Futures trading on Huobi involves a different fee structure. Typically, the fee rate for “takers” is 0.04% and for “makers” 0.02%. These fees are around the industry standard and are applied each time you execute a trade.

Perpetual Swaps & Funding Rate:

Huobi uses a funding rate mechanism for perpetual swaps to ensure the perpetual contract prices are anchored to the spot market. This funding rate may result in either a payment or a collection, depending on whether you are long or short.

| Position | Payment |

|---|---|

| Long | May Pay |

| Short | May Receive |

As of May 14, 2024, specific fees may have been adjusted, so you are advised to review the latest fee schedule on the Huobi Australia platform before engaging in trading activities.

Huobi Deposit & Withdrawal Fees

When you engage in transactions on Huobi Australia, understanding the deposit and withdrawal fees is critical to smoothly managing your financial operations.

Deposit Fees:

Huobi Australia allows you to top-up your account using various methods. A fee of 0.15% + $1 is typically charged for fiat currency deposits. However, if you’re a KYC-verified user, you benefit from fee-free credit/debit card deposits.

Withdrawal Fees:

Huobi takes a different approach to withdrawal fees:

- Crypto Withdrawals: These incur a network-based fee ranging depending on the cryptocurrency. For example, you might see fees as low as 0.001 USDT for certain assets.

- Fiat Withdrawals: If you’re withdrawing fiat, you should note that fees are reviewed periodically and could vary.

- OTC Trading: Fees for Over-The-Counter (OTC) trading might differ and must be checked in real time.

Limitations:

- Crypto Withdrawal Limits: As a KYC Verified user, you have a daily limit of 200 BTC, while institutions may withdraw up to 1000 BTC daily.

- Fiat Withdrawal Limits: For KYC Verified accounts, the daily and monthly limits are set at $50,000 and $500,000 respectively.

It’s necessary to continuously check for updates as withdrawal fee structures are subject to periodic changes by Huobi Australia, occasionally introducing discounts based on trading volumes or special promotions.

Huobi Account Types & KYC Tiers & Limits

Huobi Australia offers a tiered account system for its users, which provides different trading and withdrawal limits depending on the level of identity verification (KYC) you have completed.

Level 1 (Basic Verification)

This is the initial verification tier for Huobi users. Once you supply your basic personal information, you can access:

- Cumulative Purchase Limit: Limited trading capacity

- Withdrawal Limit/24H: Restricted funds withdrawal

Complete the Level 1 Basic Verification by selecting an ID type and uploading relevant identity documents.

Level 2 Verification

For increased limits, you are required to undergo a more detailed verification process. This includes:

- Cumulative Purchase Limit: Moderately increased compared to Level 1

- Withdrawal Limit/24H: Higher withdrawal allowance

This will be followed by uploading an acceptable photo of your identity document and waiting for the approval of your verification application.

Level 3 Advanced Verification

At the highest verification level, your account is granted the maximum limits on purchases and withdrawals. This level requires:

- Facial Recognition: Complete this step directly in the Level 3 Verification section.

- Highest Limits: You enjoy the highest transaction and withdrawal thresholds Huobi offers.

Huobi requires these KYC procedures to maintain security and meet regulatory compliance. You can find further details and begin the process for each tier on Huobi’s dedicated Verification pages.

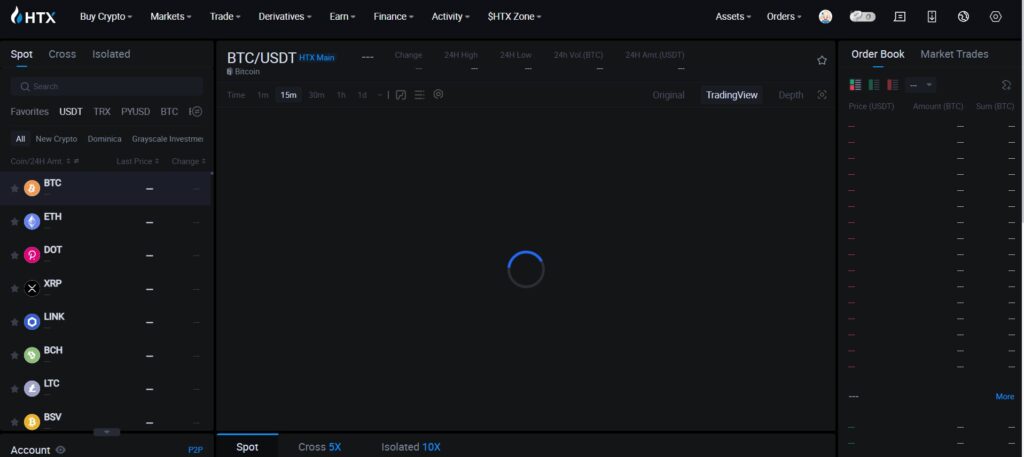

Huobi Trading Platform & Tools

Huobi boasts a robust trading platform that integrates advanced charting tools from TradingView, enabling you to analyze the market precisely.

