Crypto Trading In Australia: Navigating Crypto Market Down Under

Cryptocurrency trading in Australia has become a significant activity for investors and enthusiasts alike, seeking to capitalize on digital assets’ volatility and potential gains.

As an emerging financial market, crypto trading encompasses the buying, selling, and exchanging of cryptocurrencies like Bitcoin, Ethereum, and hundreds of others on various exchanges.

With the right approach, you have the opportunity to be part of a movement that’s transforming traditional financial paradigms.

Australia presents a unique environment for crypto trading due to its progressive regulatory stance and active adoption.

Surveys suggest that around one in four Australians own cryptocurrency, marking a considerable leap in participation over recent years.

As you delve into the crypto markets, you’ll find user-friendly platforms that cater to both novices and seasoned traders, emphasizing security and ease of use to ensure a solid trading experience.

In exploring the dynamics of cryptocurrency trading within Australia, you’ll gain insights into the reputable trading platforms that align with your investment strategy, whether you’re looking for a simple entry point or sophisticated trading tools.

This guide will walk you through the essentials, from understanding market trends to executing trades effectively, ensuring you are well informed and prepared to navigate the digital currency landscape.

The Australian Crypto Trading Landscape

Australia’s affinity with cryptocurrency trading has evolved significantly, making it a prominent market for digital currency investment. In this thriving environment, a diverse array of cryptocurrencies are traded, with Bitcoin, Ethereum, and Ripple among the popular choices.

Key Exchanges:

The landscape features several key players. Binance Australia offers various resources, including market updates and a crypto tax guide, catering to your need for current information.

Koinly and Forbes Advisor Australia also provide insights into the market state and regulation particulars, which are crucial for informed trading decisions. Below is a snapshot of the significant exchanges you might engage with:

- Binance Australia: Known for user rewards and promotions.

- Koinly: Offers market research and tax guidance.

- Lander & Rogers: Discusses regulatory changes affecting crypto.

- Forbes Advisor Australia: Provides expert advice on crypto regulation and taxation.

Cryptocurrency regulation in Australia is dynamic and, in 2023, showed movement toward a more tailored framework.

This focus on regulation recognizes cryptos not fitting neatly within pre-existing financial regulations. Awareness of tax obligations relating to crypto trading is essential for compliance.

Cryptocurrency Prevalence:

- Bitcoin – The pioneering cryptocurrency continues to lead the market.

- Ethereum – Preferred for its innovative contract capabilities.

- Ripple – Gains traction for its real-time international transaction network.

Your understanding of the regulatory climate and major players here supplies the foundation for successfully navigating the Australian crypto trading realm.

Choosing a Crypto Exchange

When venturing into the world of cryptocurrencies, your choice of exchange is crucial. It serves as your gateway to buy, sell, and trade digital assets.

Not all cryptocurrency exchanges are created equal, and your priorities significantly determine which exchange best suits your needs.

- Security: Always prioritize exchanges with robust security measures. Look for features such as two-factor authentication (2FA), cold storage options for digital assets, and insurance against cyber theft.

- Fees: Transaction fees can vary widely between exchanges. Weigh up the fees against the services provided, as a lower fee structure might come at the expense of essential features or customer support.

- User Experience: An intuitive interface and ease of use, especially for beginners, can significantly enhance your trading experience. Responsive customer support is also a crucial component of a positive user experience.

Consider these leading exchanges in Australia:

- CoinSpot: It stands out for newcomers to the crypto space due to its user-friendly approach.

- Swyftx: This exchange offers competitive fees and is often recommended for its overall service.

- Binance Australia: Known for its wide range of cryptocurrencies and high liquidity, it is suitable for both novices and experienced traders.

When selecting an exchange, assess your requirements against the offerings of each platform.

Whether it’s low fees or a comprehensive range of services, the proper exchange should align with your investment strategy and provide a secure transaction environment.

How to Start Trading Cryptocurrencies in Australia

To begin trading cryptocurrencies in Australia, you must follow a systematic approach to ensure compliance with local regulations and a smooth trading experience.

Firstly, you must select a reputable cryptocurrency exchange within the Australian market. Ensure the exchange is registered with AUSTRAC to adhere to Australian regulations regarding financial transactions.

Creating an Account

- Choose a cryptocurrency exchange.

- Fill in the required personal details to start the account creation process.

- Complete the verification process to comply with KYC (Know Your Customer) rules, including providing identification and address proofs.

Depositing Funds

Once your account is verified, deposit funds to start trading. Australian exchanges typically support various methods such as:

- POLi Payments: A favored method due to its fast processing times.

- BPAY: Offers secure bill payments but may take a few days to clear.

- PayID: Allows for near-instantaneous bank transfers.

Deposit steps:

- Navigate to the deposit section of the exchange.

- Select your preferred payment method.

- Follow the prompts to link your bank account or payment service.

- Enter the amount you wish to deposit in AUD.

- Confirm the transaction.

Starting to Trade

After funding your account:

- Access the trading platform.

- Research which cryptocurrency you want to buy or sell.

- Make your trade by selecting the ‘Buy’ or ‘Sell’ option.

- To manage risk, define the amount and set appropriate trading orders such as market orders, limit orders, or stop-loss orders.

Always remain informed about market conditions and potential risks associated with cryptocurrency trading. Stay updated with financial news and engage in continuous learning to make informed trading decisions.

Challenges and Considerations

When trading cryptocurrency in Australia, you’ll likely encounter challenges and considerations that can impact your investment decisions and peace of mind. Understanding these factors will help you navigate the crypto space with greater confidence.

Taxation: Cryptocurrency is treated as an investment asset in Australia, which has implications for capital gains tax (CGT). You must track every transaction meticulously to comply with Australian Taxation Office (ATO) regulations. Record-keeping includes:

- Date of transactions

- The value in Australian dollars

- The purpose of the transaction

- Details of the other party involved (even their wallet address)

Reporting your crypto activities accurately is essential to avoid legal and financial repercussions.

Security concerns: The unregulated and relatively volatile crypto market puts your assets at risk from hackers and fraudsters. To safeguard your investments, consider the following measures:

- Use reputable exchanges: Research and choose platforms with solid security measures.

- Two-factor authentication (2FA): Always enable 2FA on your exchange and wallet accounts.

- Cold storage: Store a significant portion of your crypto offline in hardware wallets.

- Stay informed: Stay updated with the latest security practices and potential threats.

Be aware of the evolving landscape of crypto regulations in Australia to ensure that your trading practices remain compliant and secure.

Advanced Trading Tools and Features

When engaging with Advanced Trading Tools and Features in the Australian crypto market, you’ll encounter several powerful instruments to enhance your trading capabilities.

Derivatives trading is a significant aspect that allows you to trade on the future price of cryptocurrencies without directly owning the asset. This includes instruments like futures and options that can provide leveraged market exposure.

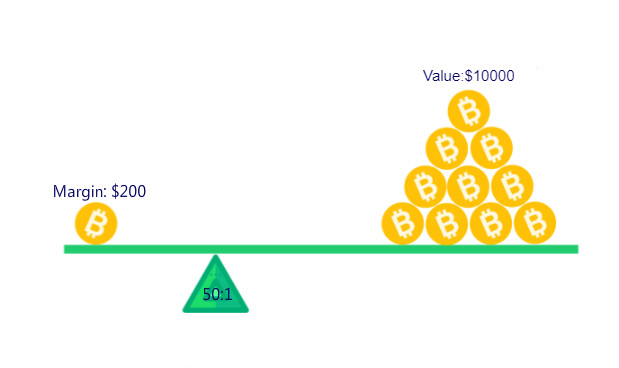

Leverage is another tool that amplifies your buying power, enabling you to trade more prominent positions with a smaller capital outlay.

However, leverage can also amplify losses, so risk management is critical. Platforms such as Bybit and KuCoin offer tailored features for leverage trading while implementing tools to control risk.

-

Trading Bots: Employ automated strategies using trading bots that can execute trades on your behalf, using predetermined criteria. This is especially advantageous in the volatile crypto markets where quick reactions are often required.

-

Risk Management: You must be diligent with risk management techniques.

- Set stop-loss orders to limit potential losses.

- Only trade with funds you can afford to lose; never jeopardize your financial security.

- Diversify your investment portfolio to spread risk across different assets.

| Feature | Description | Benefit |

|---|---|---|

| Derivatives Trading | Engage in contracts based on crypto price movements | Trade on future prices without needing total asset exposure |

| Leverage | Borrow capital to increase trade size | Amplify potential profits |

| Trading Bots | Automated systems executing trades based on set criteria | Respond to market changes rapidly |

| Stop-Loss Orders | Pre-set orders to sell at a specific price | Limit potential losses |

Always remember that with more excellent advanced trading capabilities comes increased risk. Educate yourself thoroughly on these tools and start with caution.

Continuous Learning and Community Engagement

In the dynamic world of cryptocurrency trading in Australia, continuous learning is essential.