As a trader, you will appreciate the user-friendly interface, which allows real-time data visualization with many charting options.

This feature is crucial for novice and experienced traders relying on technical analysis to make informed decisions.

In addition to the web-based platform, Huobi offers a mobile app for iOS and Android. With this app, you have the flexibility to trade on the go.

You can manage your trades, monitor the markets, and receive updates from your mobile device. This convenience ensures you never miss an opportunity, no matter where you are.

Platform Features:

- Real-Time Data Visualization: Instant access to market data with the ability to analyze trends as they develop.

- Advanced Charting: Utilize a variety of indicators and drawing tools to aid in your market analysis.

- Mobile Trading: Stay connected to the markets with the Huobi mobile app, making trading accessible anytime.

Huobi’s trading platform is designed to meet the needs of a diverse user base. Whether you require a detailed analysis of cryptocurrency trends or want to execute trades quickly, the platform accommodates your strategy efficiently and reliably.

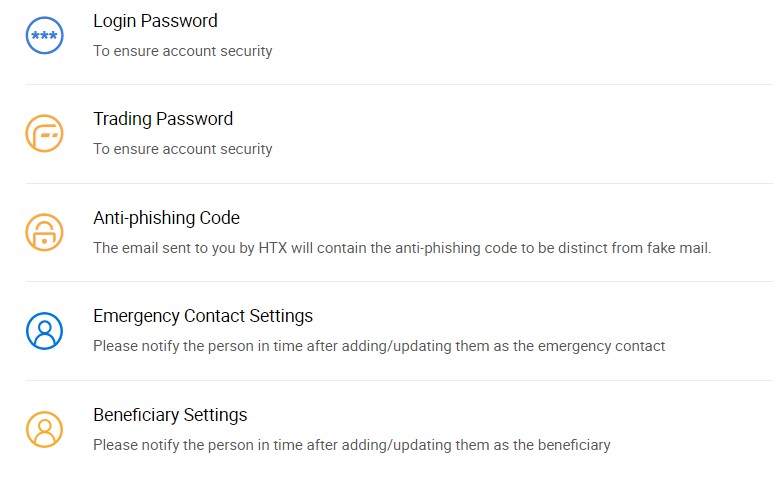

Huobi Insurance Fund

An insurance fund protects your Huobi assets. This fund has been established to offer an added layer of security against potential cybersecurity incidents. Huobi takes security seriously, ensuring peace of mind when you use their services.

Protection Mechanisms:

- Bank-like Security Measures: Huobi employs advanced security protocols.

- Two-Factor Authentication (2FA): Multiple 2FA options are available to safeguard your account.

The insurance fund is financially fortified by diverting some of Huobi’s income. This strategic allocation demonstrates Huobi’s commitment to your asset safety in the event of unauthorized access.

Insurance Fund Usage:

- In a security breach, the fund is utilized to compensate affected users.

- Regular audits ensure that the fund size is adequate to cover potential risks.

Quick Facts:

- Established: The fund has been a part of Huobi’s financial strategy to ensure user protection.

- Security Record: Huobi’s exchange has a strong track record, with no security incidents in over nine years.

Remember, your financial security on the exchange is a priority for Huobi, thanks to their dedicated insurance fund.

Huobi Deposit Methods

When funding your account on Huobi Australia, you have various deposit options. Understanding the alternatives allows you to choose the most convenient and cost-effective method.

Fiat Currency Deposits:

- Bank Transfers: One of the most common methods is using traditional bank transfers. This method is reliable and widely used, though processing times may vary.

- Credit/Debit Cards: You can use your credit or debit card for faster transactions. Remember, there is typically a fee of around 4% for such transactions.

Cryptocurrency Deposits:

- Cryptocurrency Transfer: If you already hold cryptocurrency, you can directly deposit digital assets into your Huobi account. Follow these steps for depositing crypto like USDT:

- Navigate to “Balances” in your account.

- Select the currency you wish to deposit.

- Click on the “Deposit” icon associated with your chosen currency.

- Copy the deposit address or scan the QR code to initiate the transfer from your external wallet.

Third-Party Providers:

Utilizing third-party services is another way to fund your account. Depending on your chosen provider, such services might incur a fee starting at 1%.

Double-check the fee structures for each deposit method, as they can vary and might influence your decision on which route to take. The deposit process on Huobi is designed to be straightforward, ensuring that you can quickly begin trading or investing on the platform.

Huobi Security Features

The protection and safety of your assets are top priorities at Huobi. The platform ensures the security of your holdings through several rigorous measures:

- Cold Storage: Many digital assets are securely stored offline in cold storage systems, mitigating the risks associated with online hacking attempts.

- Two-Factor Authentication (2FA): You are encouraged to enable 2FA on your account, adding an extra layer of security at the time of login and when performing transactions.