As you embark on this journey, familiarize yourself with trading simulators that offer a risk-free environment for honing your skills. These simulations can be invaluable in gaining experience without the threat of actual losses.

Communities form the backbone of the crypto ecosystem.

You engage with a wealth of shared knowledge by joining online forums and communities, such as those related to educational platforms like Empire Crypto Trading.

Here’s a simple breakdown:

- Participate in forums and groups.

- Share experiences and strategies.

- Ask questions to clarify doubts.

These platforms often come equipped with various educational content suitable for all skill levels, emphasizing the importance of a strong foundation in trading principles.

Following market trends closely will keep you abreast of the latest developments in the crypto space.

- Monitor news outlets.

- Analyze price charts.

- Read whitepapers and research documents.

In summary, your growth in the crypto trading arena is fueled by continuous learning and active community participation. Remember, the landscape is constantly changing, and staying informed is your key to navigating it successfully.

Future of Crypto Trading in Australia

Your understanding of the crypto market in Australia is set to evolve with the digital currency landscape.

Legislative changes indicate that you must consider cryptos as investment assets with capital gains tax implications.

The Australian government is taking steps to integrate crypto into the financial system, thus providing a more transparent regulatory framework.

Regulatory Environment

- 2022-2023: The government confirmed crypto as an investment asset for CGT.

- 2024: Proposed new licensing for crypto exchanges, awaiting legislation.

Crypto Exchanges

Your choice of crypto exchanges has broadened in 2024. With platforms like Swyftx leading for user-friendliness and security, you can access competitive fees and robust customer support.

Trading Options and Platforms

- Swyftx: Offers a balance of fees and security.

- Gate.io: Known for a vast array of digital assets (1,700+ cryptos).

As Australian exchanges aim for higher operational standards, you’ll witness a significant role in innovation and technology. These include securing international security certifications and providing advanced financial tools to meet your trading needs.

Market Trends

Speculation and investment drive the market, with traders leveraging platforms to capitalize on price fluctuations. The potential for market growth is tied to user adoption and the integration of new technologies that make trading more accessible and efficient.

In short, your engagement with crypto trading in Australia is becoming more structured and secure as the country embraces crypto within its financial ecosystem. It provides you with various sophisticated tools and services set against the backdrop of a developing regulatory framework.

Frequently Asked Questions

When engaging with crypto trading in Australia, you have various platform options, must adhere to legal protocols, and can convert crypto to cash.

Which platforms are considered the best for crypto trading in Australia?

In Australia, platforms like KuCoin stand out for their extensive selection of altcoins and competitive trading fees that range from 0.1% to -0.005% for maker trades and 0.1% to 0.025% for taker trades. When choosing a platform, consider fees, security, and ease of use.

What are the legal requirements for trading cryptocurrencies in Australia?

You must comply with the Australian Tax Office (ATO) guidelines, which treat cryptocurrency like property for tax purposes. This entails keeping detailed records of all transactions, trades, and capital gains or losses. Trading platforms in Australia require you to undergo a Know Your Customer (KYC) process to verify your identity in compliance with anti-money laundering laws.

Can you sell crypto for cash in Australia?

Yes, in Australia, you can sell cryptocurrencies for fiat currency. This process typically involves using a cryptocurrency exchange where you can list your crypto for sale and withdraw the resulting funds in Australian dollars to your bank account after considering any taxable events as per ATO’s regulations.

Conclusion

Australia’s cryptocurrency landscape is dynamic, with a notable increase in investment safety measures and user-friendly trading interfaces.

Cryptocurrency exchanges such as KuCoin, MEXC, and Binance Australia rank among the top choices for Australian traders, offering features like automated trading, low spot trading fees, and access to a wide array of cryptocurrencies.

The adoption of cryptocurrency in Australia is significant, with a quarter of Australians reportedly owning crypto assets.

Exchanges like BingX and Bybit are at the forefront, providing sophisticated trading tools, including trading bots and derivatives trading options.

High-leverage trading is also accessible on platforms such as PrimeXBT, appealing to seasoned traders seeking to magnify their trading position with borrowed funds.

Looking ahead, the landscape for crypto trading in Australia appears to be one of continual growth and innovation.

With the country ranking 40th globally for crypto adoption, further expansion has considerable potential. As the market evolves, new regulations and technological advancements could make trading more robust and accessible.

If you’re contemplating entering the crypto trading arena, it’s essential to diligently research and consider the various exchanges available.

Ensure that your chosen exchange aligns with your trading needs and risk tolerance. Remember, with the fast pace of the crypto industry, staying informed and adaptable is critical to navigating the market successfully.