- Proprietary Risk Control System: Huobi’s in-house risk control system continually monitors operations to identify and mitigate potential threats preemptively.

| Security Feature | Description |

|---|---|

| Cold Storage | Offline asset storage to protect from online threats |

| Two-Factor Authentication | Additional authentication steps for access and transactions |

| Proprietary Risk Control | An advanced system to monitor and counteract unusual activities |

Security at Huobi is taken seriously, reflected in the platform’s sturdy track record. These measures ensure a secure trading environment for your cryptocurrency activities.

Huobi Proof Of Reserves

To maintain the integrity and trust in financial operations, Huobi regularly conducts audits. These audits are essential for verifying that your holdings are secure and that the platform can cover all user balances.

Huobi employs a method called the Merkle Tree Proof of Reserves. This method provides a cryptographic way of proving that the exchange has the necessary funds without revealing individual user’s balances.

As of the latest reports, Huobi has affirmed that their reserves cover 100% of USDT, 101% of BTC, and 103% of ETH/BETH, HT, and TRX.

This shows that the exchange meets and exceeds the required reserve ratios. Their commitment includes conducting these reserve audits with a third-party auditor, providing an added layer of transparency and security for your assets.

Moreover, the platform held a sizable amount of its HT token, amounting to $920 million as of the reported date.

Huobi has pledged to remain devoted to user asset security by continuing the practice of publishing proof of reserves to the public.

You must know that a securely maintained reserve backs your transactions, and Huobi’s approach to providing proof of reserves aims to ensure just that.

| Asset | Reserve Ratio |

|---|---|

| USDT | 100% |

| BTC | 101% |

| ETH/BETH | 103% |

| HT | 103% |

| TRX | 103% |

This structured approach to financial transparency gives you confidence in Huobi Australia’s services.

Huobi Customer Support

When you require assistance with Huobi services, you can reach out for support through multiple avenues. The Help Center provides immediate access to various solutions for common issues.

Live Chat:

To access real-time support:

- Navigate to the bottom right corner and select the Help button.

- Click on Start Chat to interact with customer service.

Email:

If you prefer to reach out via email, send your inquiries directly to:

Ensure you include details such as your UID, the type of coin, transaction hash (txid), and the issue you’re experiencing.

FAQs:

A self-help option, the FAQ section is available to find answers to common questions quickly. This could be a faster way to resolve your problem without needing live interaction.

Hours of Operation:

Huobi offers support around the clock:

- 24/7 customer support ensures that help is at hand whenever needed.

Remember, if an automatic message does not address your issue in the live chat, a customer support assistant will step in to assist further. Your patience is appreciated as they work to resolve your problem efficiently and effectively.

Is Huobi Safe & Available in Australia?

As a user interested in cryptocurrency trading, you can rest assured that Huobi operates legally within the framework of regulatory requirements.

In Australia, Huobi commits to not violating the relevant laws and regulations, striving to provide a secure and professional trading environment.

Security Measures:

- Huobi implements robust security measures to safeguard your digital assets.

- Two-factor authentication (2FA) enhances the security of your account.

- Advanced encryption is used to protect sensitive information.

Legal Compliance:

- Huobi adheres to the laws and regulations applicable in Australia.

- It ensures that its services align with international financial standards.

| Key Features | Details |

|---|---|

| Regulatory Compliance | Operates within the legal framework of Australia. |

| Security Protocols | Utilizes encryption and 2FA. |

| Financial Safety | Maintains a professional and secure trading space. |

| User Verification | Requires verification to access certain features. |

You can stake cryptocurrencies in a Huobi wallet and participate in futures trading with a competitive fee structure in the industry.

The fees are transparent and align with market averages for purchases and transactions.

In summary, your use of Huobi’s platform is backed by their commitment to legality and security. Their adherence to regulatory standards should give you confidence in the integrity of their services.

Conclusion

In examining Huobi Australia, you’ll find that its offerings align with Huobi’s global reputation as a central hub in the evolving crypto space.

Your transactions on the platform may attract a fee of approximately 4% for credit/debit card purchases. As for trading futures on Huobi, expect a fee rate of 0.02% for makers and 0.04% for takers, considered standard within the industry.

Your trades’ safety and integrity are assured as Huobi utilizes advanced security practices. With its recent legalization to operate in Australia, you gain access to a globally recognized platform that is compliant with local regulations.

By engaging with Huobi, you join a vast network of traders across more than 130 countries.

The exchange’s consistent push for innovation and its mission to empower global financial services ensures you are part of a dynamic and forward-thinking community.

-

Exchange Fees:

- Credit/Debit Card Purchases: ~4%

- Futures Trading: 0.04% (takers), 0.02% (makers)

-

Services:

- Locally compliant and globally established

- A wide array of financial products

- Stringent security measures

Your choice to trade with Huobi in Australia should be informed by its blend of global expertise and local adaptability, providing you with a diverse and secure trading experience.

Discover More Reviews: